Our research for the UK in a Changing Europe (“The economic impacts of Brexit on the UK, its regions, its cities and its sectors”) has demonstrated that the implications of Brexit are profoundly different for the different cities, regions, and nations of the UK. Yet, the proposed UK-EU Withdrawal Agreement brokered by Prime Minister Theresa May and her team of negotiators has nothing to say regarding the likely differential implications for UK regions of leaving the EU. There has been almost no UK sub-national consideration given whatsoever in the Withdrawal Agreement, other than the issues surrounding the Irish border. The word ‘regional’ only appears twice in the 585-page report on page 465 and in both cases, the use of this word is referring to the Compatibility Rules for Regional State Aid. Other than that there is no mention of the words ‘region’, ‘city’, ‘cities’, ‘devolved’, ‘sub-national’, Scotland or Wales anywhere in the document. As such, the profoundly different economic and trade-related issues facing the UK cities and regions simply do not figure anywhere in the text.

There is now a large body of evidence from many sources including our own research using different modeling techniques and data sources which suggests that in the long run the implications of leaving the EU are likely to be much more serious and problematic for the weaker (and primarily Leave-voting) regions of the UK than for the stronger (and primarily Remain-voting) regions of the UK (Los et al. 2017a; Chen et al. 2018; HM Government 2018; Levell and Norris Keiller 2018; Clarke et al. 2017; Borchert and Tamberi 2018a,b; Gasiorek et al. 2018; Cambridge Econometrics 2018; HoCEEUC, 2018; IPPR 2018; Oliver Wyman 2018). London and its hinterland along with Scotland are likely to be less affected by Brexit than the Midlands and North of England, Northern Ireland, and Wales.

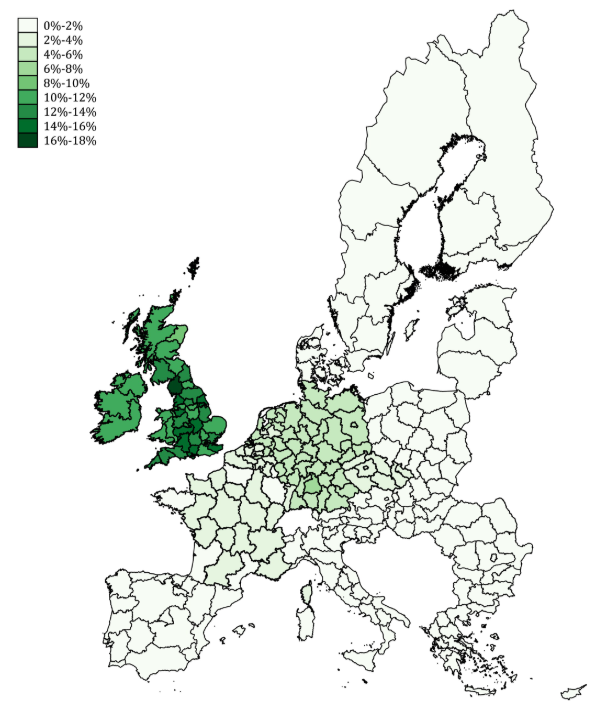

In other words, Brexit is likely to exacerbate the UK’s current interregional inequalities, which are already very high by international standards (McCann 2016, 2018). Moreover, this conclusion holds largely irrespective of the eventual form of Brexit. The reason is that the UK’s economically weaker regions, especially in the Midlands and the North of England, are more exposed to Brexit trade-related risks (Chen et al., 2018) because they tend to be much more dependent on EU markets for their prosperity than the UK’s richer regions (Los et al. 2017a). Moreover, not only are all other UK regions more dependent on EU markets for their prosperity than London but also most UK regions have been becoming more, not less dependent on EU markets (Los et al. 2017a) over recent decades.

This also implies that the ‘metropolitan elite’ argument is empirically incorrect in that London is the part of the UK which benefits relatively the least from the EU. Not surprisingly, therefore, London is also the UK region which is the least exposed Brexit, whereas, in marked contrast, Leave-voting regions are typically between 20% and 60% more exposed to Brexit than London. Indeed, the UK’s economically weaker regions are more exposed to Brexit trade-related risks than regions anywhere else in Europe. In other words, the UK’s economically weaker regions will have to restructure more rapidly and more profoundly than the UK’s stronger regions in order to withstand any (rapid or slow-burning) shocks associated with EU withdrawal. The current evidence on UK regional productivity suggests that this is very unlikely, to say the least.

The possible movement towards some sort of long-term UK-EU customs partnership combined with a ‘backstop’ agreement may serve to avoid a ‘cliff edge’ in the short term which would have fundamentally ruptured almost all of the international Just-In-Time types of relationships which are largely ubiquitous in sectors such as automobile manufacturing, aerospace, as well as whole swathes of the supermarket retail and the medical supplies industries (Bailey et al. 2018). In the short-term, this may mitigate some of Brexit’s most adverse impacts on the weaker UK regions with major manufacturing sectors, but the long run the implications for these regions still depend on what type of UK-EU trade relationship is negotiated in the long term. For these economically weaker regions, while customs alignment is more important in the short to medium term, in the medium to long term it is access to the EU Single Market that is still the most critical issue because they are more dependent on EU markets, and as yet, we are almost entirely in the dark regarding this matter. Until a new and comprehensive UK-EU trade arrangement is negotiated, which could be years away from now, it is not possible to say what the implications are of the UK’s withdrawal from the EU for the different parts of the UK.

