This article was written by Professor Simon Collinson for the National Centre for Universities and Business’ seventh annual assessment of the health of collaborative partnerships – The State of the Relationship Report 2020.

This article was written by Professor Simon Collinson for the National Centre for Universities and Business’ seventh annual assessment of the health of collaborative partnerships – The State of the Relationship Report 2020.

The article reflects on regional specialisms, the unequal impact of the disruptions of 2020 and the value of analysis of regional economies.

UK regions have experienced very different rates and types of economic growth, resulting in major spatial inequalities across the country. Our regions also vary considerably, in terms of their potential long-term growth trajectories and their short-term agility, responsiveness and resilience in the face of economic shocks or disruption.

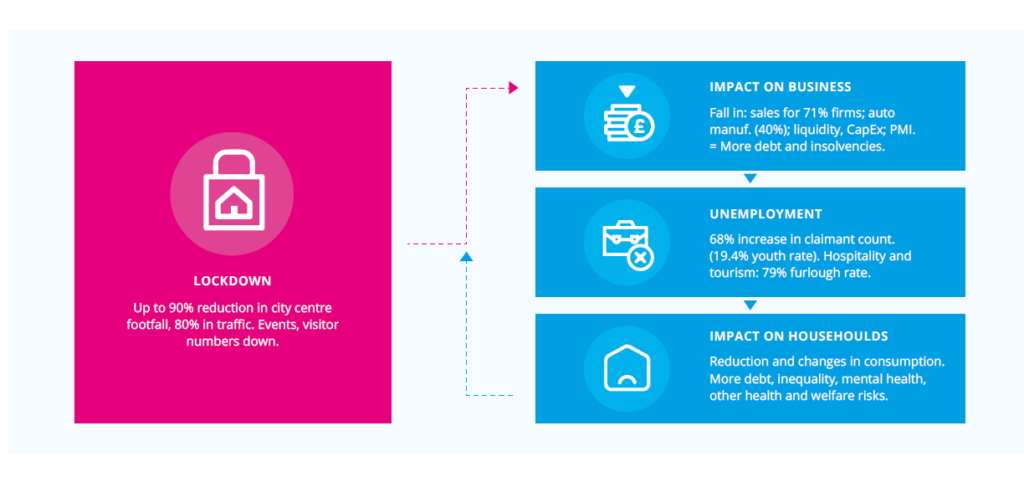

A major reason for this is regional specialisation. Each region has a different concentration of industry sectors and jobs. Therefore, just as firms and industry sectors have been impacted very differently by Brexit and Covid, so have UK regions. The effects of the changing costs of trade with Europe coupled with the impacts of national and local lockdowns have stalled growth and driven up unemployment in an uneven way. This presents a challenge for policymakers responsible for local market intervention, investment and support in their particular regions.

Research at City-REDI has developed a deep understanding of the West Midlands economy, its key industry sectors and its strengths and weaknesses, relative to other regions in the UK and globally. It has been amongst the hardest hit of all the UK regions and these insights have helped local policymakers intervene more effectively to support key firms, employees and communities.

The Advantages and Disadvantages of Local Economic Clusters

Geographic proximity has many positive effects on business growth. Clusters or agglomerations of complementary firms enable a region to develop a critical mass of skills, expertise and talent in particular sectors. These often evolve with corresponding strengths in local universities and specialist suppliers and contractors. Similar kinds of firms and specialist workers are attracted to a region and investment grows to create an overall level of specialisation and differentiation, relative to other regions.

The automotive industry in the West Midlands provides an important illustration. The region is well-known for its long tradition of automotive R&D, design and manufacturing, from large producers like Jaguar Land Rover (JLR) to smaller, high-tech specialists like ProDrive. The region has the highest concentration of such firms in the country, with a ‘location quotient’ of over 4.5 (over 1 indicates more than average concentration). The industry is directly worth just over £8 billion to the regional economy, and the components supply chain adds another £3.2 billion. The benefits of hosting these firms, in terms of investments and jobs and strong multiplier effects on local service businesses (cinemas, retailing, restaurants etc.) are evident.

Directly and indirectly, the automotive industry is worth over 10% of the regional economy. But this also means the region has a high level of dependency on this industry cluster and the economic fortunes of the region are more tied to the trends affecting this specific sector.

Automotive firms had already started to experience declining sales in China, the challenges of the shift to low-carbon transport, and the threats of supply chain disruption and higher trade costs from Brexit. The Covid pandemic has made things significantly worse.

Analysis of the effects of the Coronavirus Large Business Interruption Loan Scheme (CLBILS), focused on the financial position of the 50 largest (in terms of revenue) automotive firms in the West Midlands, showed additional reasons for concern. Their resilience in the face of economic shocks is undermined by low levels of liquidity. Specifically, 21 firms, including some of the large original equipment manufacturers -or OEMs-, are at high risk because they face severe cash flow problems. These 21 businesses employ almost 46 thousand people, but only 12 of these high-risk firms are eligible for the CLBILS. Taking into account the multiplier effects, if these firms failed, there would be a significant negative impact beyond this industry, on the regional economy.

