Tracey Stephenson, Managing Director of Staying Cool, discusses how the UK’s hospitality industry suffered disproportionately during the COVID-19 pandemic.

This article was written for the Birmingham Economic Review.

The review is produced by City-REDI / WMREDI, the University of Birmingham and the Greater Birmingham Chambers of Commerce. It is an in-depth exploration of the economy of England’s second city and a high-quality resource for informing research, policy and investment decisions.

Government grants for larger Small and Medium Enterprises (SMEs) were insufficient to cover costs during long periods of closure and zero revenue. To survive, many businesses like ours turned to CBILS loans, incurring substantial debt. Now with higher interest rates and ongoing economic challenges, we are burdened with high loan repayments that are hindering our recovery. We are calling for the government to soften the repayment terms of loans to facilitate capital investment and to review the punitive interest payments that have accrued due to interest rate rises.

Background

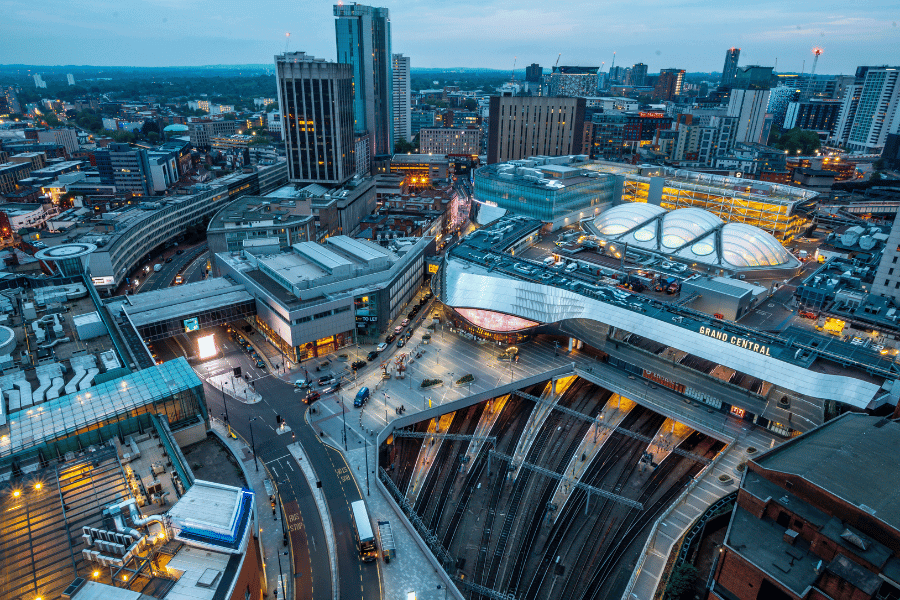

The coronavirus pandemic unleashed a devastating and unjust blow to the hospitality sector in Birmingham and across the United Kingdom. As the world grappled with an unprecedented crisis, leisure and tourism businesses found themselves disproportionately affected.

The sector was among the first to be hit in January 2020. Firstly, by international visitors cancelling their trips to the UK and secondly, by domestic guests choosing to stay home rather than risk exposure to the virus. This was compounded by the strict lockdown measures to curb COVID-19’s spread that followed in March of that year.

Subsequent lockdowns often coincided with peak season and holiday periods, depriving businesses of the crucial revenue streams that help to sustain us through the quieter months.

In short, the pandemic caused financial turmoil.

Government support

Government support, in the form of furlough to cover staff salaries, came just in time but what about rents, contracted supplies, and other commitments? The subsequent grant distribution scheme, though welcome, proved to be a blunt instrument that scarcely distinguished between micro and medium-sized companies. While smaller companies were able to use the grants to cover all of their costs, we were left with a significant shortfall. As a city centre business, our rents are high and while most landlords compromised on payments, at least for the first lockdown, we were left with a significant financial void with zero revenue coming in.

Bounce Back Loans and CBILS

Bounce Back Loans and CBILS

We secured a Bounce Back Loan but knew it wouldn’t be enough and subsequently applied for a CBILS loan of several hundred thousand which we finally received in September 2020, adding a further tranche of debt a few months later when it became clear the pandemic showed no sign of relenting anytime soon.

Interest rates were at a historic low and our Covid recovery plan enabled the repayment of the debt over the next five years, but barely left any funds in the business for investment or shareholder returns.

Roll forward to today: interest rates have risen 14 times; our cost base has sky-rocketed while leisure bookings have weakened as consumers spend less on non-essential items, such as a city break, in the current cost of living crisis. The impact of Birmingham City Council’s section 114 notice (notifying the government that it will not be able to balance the books) is yet to be determined, but it is unlikely to be a boon for the city’s tourism sector.

Our monthly CBILS payments are stifling our ability to invest in our team and make capital investments. In 2022 we paid the equivalent of a full-time member of staff’s salary in interest payments alone.

Our call to the government

- To formally soften the repayment terms of CBILS loans to reduce monthly repayments and provide funds for reinvestment. This is currently still at the discretion of individual banks.

- To look at ways of reducing the excessive interest burden that has accrued due to successive rate hikes.

This blog was written by Tracey Stephenson, Managing Director of Staying Cool.

Disclaimer:

The views expressed in this analysis post are those of the authors and not necessarily those of City-REDI / WMREDI or the University of Birmingham.