With the Russian invasion of Ukraine, both countries reduced their trade with the world, and supply chains were disrupted. Maryna Ramcharan looks at UK international trade with both countries and the subsequent supply chain disruptions.

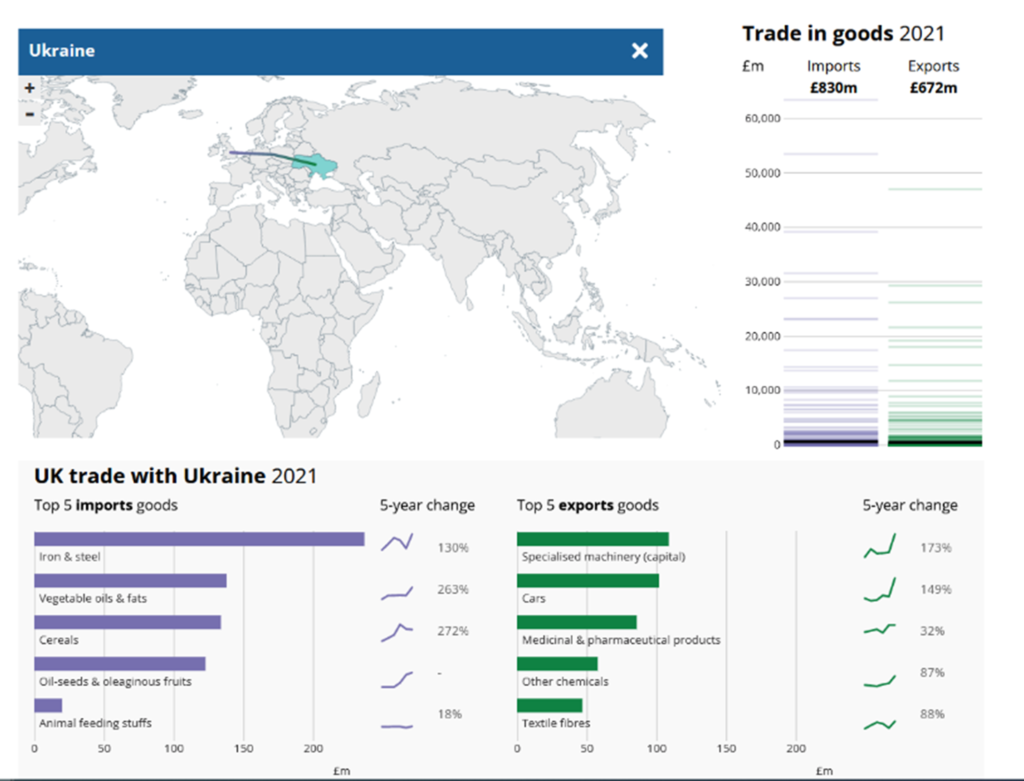

International trade in the UK has a negative trade balance. Imports from Ukraine accounted for 0.2% of all goods imports. Imports of refined oil from Russia accounted for almost a quarter of all UK imports of this commodity. In 2021, the UK imported £830 million of goods from Ukraine (0.2% of all goods imports) and exported £670 million of goods (0.2% of all goods exports). The UK imported £270 million from material manufacturers from Ukraine in 2021, which primarily included iron and steel. While the main goods’ export was machinery and transport equipment (£320 million). (Figure 1)

Trade with Russia

In 2021, the UK imported £10.3 billion of goods from Russia, which accounted for 2.2% of all goods imports, making Russia our 12th biggest importing partner. There were £3.0 billion of goods exports to Russia (0.9% of all goods exports), making Russia our 24th biggest exporting partner.

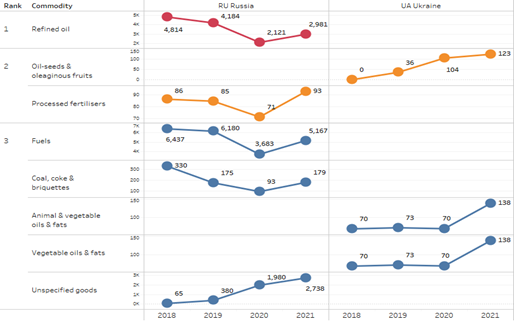

The UK imported £5.2 billion of fuel from Russia in 2021 which accounted for 9.7% of all fuel imported. The main imported fuel type was refined oil (£3.0 billion), which is oil that has been refined to be used as petrol or diesel for road vehicles, or lubricating oil. Russia was the UK’s largest supplier of refined oil in 2021, accounting for 24.1% of all imports of this commodity (Table 1).

