Alice Pugh takes an in-depth look at the government's recent mini budget and what it means for people and businesses in the UK.

The ‘mini’ budget was released with the aim of helping to tackle and provide support for the growing cost of living crisis. However, this budget was far from a ‘mini’ one. This budget offers one of the largest tax-cutting regimes in UK history. It offers around £45bn of tax reductions for people and businesses by 2027: 50% more than anticipated before the mini-budget announcement.

Key announcements

The following are the key announcements made within the ‘mini’ budget:

Taxes

- Income Tax – Cut in the basic rate of income tax to 19% from 20% as of April 2023. 45% higher rate of income tax abolished for England, Wales and Northern Ireland taxpayers.

- National Insurance – The health and social care levy has been scrapped; the 1.25% additional tax will be removed from the 6th.

- Corporation tax – The government has cancelled the expected rise in corporation tax rise from 19% to 25%.

Benefits

- Universal Credit – Rules are being tightened around Universal Credit, by reducing benefits if people do not fulfil job search commitments.

Work and Investments

- IR35 rules – the rules which govern off-payroll working are to be simplified

- Annual investment allowance – the amount companies can invest tax-free, remains at £1m indefinitely.

- Pension funds – regulations change so pension funds can increase UK investments.

- New and start-up companies – able to raise up to £250,000 under a scheme giving tax relief to investors.

- Share options for employees – doubled from £30,000 to £60,000.

Banker’s Bonuses

- Rules which limit bankers’ bonuses have been scrapped, with regulatory reforms expected later in the Autumn.

Shopping

- VAT-free shopping – for overseas visitors.

- Alcohol – Planned increases in the duties on beer, cider, wine, and spirits are cancelled.

Infrastructure and Investment Zones

- Investment zones – The government is discussing setting up 38 new investment zones, with measures such as no business rates and stamp duty waived.

- Tax cuts and liberalised planning rules – are to be offered to release land for housing and commercial use.

Tax

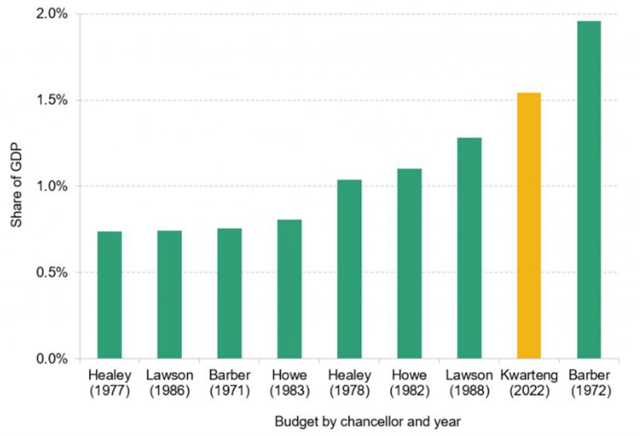

As stated above this budget is anything but ‘mini’. In fact, this budget represents the largest tax cut to the planned level of tax of any budget since 1972, as seen in the graph below. Whilst the tax reductions are substantial, their impact is forecast to only lower the tax burden to 2021-22 levels. This means the tax burden will still remain at its highest sustained level since the 1950s, according to the IFS.

Net permanent tax cuts as a percentage of GDP, relative to previous plans.