This is also the case for different sectors. Our work has demonstrated that while manufacturing and agriculture are relatively very exposed to Brexit, in total it is actually the UK services industries that are the most exposed, with some 2.5 million jobs directly affected (Los et al. 2017b). The jobs which are the most exposed to Brexit tend to be the more productive jobs, which poses a challenge to the whole UK productivity debate, although these are not the financial services industries in The City, which actually face relatively very low levels of exposure to Brexit (Los et al. 2017b). The broad aspirations outlined in the political declaration provide no real clues as to how Brexit will impact on the numerous different services occupations and activities which are currently very exposed.

This vacuum of knowledge is also exacerbated by the fact that the different layers of UK sub-national government have been almost entirely locked out of the UK-EU negotiations and at the same time they have very limited discretionary powers. The lack of engagement along with limited powers means that most localities are unable to develop any locally-tailored policies aimed at responding to Brexit. In particular, their local efforts at mitigating any of the potentially adverse effects of Brexit, and their attempts at taking advantage of any possible post-Brexit opportunities, have been almost entirely ad hoc, uncoordinated and limited (Billing et al. 2019) and will almost certainly prove to be completely ineffectual. Moreover, as yet we know almost nothing about the UK’s replacement and successor to EU regional development funds, known as the ‘Shared Prosperity Fund’ (Billing et al. 2019), so it is doubly difficult for the economically weakest localities to plan ahead on any meaningful basis. The Withdrawal Agreement does nothing to improve this situation. Nor does the outline political declaration really provide any real clarity on these matters.

References

Bailey, D., McCann, P., and Ortega-Argilés, R., 2018, “Could Brexit Spell the End for ‘Just-In-Time’ Production?”, Prospect, and also here.

Billing, C., McCann, P., and Ortega-Argilés, R., 2019, “Interregional Inequalities and UK Sub-National Governance Responses to Brexit”, Regional Studies, Forthcoming, doi: 10.1080/00343404.2018.1554246

Borchert, I and Tamberi, N., 2018a, “Brexit and Regional Services Exports: A Heat-Map Approach”, UK Trade Policy Observatory Briefing Paper 14, January

Borchert, I and Tamberi, N., 2018b, “Leave Voting Regions are ‘Most Exposed’ to Brexit Services Shock”

Cambridge Econometrics, 2018, Preparing for Brexit, Report for the Greater London Authority

Chen, W., Los, B., McCann, P., Ortega-Argilés, R., Thissen, M., and Van Oort, F., 2018, “The Continental Divide? Economic Exposure to Brexit in Regions and Countries on Both Sides of the Channel”, Papers in Regional Science, 97.1, 25-54

Clarke, S, Serwicka, I., and Winters, L.A., 2017, Changing Lanes: The Impact of Different Post-Brexit Trading Policies on the Cost of Living, Resolution Foundation and the UK Trade Policy Observatory

Gasiorek, M., Serwicka, I., Smith, A., 2018, “Which Manufacturing Sectors are Most Vulnerable to Brexit?”, UK Trade Policy Observatory Briefing Paper 18, February

HM Government, 2018, EU Exit: Long-Term Economic Analysis, Cm9741,

HoCEEUC, 2018, “EU Exit Analysis: Cross Whitehall Briefing”, House of Commons Exiting the EU Committee, January

IPPR, 2018, An Equal Exit? The Distributional Consequences of Leaving the EU, Institute for Public Policy Research, London

Levell, P., and Norris Keiller, A., 2018, “The Exposure of Different Workers to Potential Trade Barriers between UK and EU”, Chapter 10, IFS Green Budget, Institute for Fiscal Studies, 16 October (pre-released chapter, 5 October)

Los, B., McCann, P., Springford, J., and Thissen, M., 2017a, “The Mismatch between Local Voting and the Local Economic Consequences of Brexit”, Regional Studies, 2017, 51.5, 786-799

Los, B., Chen, W., McCann, P., Ortega-Argilés, R., 2017b, “An Assessment of Brexit Risks for 54 Industries: Most Services Industries are also Exposed”, City-REDI Policy Briefing Series, December

McCann, P., 2016, The UK Regional-National Economic Problem: Geography, Globalisation and Governance, Routledge, London

McCann, P., 2018, Perspectives in UK Regional Inequality and the Geography of Discontent, Discussion Paper, Productivity Insights Network PIN-D1

Oliver Wyman, 2018, Costs Up, Prices Up: Brexit’s Impact on Consumer Businesses and their Customers, London

This blog was written by Philip McCann, Professor of Urban and Regional Economics, University of Sheffield Management School and Raquel Ortega-Argiles, Professor of Regional Economic Development, City-REDI, Birmingham Business School, The University of Birmingham

Disclaimer:

The views expressed in this analysis post are those of the authors and not necessarily those of City-REDI or the University of Birmingham

To sign up for our blog mailing list, please click here.