The latest edition of REDI-Updates is out now - providing expert data insights and clear policy guidance. In this edition, the WMREDI team investigates what factors are contributing to the cost-of-living crisis and the impact it is having on households, businesses, public services and the third sector. We also look at how the crisis in the UK compares internationally. Chloe Billing discusses what implications increasing energy and material prices have on businesses in the West Midlands. View REDI-Updates.

Introduction

The aim of this chapter is to analyse the impact of rising energy and materials prices on businesses in the West Midlands Combined Authority (WMCA). Evidence shows that the price rises have resulted in higher operating costs and a reduction in consumer spending power, which are having a series of knock-on effects on local businesses, including a fall in business confidence (as shown by the latest Business Confidence Monitor), firm insolvencies, redundancies, reduction in business hours and a decrease in private spending on research and development (R&D). The impact of the inflationary pressures varies between sectors and different-sized firms, hitting small businesses in the construction, manufacturing, hospitality, and transport sectors especially hard (Centre for Economic Performance, 2023).

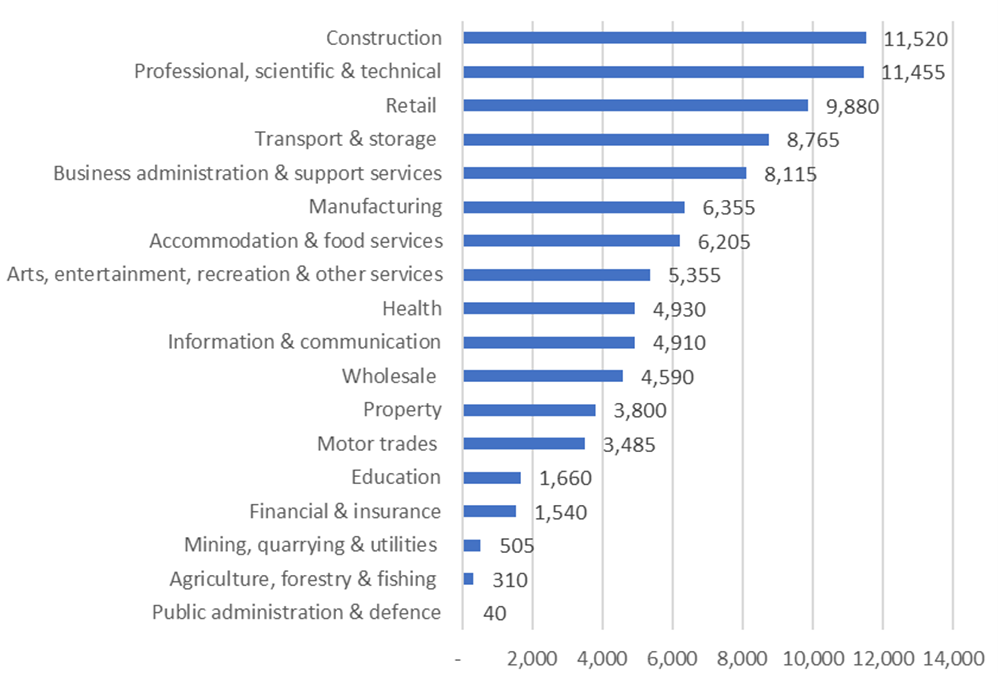

The sectors which are hardest hit by the price increases are shown in the below graph on ‘Business Counts by Sector in the West Midlands’ (Nomis, 2023), highlighting the place-based impact on the region.

Figure 1: Business Counts by Sector in the West Midlands

Inflation in the cost of materials and business services

Businesses are seeing rapid inflation in the cost of materials and business services (British Business Bank, 2023). Around 4 in 10 (41%) trading businesses reported a rise in the price of goods or services bought in December 2022, compared with the previous month. Looking ahead in February 2023, around a quarter (26%) of trading businesses expected the price of goods and services sold to rise (ONS, 2023b). These increases are shown in the ‘Input Producer Price Index’ illustrated in Figure 2. In total, producer input prices (materials and fuels purchased by manufacturers) rose by 12.7% in the 12 months to February 2023, down from 14.7% in the year to January 2023. Meanwhile, producer output (factory gate) prices rose by 12.1% in the 12 months to February 2023, down from 13.5% in the year to January 2023.

Figure 2: Input Producer Price Index (PPI), contribution to monthly and annual inflation rate, UK, February 2023

Underpinning these price increases is the wide array of supply-side problems that businesses continue to face. For example, a more difficult trading environment, because of Brexit, is increasing the import costs for companies (ICAEW, 2023). To protect themselves against any ‘near-term surges in commodity prices businesses have been stockpiling raw materials. This, coupled with weaker market demand, has led to the proportion of companies with above-normal levels of raw materials and components (25.5%) at almost double the historical average for UK businesses (ICAEW, 2023). Furthermore, higher consumer shopping basket prices put pressure on wages, as employees seek higher salaries to meet the increased cost of living (British Business Bank, 2023). This comes at a time in which the government has recently ended its business finance support packages, and firms are having to start paying back CBILS and Bounce Back loans % (ICAEW, 2023).