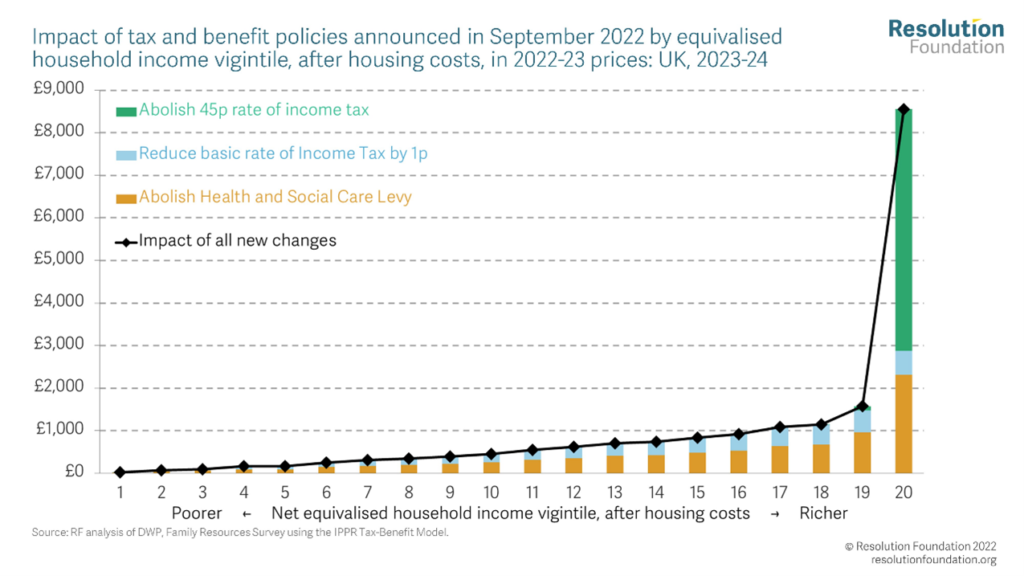

The Resolution Foundation has found that the gains from the personal tax cuts announced will go to the richest fifth of households. Almost half (45%) will go to the richest 5% alone, while just 12% of the gains will be felt by the poorest half of households. The graph from the Resolution Foundation below shows that the richest fifth of households will be on average better-off by £3,090 next year. Whilst the poorest will gain only £230. The government is chasing ‘trickle-down’ economics in an effort to boost economic growth.

Benefits

The Chancellor is also reforming Universal Credit (UC). Currently, UC claimants working up to 12 hours a week at the National Living wage, risk having their benefits reduced if they do not take steps to increase their earnings and regularly met with a work coach. Under the reform, which takes effect in January 2023, this requirement will now be extended to people on UC working up to 15 hours a week at the National Living Wage. This will affect an estimated 120,000 people.

Energy Price Caps

Households

To protect households from energy price rises, the government has announced an ‘Energy Price Guarantee’ (EPG). The EPG will raise household bills to £2,500 a year from 1st October from £1,971 currently; this is based on a household which uses 12,000 kWh of gas a year, and 2,900 kWh of electricity a year. This is a 26.8% increase in the price cap. However, this is a smaller increase than was expected as OFGEM was setting the price cap rise at £3,549 a year from the 1st of October, which would have been an 80.1% rise in the price cap.

Whilst, the new cap will help households, the energy price cap will have still almost doubled since the same time last year. In October 2021 the price cap was £1,277; the new £2,500 price cap is an increase in energy bills of 95.8%, representing almost a doubling of household bills within a year. This includes the £400 fuel discount for all households, so reducing the increase to around 64.4%. This will be devastating to most households and will likely plunge many households into fuel poverty. However, if the cap had increased to £3,549 in October, this would have been a 178% rise in the energy price cap compared to October 2021.

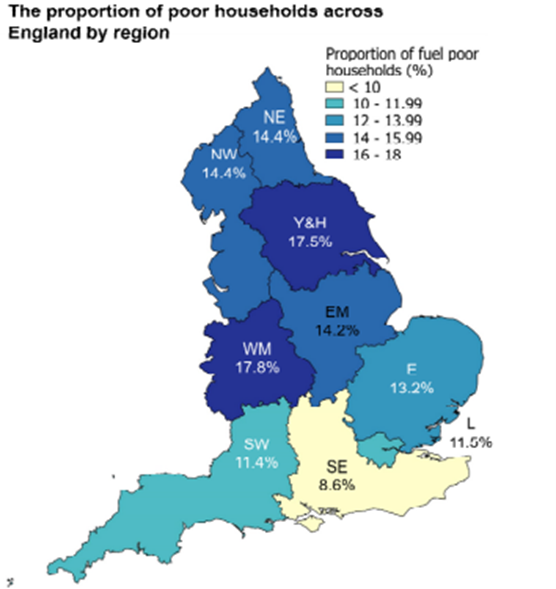

As of 2020, the West Midlands had the highest rate of fuel poverty of any region in England, as demonstrated in the map below. In 2020 17.8% of households within the West Midlands were fuel poor. Even before the energy price rises over the last year almost one-fifth of households in the region were fuel-poor. Energy bills have almost doubled even with the cap, meaning when data comes out for 2022 this figure will be much higher.

