The Birmingham Economic Review is out now! This year’s report will provide a comprehensive analysis of the city’s economy amid the wider geopolitical landscape, and actionable measures that businesses and stakeholders from across the city-region can take to drive economic growth.

Read the full Birmingham Economic Review 2025.

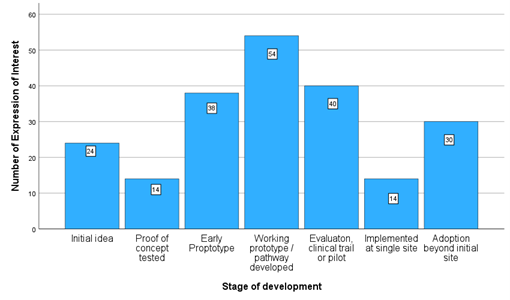

The creation of the WMHTIA has enabled the development of unparalleled understanding of the needs of businesses in a health technology cluster in the United Kingdom. Attempts to understand and map clusters have often relied on using business databases such as FAME to generate long lists of potential companies based on their standard industrial code and postcodes and their verification. This used to involve identifying every feasible 4 digit SIC code that a health technology company might be registered under. This was the approach used to map the MedTech sector the Midlands in 2019 alongside data provided by Strengths & Opportunities data produced annually by the Office for Life Sciences (OLS). A survey was distributed through networks of MedTech businesses engaged with MI Health, Medilink Midlands and regional research/ commercialisation/support programmes to identify their needs. Things have moved on since with the development of new methodologies underpinning real time industrial codes (RTICs) for the sector provided by commercial database providers such as Red Flag and Data City and the DSIT innovation cluster maps. Usual approaches to mapping HealthTech sector tend not to capture new enterprises being spun out of academia or the NHS, that not yet VAT or Company House registered or those businesses capable of pivoting to be part of the supply chain. The registration process for WMHTIA captured information on such businesses who provide a potential pipeline in terms of future opportunities as well as more established enterprises. Through the registration process we capture rich information on 215 enterprises either located in considering establishing a base or collaboration in the West Midlands including the self-reported stage of development and asks in terms of support sought.  Regardless At the stage of development, support in securing funding was requested by most businesses. Support with commercialisation was the second most common ask for businesses that had reached the early prototype stage or later stages of development. Those with an initial idea were more likely to ask for support with bid support, market research, leadership and mentoring, intellectual property, and global market research. Those at the proof of concept tested were more likely to ask for assistance with real-world evaluation, and those at the early prototype stage were most likely to ask for help with commercialisation. Those with a working prototype/pathway were more likely to ask for support in several areas (funding, commercialisation, adoption, clinical engagement, market research and regulation). It should be noted that asks were those identified by enterprise at the time of their application and do not reflect additional areas of development identified at diagnostic clinics and through discussions with partners. Overall ranking of initial asks for support with were:

Regardless At the stage of development, support in securing funding was requested by most businesses. Support with commercialisation was the second most common ask for businesses that had reached the early prototype stage or later stages of development. Those with an initial idea were more likely to ask for support with bid support, market research, leadership and mentoring, intellectual property, and global market research. Those at the proof of concept tested were more likely to ask for assistance with real-world evaluation, and those at the early prototype stage were most likely to ask for help with commercialisation. Those with a working prototype/pathway were more likely to ask for support in several areas (funding, commercialisation, adoption, clinical engagement, market research and regulation). It should be noted that asks were those identified by enterprise at the time of their application and do not reflect additional areas of development identified at diagnostic clinics and through discussions with partners. Overall ranking of initial asks for support with were:

- Funding

- Commercialisation

- Spread and adoption

- Operational or clinical engagement

- Bid support

- Market or demand research

- Regulation

- Real world validation

- Clinical trials

- Leadership and mentoring

- Brokering and networking

- Intellectual property

- Value proposition development

- Global market research

- Advice and idea design

- Procurement

- Analytics and Evaluation

- Care pathway analysis

- Prototyping

- Clinical service development

- Supply chain assistance

- Signposting

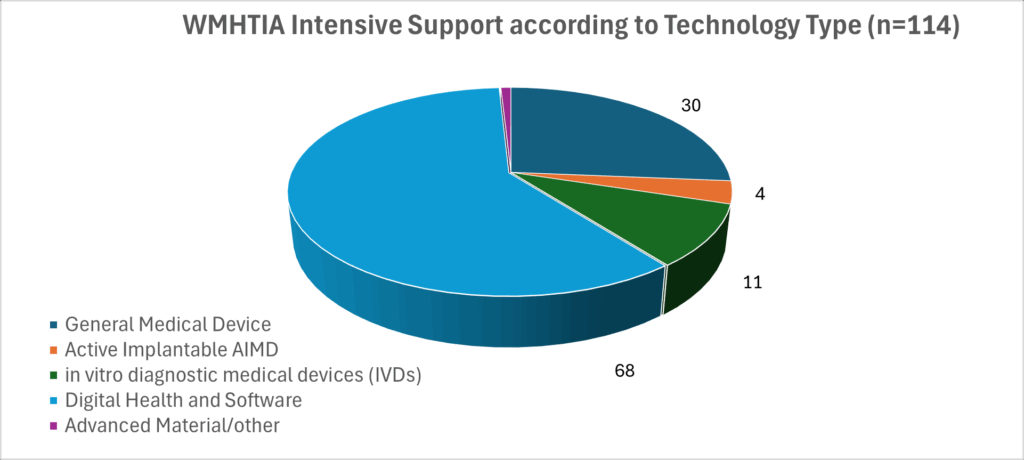

At the end of the initial two-year pathfinder (March 2025) WMHTIA had engaged with 269 enterprises and provided intensive support to 114 enterprises. While most were based the region, the cohort included enterprises that wish to relocate all or part of their business to the region and/or enter a collaboration with a regionally based partner to develop their product or service. The majority of intensively supported enterprises were developing general medical devices. We have classified health technologies being develop by intensively assisted enterprises using the definitions set below. Of the 114 intensively supported technologies, just over a third incorporated AI. In response WMHTIA has introduced an AI Hub in recognition of the importance of digital health and a Regulation Navigation service.

| Classification | Description |

| General medical devices | e.g. syringes, dressings, heart valves, ECG monitors, CT scanners and dialysis machines, including any software used to drive them |

| Active implantable medical devices (AIMDs) | e.g. powered implants or partial implants that are left in the human body, such as implantable cardiac pacemakers, implantable nerve stimulators, cochlear implants and implantable active monitoring devices |

| In vitro diagnostic medical devices (IVDs) | e.g. equipment or systems intended for use in vitro to examine specimens including all instruments, software, reagents and calibrators, such as blood grouping reagents, pregnancy test kits and hepatitis B test kits |

| Digital health and software | e.g. standalone software, decision support and mobile apps |

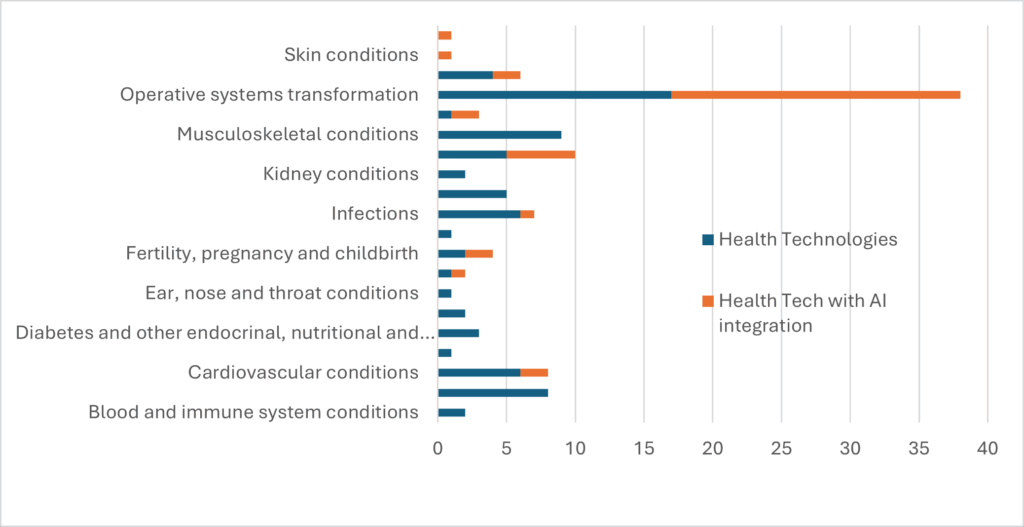

Intensively supported technologies covered 20 clinical areas. The significant focus on operative systems transformation (e.g. systems interoperability; integration with electronic health records; data insights) was largely due to themes identified by NHS Trusts/ Integrated Care Boards via the needs-driven WMHWIN element of the WMHTIA programme.

Intensively supported technologies covered 20 clinical areas. The significant focus on operative systems transformation (e.g. systems interoperability; integration with electronic health records; data insights) was largely due to themes identified by NHS Trusts/ Integrated Care Boards via the needs-driven WMHWIN element of the WMHTIA programme.  Because of Birmingham’s diversity and STEM assets WMHTIA is supporting several technologies that have the potential to reduce health inequalities. These include enterprises that have chosen to work with regional partners including University Hospital Birmingham in their commercialisation journey of their technology; For example, LBN Innovations who are developing an alternative to the traditional speculum and Earswitch who are developing EarMetrics®-Oximetry to measure oxygen blood saturation across a wider range of skin tones.

Because of Birmingham’s diversity and STEM assets WMHTIA is supporting several technologies that have the potential to reduce health inequalities. These include enterprises that have chosen to work with regional partners including University Hospital Birmingham in their commercialisation journey of their technology; For example, LBN Innovations who are developing an alternative to the traditional speculum and Earswitch who are developing EarMetrics®-Oximetry to measure oxygen blood saturation across a wider range of skin tones.

This blog was written by George Bramley, City-REDI, University of Birmingham and Thorsten Kampmann, Luan Linden-Phillips, Derek Sear.

Disclaimer: The views expressed in this analysis post are those of the authors and not necessarily those of City-REDI or the University of Birmingham. Sign up for our mailing list.