Table 1 Trade in goods with Russia by detailed commodity type, top five imports and exports. Source – ONS – UK trade statistics, current prices, non-seasonally adjusted

| Imports | Exports | ||||

| Commodity | Value (£bn) | Percentage of all UK imports of this commodity | Commodity | Value (£bn) | Percentage of all UK exports of this commodity |

| Refined oil | 3.0 | 24.1% | Cars | 0.4 | 1.6% |

| Unspecified goods | 2.6 | 20.2% | Medicinal and pharmaceutical products | 0.3 | 1.4% |

| Non-ferrous metals | 1.5 | 8.0% | Specialised machinery (capital) | 0.2 | 3.4% |

| Crude oil | 1.0 | 5.9% | Mechanical power generators (intermediate) | 0.2 | 1.0% |

| Gas | 1.0 | 4.9% | General industrial machinery (capital) | 0.1 | 1.7% |

The top five suppliers of refined oil in the UK were Russia, Netherlands, United Arab Emirates, Belgium, and Sweden in 2021.

Vegetable Oils and Refined Oil trade

Ukraine ranks #2 to export Oil – seeds & oleaginous fruits to the UK and Russia ranks #1 to export Refined Oil. According to Chris Mejia Argueta, one of the most alarming supply chain issues resulting from the Russia-Ukraine war is food shortages, particularly acute in low-income countries in Africa. Ukraine and Russia account for about a third of the world’s wheat and a quarter of barley production, not to mention some 75% of the sunflower oil supply — all critical commodities for keeping humans fed.

Although the UK’s trade with both countries is rather a minor part of the UK’s total international trade, Ukraine was the second main partner of the UK to export vegetable oils and Russia was the main partner selling refined oil to the UK in 2021 (Figure 2).

That reset entails establishing alternative suppliers, forging public-private partnerships, and leveraging advanced analytics to forecast food waste and identify opportunities to divert resources to shore up global food supplies, EU Foreign Policy Chief Josep Borrell suggests.

War and its impact on global supply chains

The Russian invasion and subsequent sanctions put pressure on an already stressed global supply chain system. China – Europe supply chain routes have been disrupted. Russian invasion in Ukraine followed Covid-2019 outbreaks and subsequent lockdowns have been putting pressure on an already stressed global supply chain system. In a global supply chain survey Jabil conducted in partnership with Industry Week in January and February 2022, 41% of supply chain professionals surveyed across a wide range of industries said they believe delayed shipments, price volatility and supplier component/material shortages will continue beyond the pandemic. A full quarter is expected to see travel restrictions and port closures extend into the future as well.

Bottlenecks in international freight remain high and are being accentuated by the Ukraine war and the shutdowns in China. The freight route across Russia, which for decades served as the main overland link between Europe and China, has become problematic as Beijing and other countries try to shield their economies from the snags caused by the sanctions on Moscow. These have been overlaying disruptions that arose as the impact of the strict zero-COVID strategy in China.

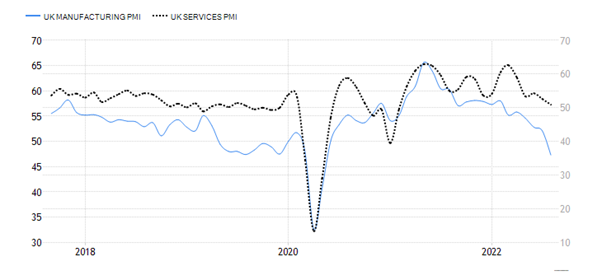

These hurdles have been reflected in steadily decreasing both Manufacturing Purchasing Managers’ Index and Services Purchasing Managers’ Index in the UK (Figure 3). These indices are based on a monthly survey of supply chain managers across 19 industries, covering both upstream and downstream activity. The decline in the PMI, therefore, indicates the prevailing direction of economic trends in manufacturing and services according to the experts’ opinions.