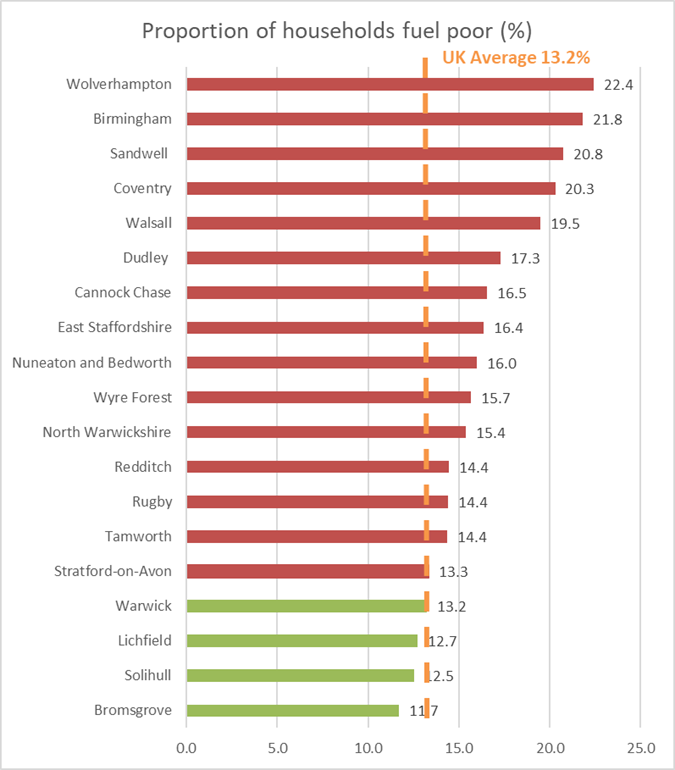

The table below uses ONS calculations to show the percentage of households that are considered fuel-poor by local authority within the WMCA area. As can be seen in the figure below, 4 of the 19 local authorities within the WMCA have higher fuel poverty than the UK average of 13.2%. The areas with the highest rates of fuel poverty are Wolverhampton (22.4%), Birmingham (21.8%) and Sandwell (20.8%). 4 local authorities within the WMCA have more than 20% of its households living in fuel poverty. Rising energy bills will likely push a significant proportion of additional households into poverty, as well as squeezing those already in it.

Unsurprisingly, more affluent areas of the WMCA, Bromsgrove (11.7%), Solihull (12.5%) and Lichfield (12.7%) have lower fuel poverty rates. This is likely a result of not only higher incomes, but more efficient housing reducing energy bills.

Business

Earlier in the month, the government announced an energy price cap for businesses, to protect companies against rapidly rising energy prices over the winter. Businesses with high energy use are expected to be the most heavily impacted by rapidly rising energy prices. RedFlag estimates show that nationally there are 75,672 businesses with a turnover of more than a million and classed as high energy users that could be at risk of closure in the following months as a result of energy price rises. This would place hundreds of thousands of jobs at risk. Note this figure does not include all the businesses turning over less than a million pounds; therefore, there are likely to be more businesses at risk within the economy.

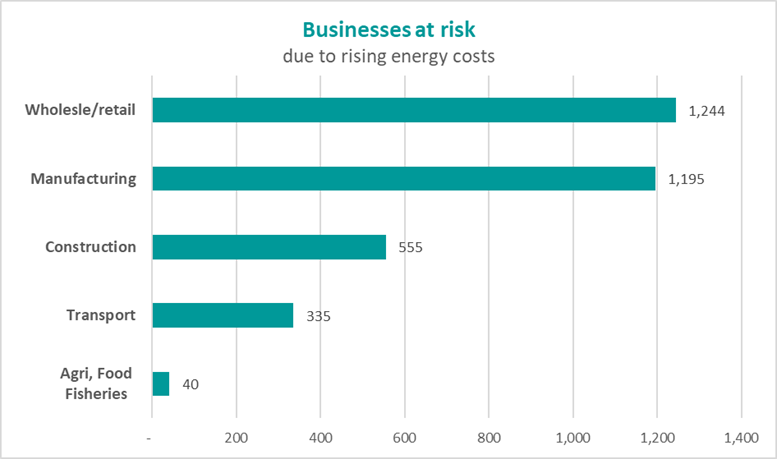

Data from RedFlag, produced for WMREDI, shows that currently within the WMCA, there are around 8,054 businesses with more than 10 employees which are classed as high energy users. Of these RedFlag found that 3,369 businesses would be at risk of closure, due to rising energy prices and their financial stability rating. The sectoral split of these businesses can be seen in the graph below.

