This blog post has been produced to provide insight into the findings of the Birmingham Economic Review.

This blog post has been produced to provide insight into the findings of the Birmingham Economic Review.

The Birmingham Economic Review 2019 is produced by City-REDI, University of Birmingham and the Greater Birmingham Chambers of Commerce, with contributions from the West Midlands Growth Company. It is an in-depth exploration of the economy of England’s second city and is a high-quality resource for organisations seeking to understand Birmingham to inform research, policy or investment decisions.

This post is featured in Chapter One of the Birmingham Economic Review “Adapting, Innovating and Preparing for the Near Future”.

Over the last two and half years an international research team led by City-REDI and involving the University of Sheffield, the University of Groningen in the Netherlands and the PBL Dutch Environmental Assessment Agency have undertaken the most detailed work to date regarding the city, regional and rural implications of Brexit. Most of the economic narratives and debates surrounding Brexit are framed at a national level with comparisons made between the UK as a whole and the EU as a whole, as reflected the bilateral nature of the UK-EU negotiations. However, the complex nature of modern trade means that ‘national’ implications may differ substantially from local implications, depending on the industrial and commercial structure of the local economy. The fact that the implications of Brexit may be markedly different for different places is important because recent years have also seen a growing awareness in the UK that the opportunities and difficulties associated with modern globalisation are unevenly distributed across the country. Indeed, some commentators have argued that this is one of the reasons for the specific geography of the Brexit vote in which many ‘left-behind’ places voted Leave. These potentially very different post-Brexit implications also raise the question as to how localities may best respond to their specific challenges and the policy levers that they have available to them. Understanding these issues requires the construction and analysis of very large datasets which take account of the fact that the UK is part of deeply-embedded pan-EU value-chains which involve large amounts of re-importing and re-exporting. These complex value-chains mean that simple export-minus-import trade balance figures quoted by politicians are largely meaningless. In addition, in order to understand the local policy implications and responses, our work involves engagement with very large numbers of key stakeholders.

The evidence produced and published by the City-REDI led team has five key elements to it:

(i) The UK regions which most strongly voted Leave tend to be the same regions which are the most dependent on EU markets for their economic viability and prosperity, and as such, are likely to face the most adverse shocks (Chen et al 2018).

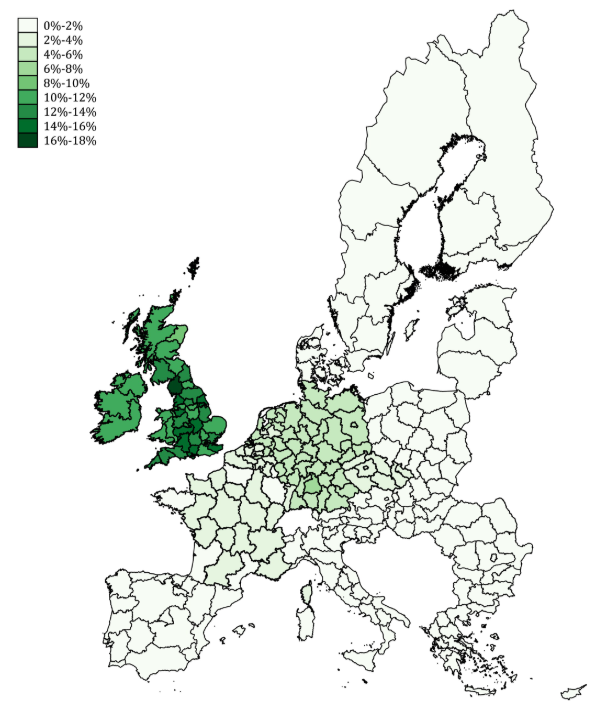

(ii) UK regions are far more exposed to Brexit-related risks than regions anywhere else in Europe, except for those in the Republic of Ireland whose exposure is equivalent to the least exposed UK regions, namely London and parts of Northern Scotland (Chen et al 2018).

(iii) UK localities are very poorly prepared for Brexit, not only because they have few policy levers to pull, but also because they are almost entirely excluded from any negotiations. Those preparations which underway tend to be ad hoc, uncoordinated and very limited (Billing et al. 2019).

