The West Midlands Combined Authority (WMCA) has published “West Midlands Futures – Exploring Emerging and Future Opportunities in the West Midlands Combined Authority Region”, a study completed by the Economic Intelligence Unit (EIU) and City-REDI team.

Making Place-based Futures in the West Midlands

In August 2022, the WMCA published the West Midlands Plan for Growth. The Plan aimed to stimulate economic growth by developing nine high-growth economic clusters where the region has significant strengths. While existing high-growth opportunities are central to the region’s economic strategy, there are new and fast-evolving areas must be explored to ensure long-term success.

To understand what might the West Midlands economy look like in 10, 20 and 30 years’ time, the WMCA commissioned the Economic Intelligence Unit (EIU) and City-REDI to examine how existing industries and new technologies interact to create new economic opportunities in the region. The research aimed to provide clear, evidence-based insights to help shape the Local Growth Plan and guide investment in the most promising areas for the future of the region.

Our Methodological Approaches

The study adopted a mix-methods approach. Quantitative analysis drawing on firm-level and spatial data was synthesised with the qualitative insights gained from stakeholder engagement.

An Analytical Framework developed by Midlands Engine was deployed to identify emerging and future opportunities of technologies and capabilities around four economic ecosystems: Business, Innovation, Investment & FDI, and Talent. Drawing on spatial firm-level data and national benchmarks, quantitative data-driven analysis enabled a robust and data-driven assessment of 22 emerging opportunity areas in the West Midlands. This was supplemented by the findings from a programme of targeted stakeholder engagement, which complemented the quantitative analysis by capturing place-based insights into emerging and future opportunities across the West Midlands.

Imagining and understanding the future in a world characterised by uncertainty and ambiguity is challenging. Drawing on a Megatrends framework developed by the City-REDI team, consultations were held in early 2025 with 24 experts from across academia, industry, cluster organisations, and innovation agencies, spanning sectors such as aerospace, health tech, logistics, advanced manufacturing, and digital technologies.

Synthesising Results

A structured prioritisation framework was developed to assess and rank 22 identified opportunity areas based on their potential to drive long-term economic growth in the West Midlands.

The analysis identified a group of high-ranking opportunities including Future Logistics, Defence, Land Remediation, and Future Rail, that perform strongly across multiple criteria. These opportunities demonstrate not only current economic strength but also alignment with strategic regional and national priorities. Other notable opportunities include Engineering Biology, eCommerce, and Textiles & Fashion, which exhibit strong business presence and innovation potential, though may require support in areas such as infrastructure or skills. Although not immediately evident in the data, the framework recognises through qualitative insights the strategic importance of opportunity areas such as Battery Supply Chain and FinTech, which are critical to the rapid transition to electrification and the establishment of a thriving financial hub in the region.

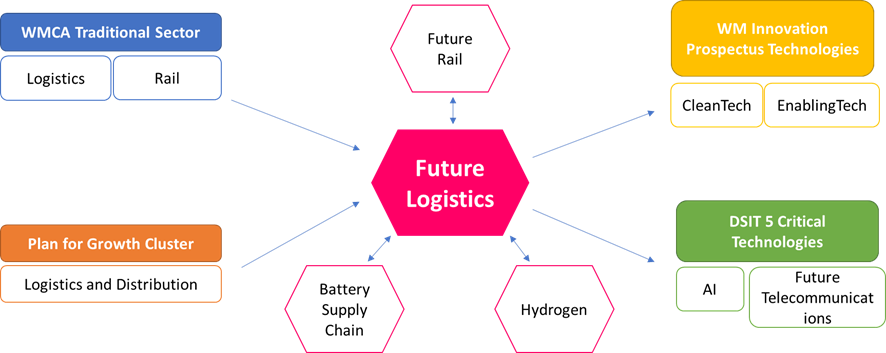

In addition to assessing individual opportunities, the study highlights the interconnected nature of emerging economic activity. As presented in Figure 1 below, opportunities such as Future Logistics intersect with existing sectors (e.g. Logistics and Rail), Plan for Growth clusters, enabling technologies (e.g. CleanTech, Enabling Tech), and national innovation priorities (e.g. AI and Future Telecommunications). These sectors provide the foundational infrastructure, workforce skills, and market networks that enable the growth of more technologically advanced logistics solutions. The interconnections reinforce the importance of a systems-level approach to policy and delivery, where value is amplified through cross-sector innovation, shared infrastructure, and combined interventions.