If these at-risk businesses were to close in the following months as a result of energy price rises, it could mean that employees lose their jobs. Each of the 3,369 businesses has a least 10 employees, if these businesses close it could lead to at least 33,690 people potentially losing their employment. However, some of these businesses will employ more than 10 employees, so this figure is likely much higher. Furthermore, this does not include microbusinesses (businesses employing 0 to 9 people) which may also be at risk from rising energy prices.

To combat the rising energy prices and prevent businesses from going under, the government is going to cap the price that non-domestic consumers pay for both electricity and gas. The cap will fix wholesale prices for all non-domestic customers at £211 per MWh for electricity and £75 per MWh for gas. To put the size of this cap into perspective, based on the latest update from OFGEM, in July 2022 the expected cost of electricity per MWh was £413.59, a £211 cap would decrease the price by -48.98%. Based on WMREDI analysis of OFGEM figures, in July 2022 the wholesale price for gas was around £144.60 per MWh, a cap of £75 per MWH would reduce the price by -47.77%.

However, even with the cap, the prices are far higher than otherwise would have been expected. In September last year, electricity prices were £116.96 per MWh, a cap of £211 is an 80.4% increase on last year’s prices. Gas prices were around £38 per MWh in September last year, according to WMREDI analysis, the £75 cap is a 95.57% increase in prices. Therefore, whilst the cap on energy will prevent prices from rising exponentially, businesses have still seen their energy bills almost double compared to the same time last year.

Therefore, whilst the energy cap will undoubtedly save many firms from closure over the next 6 months, many may still be forced to close, given energy bills will be almost double the price they were paying last year, even with the cap. Plus, in 6 months many businesses may not be able to survive the removal of the cap. Therefore, over the next few months, we will still likely see the insolvency of more businesses, however, these insolvencies will be lower than would have been without the price cap.

‘Animal Spirits’

The government argues that this budget is an ‘economic growth’ budget, but it is really more of a ‘tax cutting’ budget. There maybe be massive tax cuts to stimulate growth, but there are no other large-scale supply-side investment announcements, such as investment in skills. This budget heavily depends on the response of businesses and investors. If businesses take the opportunity of these tax cuts to invest, then it may increase economic growth. However, if they don’t the economy will quickly plummet into a severe economic recession.

The government will be heavily relying on the ‘animal spirits’ of businesses and investors within the market. Hoping that these tax cuts will increase investor and business confidence and spark economic growth in line with investments made. However, currently, the economy is not conducive to businesses investing. The reasons businesses and investors may not be incentivised to invest following this budget are:

