In this case study we hear from Max Schroeder, a postdoc from the Department of Finance, who has been making use of BlueBEAR to enable his research into developing an economic model that correlates graduates’ observable outcomes with their unobservable skills.

Universities tout the development of “graduate skills” as a key outcome of higher education, a promise that’s central to their appeal. Yet, despite the prevalence of this term in academic marketing, there’s a significant gap in our understanding of what skills students actually acquire – skills that are difficult to quantify and often remain hidden beneath the surface.

My research focuses on this very issue, particularly how these intangible skills relate to wealth and income inequality. Skills have a profound effect on life outcomes, including the types of jobs individuals secure and their earning potential. But the challenge remains: How can we assess these skills when they’re often not directly measurable?

BEARs computational power allowed me to run these extensive simulations, on a large scale, speeding up the estimation process considerably.

To address this, I’ve developed an economic model that correlates graduates’ observable outcomes, such as their career choices and wages, with their unobserved skills. The assumption is that graduates will naturally select occupations that demand the skills they are proficient in. For example, civil engineers and music teachers differ greatly in their skill sets, and my model predicts these professions attract individuals with corresponding skills. Armed with this model it should be theoretically straightforward to use the things that we can observe (graduate’s job choices and wages) to infer the things that we cannot observe (their skills). Well, theoretically…

Estimating an economic model is much like nurturing those captivating sea monkey crabs in a childhood aquarium; it requires a very precise environment to thrive, and you have to try out many different specifications until you get things right. In this endeavour, it meant simulating a model economy—a microcosm where graduates, armed with a spectrum of skills, ventured into the labour market. The simulation had to be run repeatedly, each iteration a meticulous adjustment of the skill distribution, striving to mirror the intricate reality of the UK’s graduate landscape. With millions of these simulations required, the task was daunting, the computational equivalent of finding a needle in a haystack. A task very much not suitable for your personal laptop computer. But this is where BEAR proved indispensable.

BEAR’s computational power allowed me to run these extensive simulations, on a large scale, speeding up the estimation process considerably. I further developed a novel global optimization algorithm that allowed me to take particular advantage of BEAR’s parallelization capabilities, to search for the global optimum in a high dimensional (non-convex) parameter space.

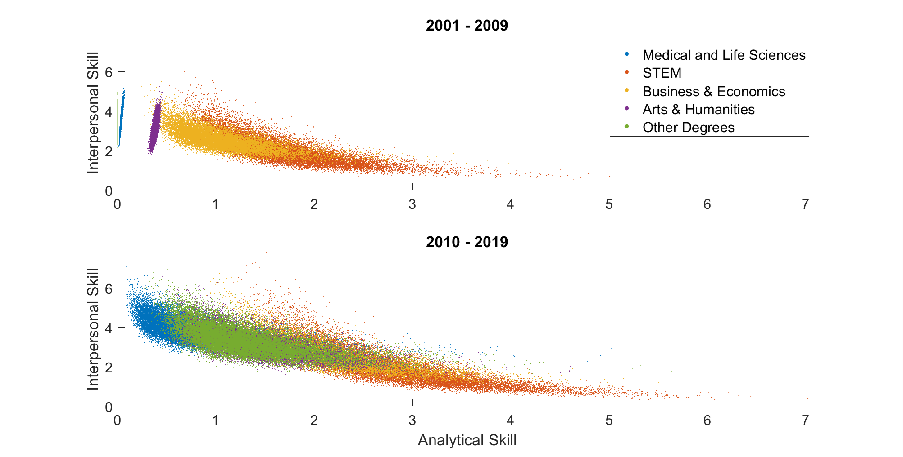

My results indicate a significant increase in analytical skills among graduates from the early 2000s to the mid-2010s. This trend suggests an evolving job market that increasingly valued analytical capabilities, which may have important implications for educational policy and economic equality.

In conclusion, the integration of BEAR’s high-performance computing capabilities was vital in conducting research that could potentially influence economic policies and contribute to a fairer society by revealing the true nature of graduate skills and their role in the labour market.

We were so pleased to hear of how Max was able to make use of what is on offer from Advanced Research Computing, particularly to hear of how he has made use of BlueBEAR HPC and its many cores – if you have any examples of how it has helped your research then do get in contact with us at bearinfo@contacts.bham.ac.uk. We are always looking for good examples of use of High Performance Computing to nominate for HPC Wire Awards – see our recent winners for more details.