Add to this the challenge that many small firms in the automotive supply chains are so-called ‘zombie’ firms, just surviving on low-interest loans. They can only afford the interest payments, so they remain in-debt and are therefore highly vulnerable to changes in interest rates or wider market conditions.

One estimate suggests that 11% of UK firms are in this situation, the majority are reliant on low-skilled workers and are less productive. The highest concentrations of firms surviving on loans are in energy (23%), automotive (17%) and utilities (15%), all of which are important sectors in the West Midlands region.

The economic contagion triggered by the failure of these firms particularly impacts low-income households, which are also often in-debt and at risk when losing key income-earners. Bankrupt firms boost unemployment which, in turn, takes some households over the tipping point into a reliance on benefits, which in turn increases a region’s social and health-related costs and challenges.

In this way, geographical proximity and clustering, based on a reciprocal network of inter-firm relationships can amount to a co-dependency between industry clusters and the regional economy. This can underpin both a ‘virtuous’ cycle of growth and a ‘vicious’ cycle of decline in regions, which has social consequences as well as economic.

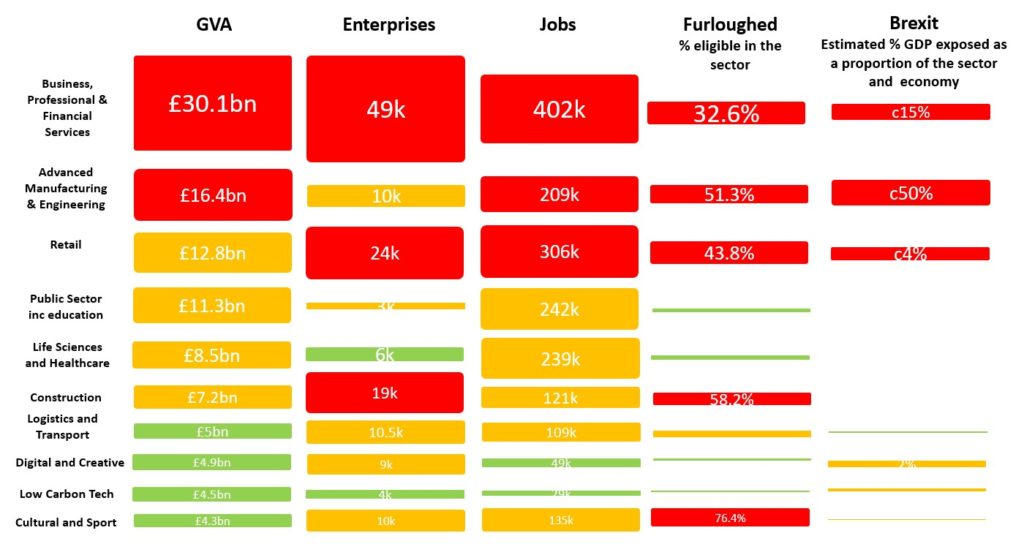

When we step back from the automotive sector to profile the West Midlands region more generally, in terms of exposure to the dual risks of Covid plus Brexit, Figure 1 shows what we find.

How Does Analysis of Regional Economies Help?

With Research England (UKRI) Development Funding, City-REDI has been able to establish the West Midlands Regional Economic Development Institute (WMREDI) in partnership with the WMCA, LEPs, WM Growth Company, Chamber of Commerce, the city council and colleagues at Aston and Birmingham City Universities. We conduct research and comparative analysis on the region, shaped by the needs of public and private stakeholders, to design better, more effective policies for local resilience and inclusive growth.

A more sophisticated understanding of local industrial structures, strengths and weaknesses improves both awareness of the key risks and the level of accuracy and precision when selecting and delivering interventions. These can help safeguard jobs and communities in response to economic shocks or help the region grow more efficiently, inclusively and/or sustainably when economic conditions allow.

Understanding the complex dynamics of regional economies takes time and resources. The UK is entering a critical juncture as it seeks to drive economic recovery in the face of both Brexit and a recession. Local initiatives and upfront investment in the capacity and capability for each major UK region to understand the distinctive nature of its local economy is vital to improve national resilience and enhance the growth opportunities for UK regions. If the UK can maintain growth at a regional level, national and international resilience will follow.

References

Riley, R. (2020) The West Midlands Weekly Economic Impact Monitor, Issue 26 Publication Date 18/09/20 (p.8), WMCA and WMREDI.

Qamar, A. and Collinson, S. (2020) The West Midlands’ Automotive Industry in the Aftermath of COVID-19: Survival of the Fittest? City-REDI Policy Briefing, 2/6/2020.

Collinson, S. (2020) Contagion: The Economic and Social Impacts of Coronavirus (Covid-19) on the West Midlands, City-REDI Blog, 26/3/2020.

Ortega-Argiles, R. (various) The Economic Impacts of Brexit on the UK, its Regions, its Cities and its Sectors.

The Birmingham Economic Review 2020

City-REDI/WMREDI response to the BEIS inquiry on the impact of coronavirus on businesses and workers

This blog was written by Professor Simon Collinson, Director, City-REDI and WM REDI.

Disclaimer:

The opinions presented here belong to the author rather than the University of Birmingham.

To sign up for our blog mailing list, please click here.