(iv) The sectors and occupations which are most at risk from Brexit tend to be the most productive activities in both services and manufacturing (Los et al 2017).

These four observations imply that Brexit is likely to increase (the already high) UK inter-regional inequalities, while at the same time increasing the serious productivity problems faced by the UK as a whole.

If we examine these issues in the specific context of the West-Midlands region, we see that the Brexit-related exposure of the (NUTS2) West Midlands region as a whole amounts to 12.2% of the West Midlands Gross Domestic Product (GDP) and 11.3% of the West Midlands local labour income (Chen et al 2018). For the broad sectors in the West Midlands, the levels of Brexit-related exposure calculated in terms of local GDP are 25.5% for Primary Industries, 32.3% for Manufacturing, 4.0% for Construction and 8.9% for Services. In terms of local labour income, the respective figures are 25.5% for Primary Industries, 32.7% for Manufacturing, 4.0% for Construction and 7.3% for Services (Chen et al. 2018).

The most recent research produced by the City-REDI team also examines the implications of Brexit on the competitiveness of UK and EU regions and sectors (Thissen et al. 2019). The analysis is based on a complex calculation incorporating all of the value-chain issues discussed above, along with detailed knowledge of the actual spatial arenas in which the various industries of different regions do actually compete. This analysis demonstrates again that the adverse competitiveness implications of Brexit are far more severe for UK regions than for regions in the rest of the EU. In addition, the new key finding from our most recent research is that:

(v) Brexit is likely to exacerbate intra-regional inequalities as well as inter-regional inequalities, with the larger agglomerations being less adversely impacts than the smaller towns and rural areas in the same region.

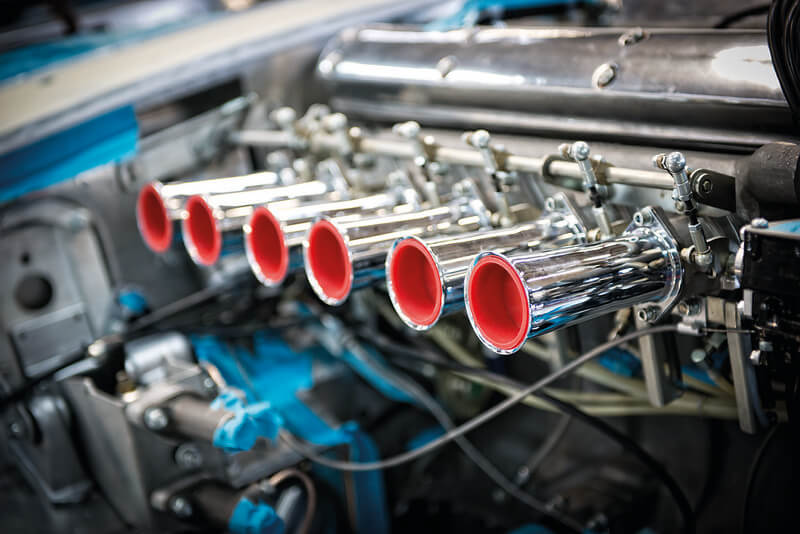

Again, if we examine the specific case of the West Midlands we see that competitiveness of the automotive industries is very severely hit. The loss of competitiveness of the West Midlands automotive industries accounts for 5.5% of total revenues, a figure which is sufficient to wipe out the profits of many of the local industry’s firms (Thissen et al. 2019). There would also be a loss of competitiveness of many of the West Midlands other manufacturing industries of a similar in size, although the key difference is that the loss of competitiveness in the West Midlands automotive industries is largely insensitive to the actual form of the final UK-EU post-Brexit trading arrangements. As such, withdrawing from Single Market and Customs Union has a severe loss of competitiveness effect of the industry, largely irrespective of whatever deal is finally negotiated.

You can download a copy of the Birmingham Economic Review here.

This commentary was written by Professor Raquel Ortega-Argiles, Chair, Regional Economic Development, City-REDI.

Sign up to our blog mailing list here.