Changing supply chains

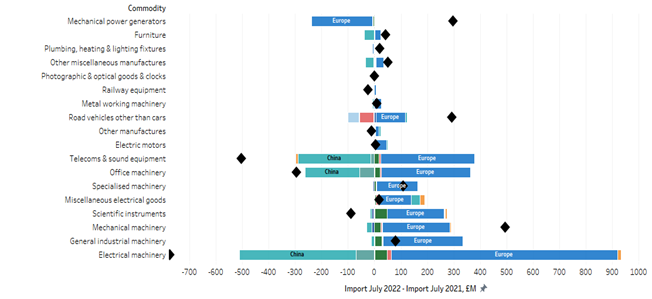

The good news is that UK businesses seem to manage to reroute their supply sources and replaced shortages from China, Japan, and Hong Kong with European suppliers (Figure 4).

Capital Goods are any tangible asset used by a business to produce goods or services for consumer goods or for use by other businesses.

For instance, the import of electrical machinery for capital needs supplied from China declined in July 2022 compared to the same month of the previous year but due to more electrical machines being imported from European countries, the UK didn’t see a total decrease in imports of this commodity. The data show the same pattern for such goods as telecoms & sound equipment and office machinery. The import of mechanical power generators for capital usage has however declined since July 2021. It happened to the drop in trade from European suppliers, predominantly Denmark and Germany.

As an alternative route, the east-west corridor has progressed with developments on:

- the Trans-Caspian International Transport Route (TITR) known as the Middle Corridor and linking Southeast Asia and China, runs through Kazakhstan, the Caspian Sea, Azerbaijan, Georgia, and Turkey before reaching southern or Central Europe, and

- the Southern Gas Corridor, linking gas fields in Azerbaijan with a pipeline across the Caspian Sea to Georgia, Turkey and across the Mediterranean to Italy.

However, obstacles remain, such as unresolved customs and border controls or data management matters. Another big problem is the lack of modernized infrastructure in the areas surrounding the corridors. These issues thwart efficient integration, making the east-west freight route less economically competitive than the northern corridor across Russia or southern maritime routes.

Supply chain makeovers are needed and inevitable

Given the hurdles, the experts at a virtual symposium hosted by the MIT Centre for Transportation and Logistics contended that now is as good a time as any to re-evaluate supply chain positions and make adjustments. They offered the following suggestions:

Consider alternative sourcing

With governments and businesses no longer able to depend on traditional suppliers, now is the time to either diversify partners or find alternative sourcing modes. While changes are necessary, there are ramifications. “When you change suppliers or change your supply mode, your lead time might increase, and when your lead time increases, there will be temporary shortages,” said Joachim Arts, a CTL research affiliate and associate professor at the Luxembourg Centre for Logistics and Supply Chain Management.

Capitalize on new opportunities

For entrepreneurs, there’s an opportunity to fill the gaps created by the volatility, creating new business models and potentially improving the lives of others. Mejía Argueta, the Research Scientist at the Centre for transportation and logistics suggests that companies need to start collaborating through trade coalitions and other joint partnerships to increase capacity, when possible, they should transition from global to a localized set of suppliers. “If you know you need to collaborate with others in order to increase capacity, start doing it,” Mejía Argueta said. “It’s important to start working, not in silos.”

Understand that quantitative approaches can help, but there are challenges.

While modelling can help optimize supply chain changes, there are limits to this approach. Most supply chain models assume a steady state, which is not applicable for redesigning something that is in transition. “Decision makers should move to systems thinking and have multiple objectives and KPIs in mind when designing supply chain networks,” Pascal Wolff, an assistant professor at the SCALE Network’s Ningbo China Institute for Supply Chain Innovation said.

Accept that this is the new normal

Planning can only get you so far in a world order that continues to be in constant flux. Therefore, the key to sustaining growth in uncertain times is developing best-in-class agile competencies. “You can’t plan for everything,” Pascal Wolff suggests. “Few saw this war coming or anticipated the pandemic. It’s hard, but enterprises need to work on becoming agile organizations.”

This blog was written by Maryna Ramcharan, Research Fellow at City-REDI / WMREDI, University of Birmingham.

Disclaimer:

The views expressed in this analysis post are those of the authors and not necessarily those of City-REDI, WMREDI or the University of Birmingham.