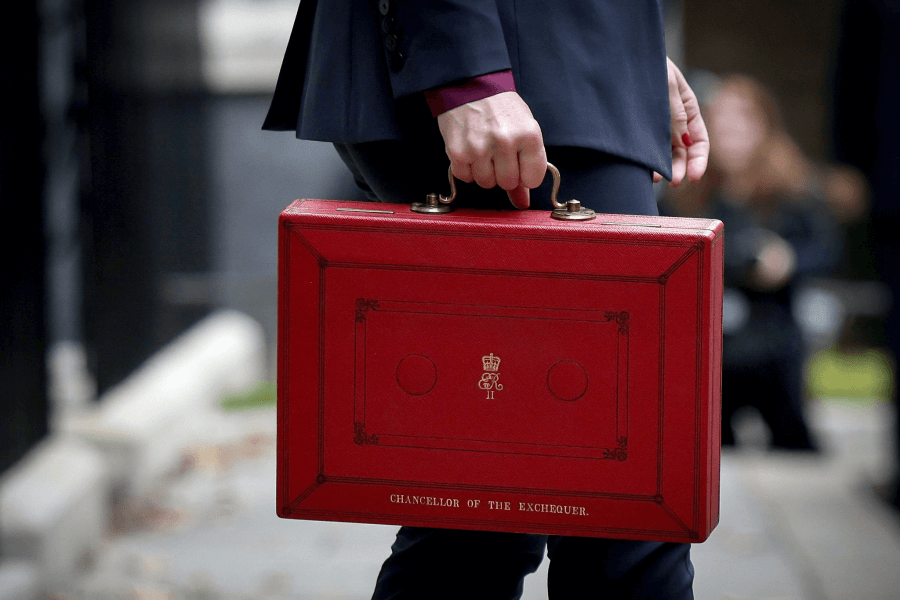

Alice Pugh provides a breakdown of the key announcements in the first Labour budget since 2010. This budget will also be the first delivered by the first female Chancellor of the UK.

OBR Economic Fiscal Outlook

Today the budget economic forecasts for the next 5 years are released by the Office for Budget Responsibility (OBR). These forecasts are important as they show the Autumn Statement’s impact in the near, medium and long term. The main findings in the OBR report about this budget have been:

- Real GDP growth is expected to increase from close to zero last year, to 1.1% this year, then 2% in 2025, and 1.8% in 2026, before falling back to 1.5% thereafter.

- CPI inflation is anticipated to be 2.6% in 2025, partially as a result of the direct and indirect impacts of budget measures.

- Interest rates are anticipated to fall to 3.5% by 2026/27.

- As a result of the Budget, unemployment is anticipated to fall from 4.3% this year to 4% in 2026, before returning to its estimated structural rate of 4.1% in 2028.

- Nominal wage growth is expected to fall from 4.7% this year to around 3.5% in 2025 and then 2.25% over the remainder of the 5-year forecast.

- Real household disposable income per person, as a measure of living standards, will grow by an average of just over 0.5% per year over the forecast.

Key Announcements within the Autumn Budget

The following are the key announcements that were made in the Autumn Statement 2024:

Wages, benefits and pensions

- Minimum Wage- legal minimum wage for over 21s is set to rise from £11.44 to £12.21 per hour from April. The wage for 18 to 20-year-olds to go up from £8.60 to £10, as part of a long-term plan to move towards a ‘single adult rate’.

- Full-time Carers- Eligibility widened for the allowance paid to full-time carers, by increasing the maximum earnings threshold from £151 to £195 a week.

Personal Taxes

- Income tax and national insurance- the freeze on income tax and national insurance thresholds will end in 2028, this should prevent individuals from being dragged into higher tax bands as earnings rise.

- Capital gains- capital gains tax paid on profits from selling shares to increase from 20% to 24%, though rates on additional property sales will remain the same.

- Inheritance tax – the threshold on this tax has been frozen beyond 2028 to 2030.

- Private school- VAT is set to be introduced on private school fees from January 2025.

- Non-domicile- the concept of non-domiciles will be abolished from April 2025.

Business Tax

- National Insurance- From April businesses will now have to pay national insurance on worker’s earnings over £5,000, down from £9,100 currently, with the rate employers pay increasing from 13.8% to 15%.

- Employment Allowance- This allows companies to reduce their NI liability, to increase from £5,000 to £10,500.

- Private Equity- tax paid by private equity managers on the share of profits from successful deals to rise to 32% from April.

- Corporation Tax- The main rate of corporation tax paid by businesses on taxable profits over £250,000, to stay at 25% until the next election.

Transport

- Bus Fares- The £2 cap on single bus fares in England to rise to £3 from January.

- Fuel Duty- 5p cut to fuel duty on petrol and diesel, extended to April 2026.

- HS2- a commitment to fund tunnelling work to take HS2 high-speed rail line to Euston station in Central London.

- Trans-Pennine rail line- a commitment to deliver an upgrade to the Trans-Pennies rail line between York and Manchester, running via Leeds and Huddersfield.

- Air Passenger Duty- the duty on flights by private jet will increase by 50%. Air passenger duty for economy short-haul flights will also increase by up to £2.

Housing

- Affordable homes- The affordable homes budget will receive a boost of £500m.

- Social housing- providers will be allowed to increase rents above inflation under a multi-year settlement.

- Stamp duty- the surcharge paid on second home purchases in England and Northern Ireland will increase from 3% to 5%.

- Right to buy- the government is decreasing the right to buy discounts, and local governments will retain the earnings from the council housing sales to allow them to reinvest.

Local Government

- Grant funding- there will be an additional grant funding worth £1.3bn for local government, including £600m for social care.

- Combined Authorities- Greater Manchester and West Midlands will get integrated settlements next year, increasing their control of spending.

Alcohol and Tobacco

- Tobacco- tobacco tax will be increased by 2% above inflation, and by 10% for rolling tobacco.

- Alcohol- the tax on non-draught drinks will increase to the higher rate of RPI measure of inflation, but tax on draught drinks will be cut by 1.7%.

- Vapes- a tax on vape liquid will be introduced in October 2026; this will be a flat duty rate of £2.20.

NHS

- Health Budget- the day-to-day health budget will see a £22.6bn increase and £3.1bn increase in the capital budget.

Energy

- Retrofitting- £3.4bn for the warm homes plan to upgrade buildings, lowering energy bills.

- Great British Energy- The government will fund Great British Energy, a publicly owned clean energy company.

Education

- Education- £6.7bn allocated for education investment next year, with £1.4bn earmarked for rebuilding over 500 schools.

This blog was written by Alice Pugh, Policy and Data Analyst City-REDI, University of Birmingham.

Disclaimer:

The views expressed in this analysis post are those of the author and not necessarily those of City-REDI or the University of Birmingham.