In the first 2025 edition of the West Midland’s Impact Monitor, President Trump re-entered the White House as the 47th President of the USA in January 2025.

The Trump presidency is expected to foster a more protectionist trade environment. Renewed trade hostilities could disrupt global commerce, create supply chain bottlenecks and most likely increase costs for consumers and businesses. Other developments include curtailing of green infrastructure investment and deportation of undocumented migrants, with economic implications for the USA and beyond.

Global outlook

- According to the International Monetary Fund and the OECD global growth is projected at 3.3% h in 2025. This is below the historical (2000–19) average of 3.7%.

- The International Monetary Fund expects global headline inflation to decline to 4.2% in 2025 and to 3.5% in 2026, converging back to target earlier in advanced economies than in emerging market and developing economies.

- The OECD Global Economic Outlook suggests that despite some easing in labour markets, labour and skill shortages remain at very high levels. Over the past decade, job vacancy rates have nearly doubled, with particularly sharp increases in sectors like healthcare and ICT. Population ageing is exacerbating these shortages and is expected to accelerate in the coming decades. Persistent labour shortages can impede economic growth and making the most out of digital and green transitions.

Business confidence

- At UK level, business sentiment contracted sharply in Q4 2024, only just remaining positive. Higher business taxes announced in the Autumn Budget are likely the principal cause of this drop in optimism, alongside the slowdown in economic activity. Business confidence declined across all sectors and regions compared to the previous quarter.

- Following the policies announced in the Budget, the tax burden has become the most prevalent rising challenge for businesses, just above regulatory requirements, reaching a survey-record high in Q4 2024.

- Business confidence in the West Midlands improved slightly but while sentiment is ahead of the region’s historical norm, it remains below the UK average.

- Companies in the region recorded weak sales growth both domestically and abroad, but they expect significant improvements in both over the coming year.

- Businesses reported the joint-lowest input price increases in the UK alongside Yorkshire & Humberside and further moderation is expected. The region also has the lowest salary growth expectations in the UK.

Regional business activity and capacity

- The West Midlands Business Activity Index decreased from 49.9 in November 2024 to 48.9 in December 2024, a second successive fall in business activity across the region despite the rate of contraction being modest. Firms that signalled a fall in activity remarked on subdued client confidence and reduced intakes of new business.

- Out of the twelve UK regions, the West Midlands ranked sixth highest for business activity in December 2024. The North East ranked highest at 55.1 while the North West ranked lowest at 46.9.

- The West Midlands Future Business Activity Index decreased from 68.6 in November 2024 to 67.2 in December 2024, a two-year low. Firms remained confident that output would increase in 2025 with optimism being underpinned by advertising, investment and hopes of a recovery in client demand.

- The West Midlands New Business Index decreased from 48.8 in November 2024 to 47.4 in December 2024, a second consecutive month of contractions in new orders placed to its fastest rate in two years. The rate of reduction was also quicker than the UK average, with challenging economic conditions, subdued client confidence and the postponement of orders being identified as the main factors behind the fall in sales.

- The West Midlands Employment Index decreased from 47.5 in November 2024 to 43.9 in December 2024, the fastest rate of job shedding in over four years. A lack of existing and new work, alongside the upcoming increase in employer National Insurance Contributions and minimum wages, prompted companies to reduce headcounts.

Labour market indicators

- For the three months ending November 2024, the West Midlands Region employment rate (aged 16–64 years) was 73.5%. Since the three months ending August 2024, the employment rate decreased by 0.3 percentage points (pp). When compared to the same period in the previous year, the employment rate was 0.4pp lower. The UK employment rate was 74.8%, a decrease of 0.1pp when compared to the previous quarter and no change when compared to the previous year.

- For the WMCA area, the economic activity rate (aged 16-64) was 73.9% in the year ending September 2024, a decrease of 1.4 percentage points (pp) since the year ending September 2023. The UK economic activity rate was 78.4% and decreased at a slower rate of 0.3pp.

- The WMCA area employment rate was 69.5% in the year ending September 2024. This was a decrease of 0.8pp since the year ending September 2023. The UK employment rate was 75.4%.

- For WMCA area overall, the economic inactivity rate was 26.1% in the year ending September 2024, an increase of 1.4pp since the year ending September 2023. The UK economic inactivity rate increased by 0.3pp to 21.6%.

- In the year ending September 2024, the WMCA area was the highest Combined Authority for unemployment.

- Permanent staff appointments in the Midlands fell at the fastest pace for 16 months, according to the latest KPMG and REC UK Report on Jobs Temporary billings continued to increase, albeit at a softer rate than that seen in November. Demand for permanent staff continued to fall in December, with the rate of decrease the most pronounced in four-and-a-half years.

