Professor Donald Houston discusses the effects of inequality on social cohesion, wellbeing, and the economy, and how it can be reduced in the long run.

This article is a chapter from the recently published UK in a Changing Europe report.

Inequality – the gap between those towards the top and bottom of the income distribution – has widened in most developed nations since the 1980s. Inequality is of obvious concern for social cohesion and wellbeing, but it can also have consequences for the economy. Social mobility can either increase or decrease inequality. Poverty and inequality are related but not the same.

What the problem is, and why it matters

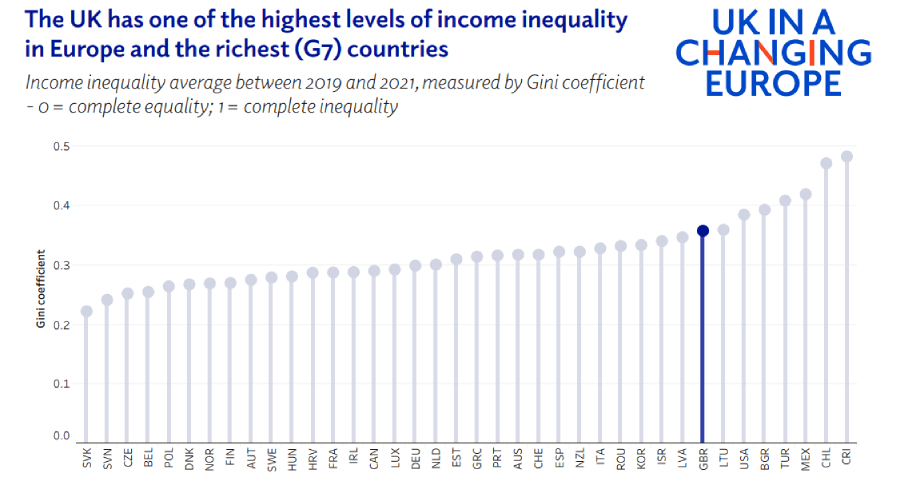

The Gini coefficient measures inequality on a 0-1 scale, with 0.0 representing everyone with the same and 1.0 representing a single person receiving all income. The latest internationally available figures show that the UK’s Gini coefficient was 0.355 in 2020, corresponding to one of the highest levels of income inequality in Europe and the richest (G7) countries. Among these countries, only the USA had income inequality greater than the UK.

Source: OECD. Income inequality Gini coefficient, 0 = complete equality; 1 = complete inequality, 2022 or latest available.

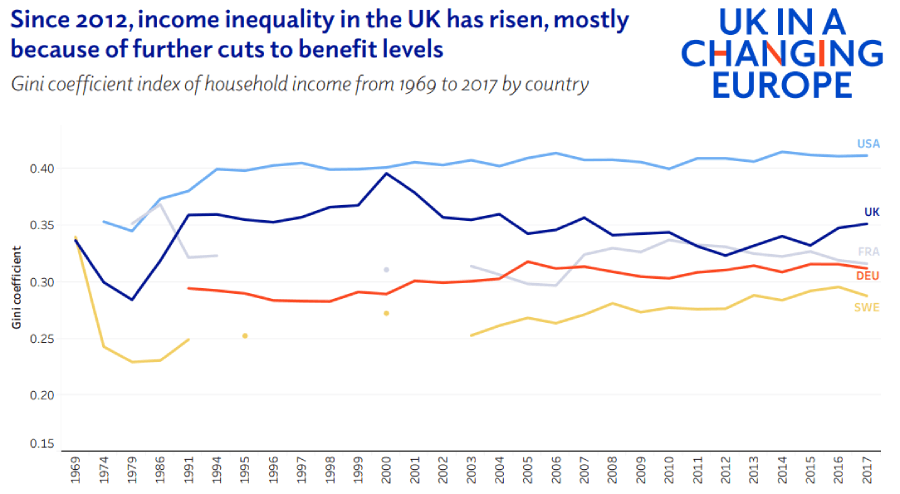

Income inequality significantly rose in the UK during the 1980s and 1990s with the ‘hollowing out’ of middle-income jobs vulnerable to deindustrialisation and automation. At the same time, competition rose from the liberalisation and globalisation of markets, squeezing employer training provision and driving pay up in some sectors and down in others. These trends were exacerbated by changes to the tax and benefit system, making it less redistributive.

