There are many unknowns relating to Brexit, regarding (i) the nature of the final trade deal and (ii) the potential responses of firms and consumers to any major shock like Brexit. Nevertheless, “a partial but still very wide-ranging and impact assessment can be undertaken even without such specific knowledge of the final trade deal and the associated responses” (Los et al., 2018). For instance, it is perfectly possible to model the level of Brexit-exposure of UK industries, by examining the extent to which they depend on trade with the EU (Chen et al., 2018).

There are many unknowns relating to Brexit, regarding (i) the nature of the final trade deal and (ii) the potential responses of firms and consumers to any major shock like Brexit. Nevertheless, “a partial but still very wide-ranging and impact assessment can be undertaken even without such specific knowledge of the final trade deal and the associated responses” (Los et al., 2018). For instance, it is perfectly possible to model the level of Brexit-exposure of UK industries, by examining the extent to which they depend on trade with the EU (Chen et al., 2018).

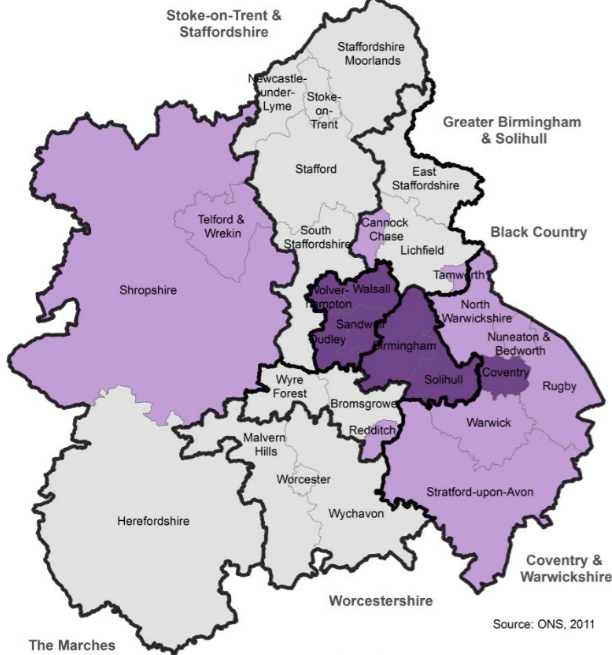

Our ESRC- Brexit priority grant: “What are the economic impacts of Brexit on the UK, its sectors, its cities and its regions” under the UK in a Changing Europe initiative aims to examine in detail the likely impacts of Brexit on the UK’s sectors, regions and cities by using the most detailed regional-national-international trade and competition datasets currently available anywhere in the world. This research, coordinated by City-REDI at Birmingham Business School with research partners from the University of Sheffield, the Groningen Growth and Development Centre at the University of Groningen, Erasmus University of Rotterdam and the PBL Netherlands Environmental Assessment Agency in the Hague, allows us to understand UK regional trade behaviour by computing the UK-EU trade exposure levels in EU regions.

Throughout the UK, industries are deeply interconnected with those in the rest of the EU through complex cross-border supply chains. Such supply chains comprise intricate processes of value-adding by firms in different countries, with component goods and services crisscrossing borders multiple times before reaching the final consumer (Bailey et al., 2018). Our research allows us to understand the role played by global value-chains in shaping UK regional trade behaviour, whereby goods and services criss-cross borders multiple times before being finally consumed by household and firms. Our trade-related effects based on input-output analysis considers the global fragmentation of production processes by including information on intermediates as well as final goods. Our data allows us to examine the impacts of different trade scenarios and to map out the sensitivity of UK sectors and regions to different post-Brexit scenarios.

Our results show that 2.64% of EU GDP is at risk because of Brexit negative trade-related consequences. In the UK, the Brexit trade-related consequences account for 12.2% of its GDP. Our results suggest that adverse effects are likely to be more severe in the regions which have the least ability to respond to adverse shocks. Our results show that 12.2% of West Midlands GDP is at risk because of Brexit negative trade-related consequences. If we consider the wider West Midlands region we see that the exposure of Shropshire and Staffordshire is 13.9% of local GDP and the exposure of Herefordshire, Worcestershire and Warwickshire is 14.3% of local GDP. In other words, the West Midlands as a whole is more exposed than the UK average (Chen et al., 2018). This inability to adjust to economic shocks is a characteristic of many of the UK’s economically weaker regions, with lower levels of diversity, skills and connectivity, including regions that voted to leave the EU such as the UK’s non-core regions in the Midlands.