Economic geographies of the West Midlands

- Mapping of a range of fine-grained origin-destination indicators across the West Midlands reveals some evidence for polycentricity – albeit the functional economic area with Birmingham at its core is bigger than the other areas. When different indicators are combined, three key geographies emerge within and across the WMCA area: (1) Birmingham – with large parts of Solihull and parts of Sandwell; (2) the Black Country – which subdivides on certain indicators; and (3) Coventry – with a small part of Solihull and with Warwickshire.

- The ‘boundaries’ of the different areas in the West Midlands are porous. On many of the indicators, functional economic relationships are evidently overlapping. This suggests that the situation on the ground is ‘messy’ and there are no ‘hard edges’. It is clear also that there are some strong links with places outside of the WMCA area. This means that the WMCA area’s overall socio-economic character and performance has been shaped not only by its constituent authorities but also by Kidderminster, Bromsgrove, Redditch, Warwick/ Leamington Spa, Nuneaton, Tamworth, Lichfield and Cannock.

- Megatrends such as technological change and digitisation, adaptation to climate change and the transition to net zero carbon, and geopolitical developments will shape economic geographies over the medium- and longer-term. For individuals, it is likely that functional economic geographies will be increasingly differentiated, varying by age, occupation and income/wealth. Relationships between home and work will be more complicated and less predictable.

When will the UK hit ‘Peak Car’?

- New car purchases have fallen since their peak in 2016 and driving licences are falling amongst the young.

- The total number of cars on the road has stabilised after a long period of growth. The total number of cars on the road in 1994 was 21.2 million, by 2004 it has risen by 27% to 27 million, by 2014 the number rose by 10% to 29.6 million. by 2024 the number is expected to rise another 10% to 32.6 million. City-REDI analysis suggests that over the next six years to 2030 that number will rise to 32.8 million a meagre 0.7% rise.

- Automotive is important sector for the Midlands region employing 44,000 full time equivalent (FTEs) employees and with 1/3 of all cars produced in the UK built in the West Midlands. It is important to the future economy of the region to understand the trends in demand.

- Looking ahead there are opportunities: estimates suggest electric vehicles will see rising demand over the next decade. From an environmental perspective fewer cars will mean lower emissions, reducing carbon footprints and lowering demand for fossil fuels. From a health perspective fewer vehicles on the road means less air pollution and more active travel is linked with improved health. Falling car dependency presents an opportunity to hand over space to people. Increasing the vibrancy of towns and communities.

- With regard to risks, falling demand for a key export of the region could have consequences for regional resilience and employment, where reskilling is required. There are concerns the domestic automotive market is ‘losing the race’ to produce competitive electric vehicle products with a ‘Gigafactory gap’ stymying production.

The economic impacts of civic universities

- Civic universities are universities which are embedded within their local area, they are rooted within a town, city and/or city-region. Universities make a significant civic and economic contribution to their locality, whether or not they adopt an explicit mission to generate local or regional impact.

- With changes in the policy context, it has become increasingly important for universities to demonstrate their civic and economic impacts.

- Currently university impact assessments are largely prescriptive and descriptive in nature. Yet university impact assessments have the potential to demonstrate the unique impact of individual universities at both a civic and economic level.

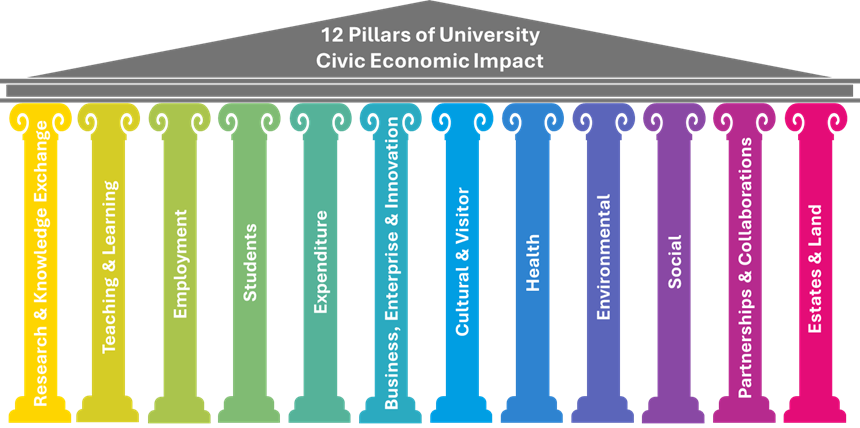

- To gain a better understanding of their civic economic impact, universities can utilise the 12 Pillars of University Civic Economic Impact tool to map the civic and economic outputs.

For further details read the full report.

This blog was written by Anne Green, Professor of Regional Economic Development and Co-Director, City-REDI, University of Birmingham.

Disclaimer:

The views expressed in this analysis post are those of the authors and not necessarily those of City-REDI or the University of Birmingham.