Source: World Bank. Gini index – 0 = complete equality; 1 = complete inequality

Between 2000 and 2012, income inequality in the UK fell, supported initially by a period of jobs growth, the introduction of the National Minimum Wage and a system of Tax Credits to support those on low earnings. The Great Recession following the Global Financial Crisis of 2008 also reduced inequality, as earnings growth stagnated, especially in some high-earning sectors. Since 2012, income inequality in the UK has risen, mostly because of further cuts to benefit levels and restrictions on eligibility, although these trends were partially offset by jobs growth and large increases in the National Minimum Wage.

It’s important to note that while technological change and globalisation affected all advanced economies, this does not mean that trends in inequality are similar; inequality has increased steadily in the US across this entire period, while the experience of France has been very different. Policy matters.

Nor is income all that matters. Returns on financial investments have run above GDP growth since the 1980s, leading to a declining share of GDP to be paid out as wages and opening up new forms of inequality based on wealth as well as income. While data is much scarcer, the available evidence suggests that wealth inequality in the UK has become a serious concern.

Inequality harms the economy through a number of mechanisms. First, insufficient job opportunities in some places, low wages and poor prospects for progression at the bottom end of the labour market reduce incentives to train as some people conclude they will remain in low-paid work in any case. Second, low incomes reduce consumer spending, which inhibits jobs growth and investment. Third, the full productive potential of under-utilised and marginalised groups and places limits productivity and growth. Fourth, the social costs of entrenched poverty on health, education, offending and family outcomes over time become financial costs as pressures on public services rise. On the other hand, collective bargaining in unionised sectors appears to have benefits for equality – but at the expense of growth. More broadly a widening disconnection between economic growth and population wellbeing observed in rich countries has fuelled calls to broaden the definition and measurement of economic success beyond GDP to include inequality (as well as wellbeing and sustainability).

What can be done?

In crude terms, increasing taxation towards the top and/or reducing taxation and/or increasing benefits towards the bottom will, at least in the short run, reduce inequality. Raising the National Living Wage would also reduce income inequality, but benefits most those in full-time employment presently on the current minimum level, rather than those out of work or working part-time, who are more likely to be poor.

Some of these changes may come with economic costs. It is often argued that executive pay needs to be high, and taxes low, to attract global talent. At the other end of the income spectrum, it is difficult to convincingly argue that more generous benefits would have much, if any, negative impact on incentives to work after decades of tightening restrictions on benefits eligibility and payment levels.

Looking at the USA, one might conclude that inequality is an inevitable consequence of a successful economy. Looking at Sweden, one might rather conclude that keeping inequality low benefits the economy. It would thus be naïve to assume that there is a predictable relationship between growth and inequality. But so too would it be simplistic to assume that there was no relationship between them, or to adopt a fatalistic view that inequality is inevitable. Inequality is both cause and consequence of how the economy is run and regulated.

Specific policy areas that will simultaneously benefit both economic growth and social inclusion identified in the ‘inclusive growth’ literature include affordable childcare, vocational education and training and local transport, particularly concessionary travel for young adults. The broader economic policy challenge is to create the conditions in which public and private investment co-ordinate and coalesce around a balanced portfolio of growth sectors that require a range of skilled jobs – not only high-paying skilled sectors. Raising wages for skilled work is the best way to incentivise training and employment. At the same time, the growth in low-paying service jobs needs to be carefully managed with appropriate workforce planning to ensure adequate labour supply, pay and predictable and

adequate hours of work.

Public investment has a role in ensuring appropriate infrastructure, R&D and skills are in place to enable private investment to create jobs, grow the economy and raise productivity and wages. Raising productivity and wages is a necessary starting point to bring down inequality – there cannot be inclusive growth without growth. But on its own productivity cannot tackle inequality, which needs investment in schools, apprenticeships, colleges and universities, not only to help foster productivity growth in the first place but also to ensure it is widely shared, giving confidence and incentives to people to invest in skills, training and businesses.

This blog was written by Donald Houston, Professor of Regional Economic Development, City-REDI / WMREDI, University of Birmingham.

Disclaimer:

The views expressed in this analysis post are those of the author and not necessarily those of City-REDI / WMREDI or the University of Birmingham.