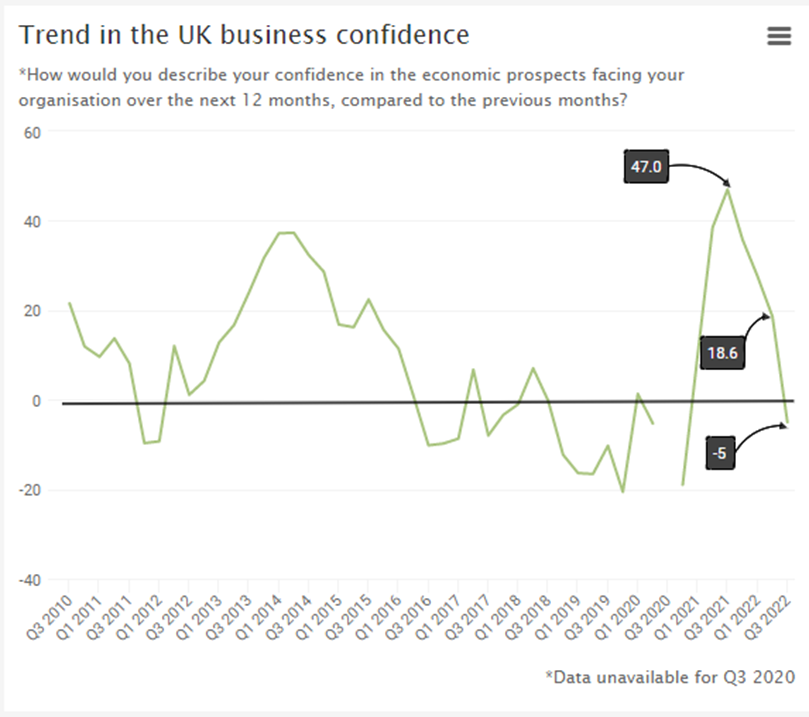

- Lower Business Confidence

The graph below shows business confidence levels over the last 12 years. Business confidence was at its highest rate at +47 in the 12-year period following the re-opening of the economy following Covid-19 in Q3 2021. However, a year later business confidence index in Q3 2022 was -5.0. Businesses are not confident in the economy and expect the next 12 months to be harder than the previous 12 months, back into the negative figures seen throughout the pandemic. If businesses and investors have low confidence in the economy to start with, then it is unlikely that they will suddenly start making large investments.

2. Failure to release OBR statistics

The government is about to spend a very large amount of money, maybe even surpassing the amount spent during Covid-19. Alone, both the household and business caps combined could cost the government more than £150bn. Plus the government has dramatically cut taxes in this budget. It has made people question how the government plans to fund such large borrowing when the government is slashing revenue streams (taxes). However, the OBR was prevented from releasing its forecasts for this budget. The forecaster’s publication provides information to the UK government’s creditors (i.e. financial markets) on the sustainability of public finances. Preventing the OBR from releasing its forecasts can be interpreted as a clear message to both the public and financial sector that the government is not confident enough in its economic and fiscal policies to subject them to scrutiny.

Following the ‘mini’ budget announcements the value of the pound promptly plummeted against the Euro, as seen in the figure below. Sterling dropped 2.04% against the Euro and 3.25% against the US dollar. This is a 37-year low for the pound, since 1985. It would suggest that the market is not in fact confident in this new budget and the likelihood is that businesses and investors will not be incentivised to invest.

Pound sterling to Euro 23/09/2022

3. Rising Supply-side costs

- Raw goods and materials – The costs of raw goods and materials are still increasing. Escalation of the war in Ukraine, Covid-19 bottlenecks, plus the elevated level of post-pandemic demand, and climate change disasters; have all contributed to the rising costs of raw materials and goods. With the escalating war in Russia, it is likely the costs of many raw goods and materials will continue to increase.

- Energy Prices – Whilst energy prices have been capped for businesses, electricity prices will still be 80.4% higher than in July 2021 and gas prices 95.6% higher. Plus, this energy relief is only short-term; most businesses are trying to plan 2, 3, 4 years in advance, not 6 months. If businesses are expecting to lose this cap in 6 months, with no end to the Ukraine invasion in sight, they will probably not make any large-scale investments when they are expecting their energy bills to skyrocket 6 months down the line.

- Rising Interest rates – Additionally, as the value of sterling falls, it makes imports more expensive than would have been the case previously. This will lead to rising costs for businesses on imports, if costs are rising businesses will be less likely to make larger scale investments.

- Wages – Wages are expected to rise. Following, 10 years of austerity depressing wages, many civil servants have had real terms pay cuts of up to 10%, and many unions are now fighting to get their members higher wages. With around 1 in 10 businesses now being impacted by industrial action, this will likely grow in the coming months as nurses and teachers vote to take industrial action. Additionally, there is a labour supply and skills shortage. The jobs market still has over a million vacancies which need filling in the economy, but the majority of employers cite skills shortages as the reason. 4% of employers were struggling to recruit in August. This is rising the prices of wages as employers compete for a small pool of labour with the skills they require. In turn, rising wages are pushing up costs for employers, which may dampen incentives to invest if they are expecting rising costs in the future. Especially, when there has been no skills investment from the government in this budget.

