Local government funding is once again coming to the fore, especially now that we are approaching the mayoral elections next week on the 4th May. In this blog, City-REDI’sTasos Kitsos discusses fiscal devolution in the UK compared to international experiences.

No big introduction needed. This post looks into the numbers related to the extent of fiscal devolution in the UK and compares them to similar figures abroad.

There is a historical pattern of fiscal centralisation in the UK. In 2014, UK local taxes were 1.6% of GDP (OECD, 2016), almost 20 times less than the taxes collected at the central government level and far below Sweden 15.8%, Denmark 12.5%, the US 3.59% and Turkey 2.72%. These percentages exclude the share of taxes at the state level for countries such as Germany and the US and place the UK 24th among 35 OECD countries.

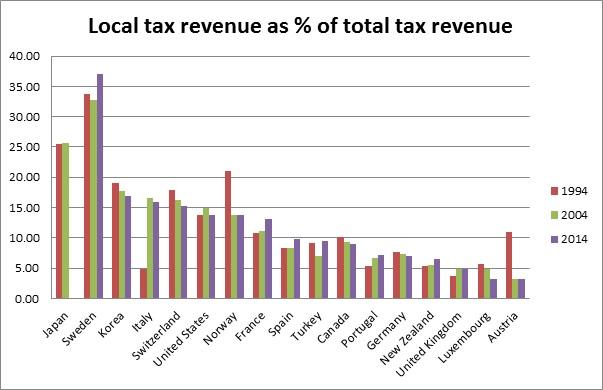

Similarly, the share of local taxes to the total tax revenue in the UK (4.9%) is substantially smaller than numerous OECD countries.

Moving on, local taxes represent a very small proportion of the total revenue for local government in the UK. In 2012, 13.34% of total local revenue was raised by local taxes in the country, compared to 60.89% in Sweden, 45.40% in Italy, 48.03% in France, 39.41 in Germany and 51.67% in Spain. (OECD, 2016)

This of course means that local government in the UK is dependent on inter-governmental transfers. In 2015, 67.03% of the local government revenue in the UK was in the form of government grants. This is compared to Sweden’s 30.59%, Spain’s 33.87%, Italy’s 39.89%, Germany’s 37.48% and France’s 25.7%. (OECD, 2016)

At the city or combined authority level, the differences become even more apparent, especially in comparison to other global world cities. More than 73% of WMCA’s and almost 69% of London’s revenues come from central government transfers. When this is compared to Frankfurt (13.2%), Berlin (33.2%), New York City (26%), Madrid (32.4%), Paris (16.3%) and Tokyo (12.5%) (London Finance Commission, 2017), the lack of any significant fiscal autonomy is apparent.

This post outlines the extent of fiscal centralisation in relation to local government funding in the UK.

I believe it is time to at least explore the possibility for greater fiscal devolution in the UK with the transfer of powers both to influence the existing and impose new local taxes.

City-REDI is already pursuing such research revolving around projections on the share of existing central taxes attributed to the WMCA area and constituent authorities; the possibility, effectiveness and rationale for new taxes; innovative forms of local authority financing; as well as the leadership and governance arrangements needed in order to maximise the benefits of this transfer of fiscal powers.

My next blog will look into the latest trends in local authority financing.

Don’t forget to vote!

Follow City-REDI on twitter

Follow Tasos on twitter and linkedin

References

London Finance Commission (2017) Devolution: A capital idea. London Finance Commission. Available.

OECD (2016) ‘Fiscal Decentralisation Database’. [Online]. Available at: http://www.oecd.org/tax/federalism/oecdfiscaldecentralisationdatabase.htm#D_9 (Accessed: 12/10/2016).

1 thought on “Fiscal devolution in the UK – the facts”