In a series of blogs, Simon Collinson, Fumi Kitagawa and Tomas Ulrichsen examine the role of universities in regional development.

The blogs are co-authored by the Policy Evidence Unit for University Commercialisation and Innovation (UCI) at the University of Cambridge Institute for Manufacturing (IfM) and the West Midlands Regional Economic Development Institute (WMREDI at City-REDI), University of Birmingham.

Read the other blogs from the series –

Enhancing University Contributions to Local Growth by Targeting High-Potential Firms and Industries

Unleashing the Regional Innovation Potential of Universities

Universities’ Role in Helping Regions Transition From Legacy Industries Into New Areas

The role of universities in regional development

Regional economies vary in their potential to grow along particular pathways, leading to higher or lower levels of productivity and/or inequality and/or progress towards net-zero targets. Amongst the wide variety of factors which contribute to this growth potential, including infrastructure, skills, levels of inward investment or the innovative capabilities of local firms, the presence of universities is an important one. This is particularly the case if R&D-led growth is the target of public sector investments by government.

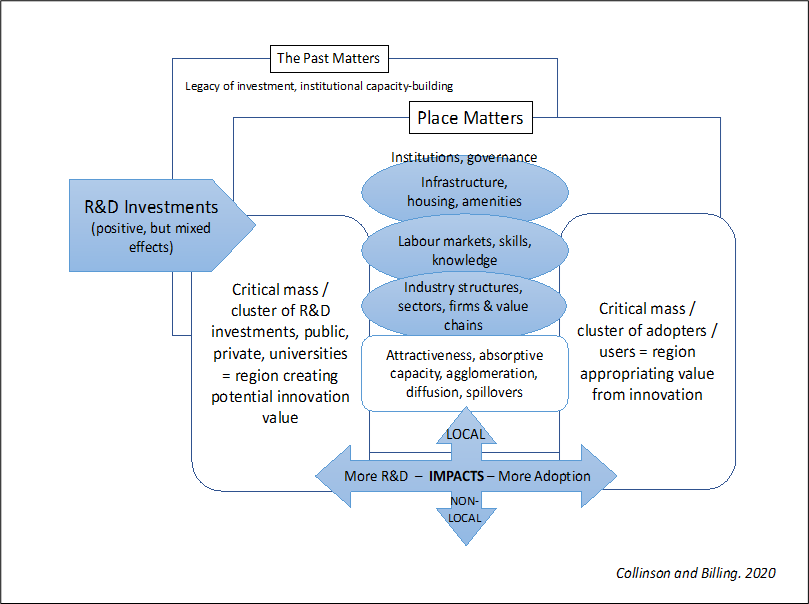

Investments in R&D, from public or private sources, into universities or other parts of the R&D ecosystem, generally have a positive effect on economic growth, but the level of the impacts, and the eventual beneficiaries of this investment, are moderated by other characteristics of the local economy. Place matters, and the past matters, in terms of the growth pathway a region is developing along.

This leads us to question, which university-firm combinations represent areas of growth potential, in different regions?

There has been a growing interest at the national and local levels of government in tackling the challenges and trade-offs between improving the productivity and competitiveness of firms, reducing inequality and deprivation in low-income communities and making economic growth more sustainable. All of these challenges are connected and vary by region, in terms of the root causes and the resulting opportunities for different kinds of economic growth and social development.

Current government thinking is rightly focused on improving regional innovation systems, partly by making targeted investments in R&D-led growth at the local level. There are two particular challenges here. First, mapping existing clusters is easier than predicting the future growth potential of clusters, which varies depending on the place and the emergent industry sector in question. Second, differentiating investments in clusters which benefit the local economy by raising average productivity in local firms, and/or increasing opportunities for lower-income communities (inclusive growth), from investments where the value appropriation takes place elsewhere (via spillovers, interregional value chains, equity transfer etc.), is complex. There are gaps in our understanding of ‘growth potential’ and the specific contributions that University-based R&D can make to catalyse and/or complement the existing growth potential in particular places.

It is critical to have a better understanding of how particular place-based innovation ecosystems provide growth opportunities where value appropriation is predominantly local. A system-wide, interdisciplinary approach is needed to answer any of these questions. We need to be able to connect inputs, including the components of existing local innovation ecosystems (skills, firms, university R&D assets etc.) and new R&D investments or catalysts, more precisely with outputs and outcomes that benefit the region.

The subsequent blogs in this series expand on these themes, building particularly on the work of Richard Lester (2005), Universities, Innovation, and the Competitiveness of Local Economies. We examine how firms and industries interact differently with universities, directly impacting the creation/lack of local value appropriation and multiplier effects. We also explore how universities vary in the degree to which they prioritise regional impact compared to other strategic themes, and the alignment or misalignment between university objectives (and assets, programmes, expertise etc.) and local needs. Finally, we look at the potential for universities to help regions transition from legacy industry structures into new growth markets partly via intermediaries such as catapults, science parks and innovation accelerators focused on R&D-led growth.

This blog was written by Professor Simon Collinson, Professor Fumi Kitagawa, Chair of Regional Economic Development at City-REDI / WMREDI, University of Birmingham and Tomas Ulrichsen, Director of the University Commercialisation and Innovation (UCI) Policy Evidence Unit at the University of Cambridge.

Disclaimer:

The views expressed in this analysis post are those of the authors and not necessarily those of City-REDI, WMREDI or the University of Birmingham.