Figure 1: Future Logistics as an Example of Interconnectedness

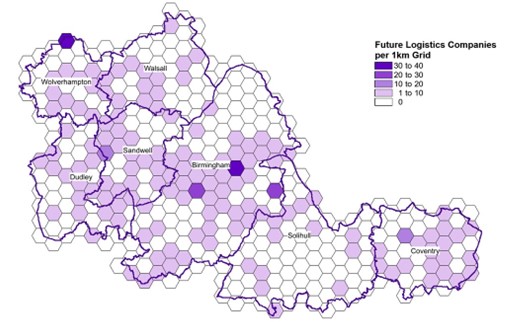

To support spatial insight and place-based decision making, the study report also includes a suite of mapping tools visualising the geographic distribution of businesses across each emerging opportunity area. An interactive map highlights where activity is concentrated, alongside the location of key regional assets such as innovation hubs, transport infrastructure, and R&D institutions.

A series of static hex-based heat maps have been developed – one per opportunity area – showing the density of firms within 1km grid cells across the WMCA region. These tools help identify spatial clusters, reveal infrastructure gaps, and inform more targeted, geography-sensitive interventions. An example is shown in Figure 2 below, which visualises the spatial distribution of firms within the Future Logistics opportunity area. The map reveals a clear concentration of logistics-related businesses around Birmingham, Coventry, and key parts of the Black Country, including Sandwell, Wolverhampton, and Walsall. Notably, several high-density cells are found in the Birmingham and Solihull corridor, close to major logistics hubs such as the M42 and Birmingham Airport, as well as in Coventry—reflecting the region’s strategic connectivity and proximity to national freight routes.

Figure 2 Spatial Distribution of Companies within the Future Logistics opportunity area

Based on the findings of this study, several strategic recommendations emerge:

- Prioritise high-performing and high-potential opportunity areas – including Future Logistics, Defence, and innovation-led sectors – within Local Growth Plans and investment strategies.

- Target support for underdeveloped but strategic opportunities, such as Battery Supply Chain and Hydrogen, to build foundational capabilities and improve ecosystem readiness.

- Strengthen diffusion of enabling technologies, particularly among SMEs, through regional innovation accelerators and transition support programmes.

- Develop tailored investment and skills strategies, aligned to the needs of future opportunity areas and based on gaps identified in talent pipelines and infrastructure readiness.

- Embed cross-sectoral collaboration and technology integration into delivery mechanisms, leveraging shared industrial capabilities across manufacturing, clean energy, and digital domains.

In summary, opportunity areas should be seen as nodes within a dynamic, multi-dimensional ecosystem.

The intelligence about the place-based economic future sits across different boundaries, where coordination is needed across places, sector by sector and between different public and private organisations. While businesses may not be constrained by the geographical and administrative boundaries, policy makers need to take strategic decisions based on strengths, opportunities, threats and weaknesses of a particular ‘place’. Strategic interventions must therefore consider how value can be amplified through cross-sector linkages, shared technology platforms, and complementary policy priorities across broader geographical areas.

See other studies and reports on the WMCA website.

This blog was written by Fumi Kitagawa, Chair of Regional Economic Development and George Bramley, Senior Analyst, at City-REDI / WMREDI, University of Birmingham.

Disclaimer:

The views expressed in this analysis post are those of the author and not necessarily those of City-REDI, WMREDI or the University of Birmingham.