In this blog, Dr Kostas Kollydas summarises a briefing co-authored with Professor Anne Green on labour market insights from online job postings in East Birmingham and North Solihull. The analysis forms part of the research project ‘Youth transitions to good employment: East Birmingham & North Solihull’, which is funded by the Nuffield Foundation.

Labour demand in East Birmingham and North Solihull

This briefing uses Adzuna online job postings data to examine labour demand in East Birmingham and North Solihull (EBNS). It also compares local patterns with those observed in the wider West Midlands region and in England. The findings suggest that the labour market in the EBNS area has become more strongly oriented towards higher-skilled work over the last few years. At the same time, there has been a decline in the relative importance of routine and lower-skilled roles. This picture likely reflects the sectoral profile of the area and its proximity to Birmingham city centre, which is home to public-sector institutions, universities and professional services-oriented employers.

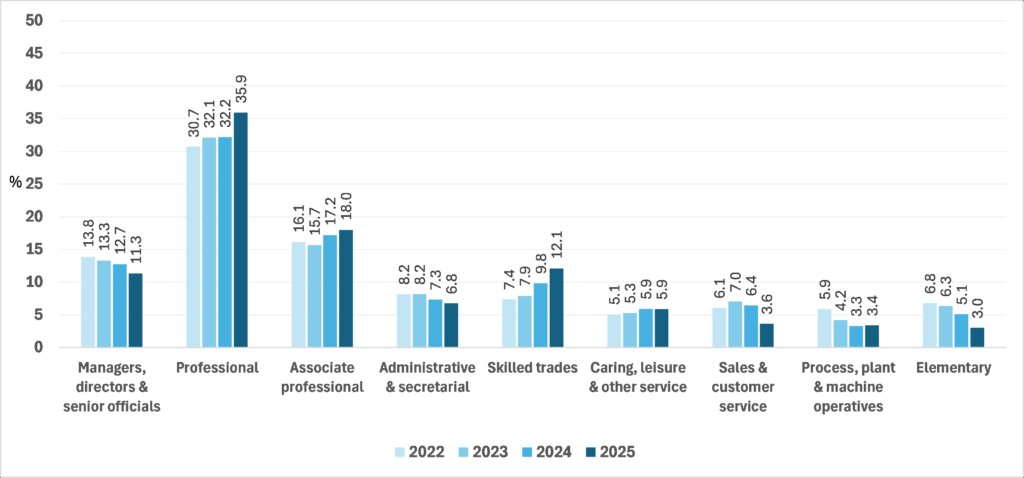

During the period of analysis (2022-2025), the share of professional occupations in total job postings in the EBNS area increased by more than five percentage points (from 30.7% to 35.9%), now accounting for more than a third of total demand (see Figure below). Skilled trades expanded at a similar pace. Overall, close to half of all job postings in the EBNS area were concentrated in higher-level occupations (managerial and professional) in 2025. This share is well above that seen in the West Midlands region and also exceeds England’s average. On the other hand, lower-skilled and routine occupations became less prominent. In particular, the share of elementary roles showed the largest fall.

Distribution (%) of online job postings by major occupation group in the EBNS area (2022-2025)

Sectoral structure of labour demand

The sectoral breakdown of job postings helps to explain this pattern. Teaching, engineering and information technology (IT) together made up around one third of all vacancies in EBNS between 2022 and 2025. Each of these sectors has a stronger presence locally than across England as a whole. For example, the share of IT jobs in the EBNS area is almost double that observed in the wider West Midlands region.

Trade and construction roles also show relatively strong demand. These jobs typically require technical or vocational skills and qualifications. In contrast, sectors such as healthcare, logistics and manufacturing account for a smaller share of vacancies in the EBNS area than in the wider region. At the national level, the distribution of jobs is more balanced, with greater representation in hospitality and marketing.

Taken together, these patterns show that the EBNS labour market is more professional and knowledge-based than that of the wider West Midlands region, which is characterised by more production-oriented demand. Lower-skilled and manual occupations form a smaller share of job postings in the EBNS area. While such jobs do exist locally, some may not be advertised online, particularly where employment is casual or short-term.

Pay levels, job density and access to ‘good jobs’

Advertised pay in the EBNS area is generally higher than the regional average. Over the period from 2022 to 2025, the weighted median salary was £36.6 thousand. This is around 15% higher than the West Midlands average and 6% above the England average. This earnings premium reflects the area’s occupational and sectoral mix discussed earlier. Salaries are particularly strong in IT, engineering, energy, and trade and construction. In contrast, hospitality, administration and customer services offer lower pay levels that are closer to regional and national norms.

Pay and job availability also vary markedly within the EBNS area itself. For instance, Birmingham Hall Green records the highest advertised salaries and one of the lowest ratios of working-age people per job posting. This demonstrates a dense concentration of job vacancies in Birmingham Hall Green. Other parliamentary constituencies, such as Erdington and Hodge Hill (which lies at the heart of the EBNS area) show much higher ratios. This suggests greater competition for available jobs in these areas. Such differences indicate that access to well-paid and secure jobs varies significantly, even across neighbouring areas.

Overall, the findings describe a local economy that is characterised by high-skill demand and relatively strong pay. Nonetheless, there may also be uneven access to opportunity. A large share of local vacancies expect applicants to hold higher qualifications, have some work experience, and be able to travel to the job. For some younger people, that combination may be hard to achieve. This makes it especially important to develop clearer routes into mid- and higher-skilled roles. Hence, it remains crucial to build stronger connections between employers and education providers. This should, in turn, help more people gain access to ‘good employment’ as the EBNS economy continues to change.

This blog was written by Kostas Kollydas, Research Fellow at City-REDI, University of Birmingham.

Disclaimer:

The views expressed in this analysis post are those of the author and not necessarily those of City-REDI or the University of Birmingham.