Rising Energy prices

Over the past year, there has been a steep rise in wholesale gas prices, due to a ‘squeeze’ on gas supplies into Europe. This squeeze was caused by the increased demand during the post-Covid reopening of economies coinciding with Russia’s illegal invasion of Ukraine (Valero, 2022). It has driven up the amount that energy providers pay for gas and electricity, which is being passed onto consumers, although policy interventions (Energy Bill Support Scheme and The Energy Price Cap) have somewhat helped cushion the extent of this impact (Valero, 2022). This ‘energy crisis’ is affecting businesses as well as households (ONS, 2022). For instance, non-domestic electricity costs increased by 29% between Q1 2021 and Q1 2022, and non-domestic gas prices rose by 71% over the same period, according to the government’s Quarterly Energy Prices data (British Business Bank, 2023). Businesses that use energy more intensively with large spending on energy relative to the size of their business, are finding themselves under increasing pressure to pass on higher costs to their customers or are vulnerable to closure (ONS, 2022). For example, industry sectors related to production and transportation are particularly energy intensive. Similarly, lighting and heating are significant cost for service sectors with relatively high energy intensity, such as accommodation and food service activities (ONS, 2023d). According to the UKHospitality group’s analysis, “the sector’s energy costs are £12bn a year higher than before the crisis” (The Guardian, 2023). The percentage price increase for energy-intensive small businesses is outlined in TABLE 1 below.

Table 1: Average cost of UK energy bills for small businesses in 2022.

| Industry Type | 2021 Total energy bill (£) | 2022 total energy bill (£) | Percentage price increase |

| HEALTH | 86,714.73 | 152,344.50 | 75.68 |

| COMMUNITY & LEISURE | 27,710.84 | 48,346.24 | 74.47 |

| ARTS & CULTURE | 33,445.16 | 56,977.92 | 70.36 |

| HOSPITALITY | 23,876.16 | 39,497.51 | 65.43 |

| OFFICES | 10,986.35 | 17,846.21 | 62.44 |

| RETAIL | 10,554.01 | 16,817.15 | 59.34 |

In response to the rising gas and electricity prices, businesses are having to find ways of cutting their costs or seeking financial support. Alternatively, they are being forced to absorb the additional costs or pass them on to consumers by raising their prices (Money.co.uk, 2022).

The impact of rising prices on different sectors

The sectors which are hardest hit by the price increases are outlined in the table below:

Table 2: Sectors which are hardest hit by the price increases

| Sector | Impact |

| Manufacturing & Engineering (6th largest sector by business count in the W Mids) | – The biggest risk to manufacturers’ competitiveness in 2023 is the increasing cost of producing goods and services (MakeUK, 2023).

– Manufacturing and engineering are among the most import-intensive sectors in the UK. – The largest upward contribution to the annual input inflation rate came from inputs of other parts and equipment, which contributed 2.80 percentage points. This product group saw an increase in the year to February 2023 of 9.0% (ONS, 2023a). – Metals and non-metallic minerals saw an increase in the year to February 2023 of 13.4%, down from 14.4% in January 2023. The annual inflation rate continues to be driven by globally high steel prices (ONS, 2023a). |

| Transport & Storage

(4th largest sector by business count in the W Mids) |

– Transport and storage have been particularly impacted by the sharp increase in fuel costs (MakeUK, 2023).

– At the more detailed industry group level, the three most energy intensive groups in 2019 were sea and coastal freight water transport (38%), passenger air transport (36%) and freight transport by road and removal services (31%) (ONS, 2023d). – The cost of transportation and shipping, including importing and exporting goods, has increased across the board. – The cost of a shipping container increased by up to 800% in 2021, though forecasters predict prices should start to decline (British Business Bank, 2023). |

| Hospitality

(7th largest sector by business count in the W Mids)

|

– Food products provided the largest upward contribution to the output annual rate in the year to February 2023, at 3.86 percentage points (ONS, 2023a). This was mainly driven by condiments and seasonings, with ingredients, packaging and energy costs pushing prices up. The annual inflation rate for food products was 16.5% in the year to February 2023, which is down marginally from 16.6% in January 2023 (ONS, 2023a).

– Food and drink service businesses were more likely than any other industry to say they plan to cut trading by at least two days per week in November 2022 to reduce energy costs (ONS, 2022b). – The broader hospitality industry, which employs around 1 in 14 UK workers, has been particularly affected by rising energy prices, according to our Business Insights and Conditions Survey (BICS). – Around 1 in 10 businesses across the hospitality industry said they had reduced or simplified goods and services (or planned to) in a bid to cut energy costs. |

| Construction

(1st largest sector by business count in the W Mids) |

– The second-largest contributor to the annual rate in the year to February 2023 came from other manufactured products, which contributed 2.60 percentage points and showed an increase of 10.8% in the year to February 2023. The annual increase was mainly driven by articles of concrete, cement and plaster because of ongoing high material and energy costs (ONS, 2023a).

– Access to capital is a prominent issue for property and construction companies; both sectors face severe difficulties with bank charges. (ICAEW, 2023). – There is considerable anecdotal evidence of property companies finding it difficult to raise funds or borrow at acceptable rates, as a result of declining real estate prices and higher interest rates (ICAEW, 2023). |

Looking Ahead

This chapter highlights the challenges of rising energy and materials prices on businesses in the West Midlands. Nevertheless, there is evidence of promising signs ahead. For example, data from Lloyds Bank shows that 62% of West Midlands firms said they are confident they would have greater success in the coming 12 months, compared to the past year. Meanwhile, 51% are expecting a higher turnover than in 2022 (Green, 2023). This is partly because companies expect annual input price inflation to soften to 4.9% over the next 12 months (ICAEW, 2023). Additionally, businesses are effectively modifying their business operations in response to rising prices, as discussed in the next chapter.

View and download the full REDI Updates report.

This blog was written by Dr Chloe Billing, Research Fellow, City-REDI / WMREDI, University of Birmingham.

Disclaimer:

The views expressed in this analysis post are those of the authors and not necessarily those of City-REDI / WM REDI or the University of Birmingham.