In our sectoral analysis, an industry’s exposure to Brexit is defined as its value-added – embodied in a product or service – that crosses a UK-EU border at least once. Exposure levels indicate how much the industry has to restructure its supply chains (by re-shoring stages of production and exploiting non-EU markets, for example) in order to mitigate the value added and employment losses due to reduced post-Brexit trade with the EU. Our research suggests that up 2.5 million jobs are directly exposed to a No Deal scenario in the UK (Los et al., 2017). Among the sectors, manufacturing is the most exposed sector in the West Midlands with a 32.3% of its GDP at risk due to EU-UK trade relationships. The frictionless trade enabled by the EU’s Customs Union and the EU Single Market allow such pan-European JIT supply systems to operate so smoothly, and today these systems are almost ubiquitous in many areas of the UK and EU manufacturing, engineering, logistics, retail and distribution industries. They are especially important in those regions of the UK with strong manufacturing bases such as the Midlands (Bailey et al., 2018). Not only the manufacturing sector is at risk because of Brexit in West Midlands, 25.5% of GDP in primary industries, 12.2% of GDP in Services and 4% of GDP in Construction are also exposed to negative trade-related risks (Chen et al., 2018).

At the same time, the changes implemented because of Brexit will also have profound implications for the design and governance of UK city and regional development policy logic and settings. The changing external environment will heavily affect the ongoing UK devolution agenda (Billing et al., 2019). Our participatory workshop held at the Birmingham City Council on the 11th of May of 2018 with city, regional and national stakeholders discussed the main challenges and opportunities brought by Brexit to the West Midlands region and the advanced manufacturing sectors. Among them, experts in the automotive industries indicated that investments in plants and production lines were substantially downsized last year due to higher levels of uncertainty surrounding trade conditions, with companies delaying or cancelling investment decisions. In addition to the negative effects linked to uncertainty due to trade relationships, regional manufacturers also raised some concerns with regard to the reduction of EU workers, in particular, high-skilled labour. The opportunities were mainly connected with the development of a stronger domestic workforce connected with the needs of UK industries from the private sector and a potential devolution agenda from the public sector. Less investment, rising prices, and competitiveness-wise the UK regions and industries face major challenges indeed. As a whole, a No Deal scenario will be disastrous for the UK economy, and in all likelihood will also make the UK’s enormous interregional inequalities much greater than they already are (UKICE, 2018). Moreover, the complete lack of sub-state representation in the Brexit process for most of these regions (Billing et al. 2018) means that these No Deal impacts will in turn probably set back the UK devolution agenda by more than a decade.

Sources:

- Billing, C., McCann, P., and Ortega-Argilés, R., 2019, “Interregional Inequalities and UK Sub-National Governance Responses to Brexit”, Regional Studies, Forthcoming

- Bailey, D., McCann, P., and Ortega-Argilés, R., 2018, “Could Brexit Spell the End for ‘Just-In-Time’ Production?”, Prospect

- McCann, P., and Ortega-Argilés, R., 2018, “Could Brexit spell the end for ‘just-in-time’ production?“, The UK in a Changing Europe

- Chen, W., Los, B., McCann, P., Ortega-Argilés, R., Thissen, M., and Van Oort, F., 2018, “The Continental Divide? Economic Exposure to Brexit in Regions and Countries on Both Sides of the Channel”, Papers in Regional Science, 97.1, 25-54

- UKICE, 2018, Cost of No Deal Revisited, September 2018

- Los, B., Chen, W., McCann, P., Ortega-Argilés, R., 2017, “An Assessment of Brexit Risks for 54 Industries: Most Services Industries are also Exposed”, City-REDI Policy Briefing Series, December

This blog was written by Professor Raquel Ortega-Argiles, Chair, Regional Economic Development, City-REDI, University of Birmingham

This blog was written by Professor Raquel Ortega-Argiles, Chair, Regional Economic Development, City-REDI, University of Birmingham

Disclaimer:

The views expressed in this analysis post are those of the authors and not necessarily those of City-REDI or the University of Birmingham

To sign up for our blog mailing list, please click here.