4. Falling consumer spending

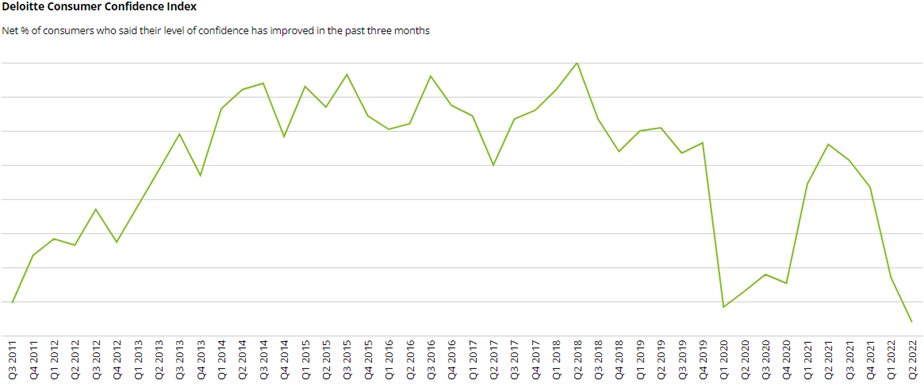

Deloitte’s consumer confidence in levels of disposable income index has reached its lowest level since 2011 when the tracker began. As seen in the graph below consumer confidence is now even lower than had been during the pandemic.

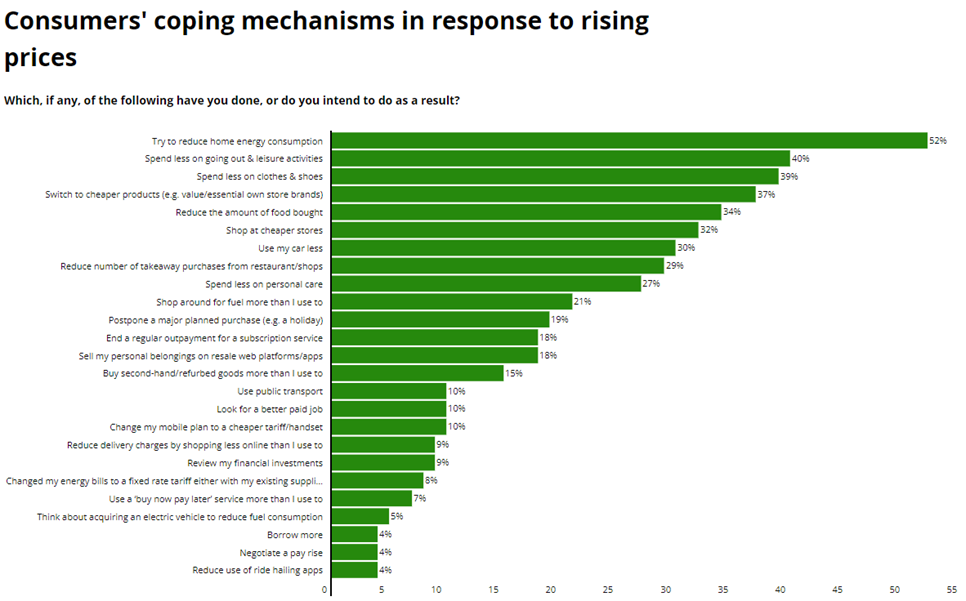

With rising inflation consumers are seeing the value of their money fall and as a result their levels of disposable income. So, they are changing their spending habits, by either spending less / being more frugal. The graph below from Deloitte shows how consumers plan to deal with rising prices – by reducing consumption.

These reductions in consumer spending are a serious concern given consumer spending accounts for half to two-thirds of all economic activity. Deloitte is forecasting that for Q3 of this year, essential spending will continue to rise with inflationary costs, and as a result, consumers will have less to spend discretionally, with discretionary spending expected to fall by 11% in Q3. Additionally, there is likely to be a further fall in disposable incomes in the following months as the Bank of England (BoE) continues to rise interest rates, leading to much higher mortgages for consumers. This may further tighten spending habits going forward. If consumer spending continues to fall so dramatically over the following months, businesses will be cautious around investing, if they think consumers will be unable to afford their products.

5. Increased Interest Rates

Interest rates have not only risen in the UK but have been risen by many central banks around the world. Higher interest rates set by the BoE to cool inflation, many lead to businesses and investors being more inclined to save than invest, especially as the BoE is predicting that interest rates will be at least 3% by the end of the year. Additionally, higher interest rates mean borrowing money or capital becomes more expensive, which may deter businesses and investors from investing.

This blog was written by Alice Pugh, Policy and Data Analyst for City REDI and WM REDI.

Disclaimer:

The views expressed in this analysis post are those of the authors and not necessarily those of City-REDI or the University of Birmingham.