On the 4th August 2021, WMREDI and partners held an event to launch the State of the Region 2021 report. Rebecca Riley, Administrative Director, City-REDI /WM REDI, University of Birmingham and Head of Research and Office for Data Analytics ODA, West Midlands Combined Authority (WMCA), provided an overview of this year’s State of the Region (SOTR) – looking back over the last year in the West Midlands and the challenges ahead.

View the State of the Region 2021 report

Rebecca began by explaining the challenges with accessing data at the appropriate geographical level, which has a comparative national benchmark, allowing us to understand performance. Due to the pandemic, much of this has been delayed or cut altogether, meaning the report had to be updated in May/June.

Performance of the West Midlands

She outlined the following key points on how the region has performed:

- There is no precedent, things have changed rapidly, data is lagging and policy actions have directly affected indicators – employment, business, innovation, FDI, visitors.

- The WMCA area had been out-performing other areas in the run-up to Brexit and pandemic impacts.

- The last 18 months have hit the region hard, the industrial make up of the region and structural issues have left the West Midlands more exposed.

- Potential issues highlighted last year have come to pass, and jobs levels are expected not to return to 2019 levels until 2023 and GVA not until 2022, after dropping back below £100bn last year.

- There are signs in the last few months of opening back up and a positive rebound, the Purchasing Managers’ Index (PMI) doing well, business sentiment in the region is still positive and jobs coming back.

Key Impacts in the West Midlands

- By May last year furloughed jobs were equivalent to all jobs in Birmingham (496k), even now it’s more than all jobs in Coventry.

- Sectors that were thriving in the region before Covid were hardest hit. Retail, hospitality and tourism, in particular, were hit by the lockdowns. Manufacturing and logistics has been hit by Brexit disruption.

- Three city centres will go through significant change and disruption due to the changes in business models for offices, where workers are unlikely to return 5 days a week.

- High health and wellbeing impacts, including infections, isolation, deaths and ongoing health problems.

5 Key Challenges for the West Midlands

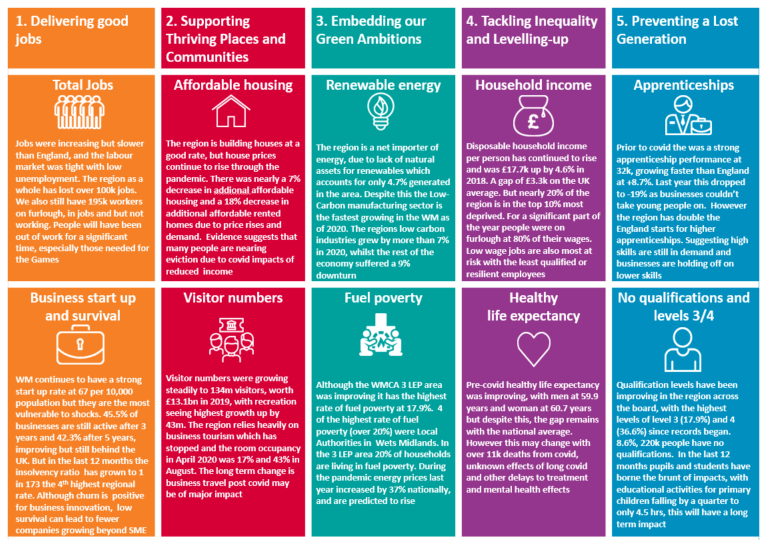

Rebecca also provided an overview of the key challenges, starting with the ‘delivering good jobs’. Rebecca outlined that:

- Unemployment in the WMCA area is higher at 5.9%, compared to the UK average of 4.6%.

- There has been a drop of 9% in FDI projects in the last year, however, the UK has dropped by 17%, so we have faired well.

- Exports and imports have dropped dramatically and by the end of Q4 2020, the region had a £5.2bn trade deficit when we had previously performed well in this area.

Additionally, the State of the Region report warns that COVID-19 impacts are yet to be seen as support has not ended. The more positive news relates to ‘business start-ups’. We still operate at 67 per 10,000 populations, which is very good, relative to the other regions and the UK. Furthermore, 45.5% of businesses are still active after 3 years and 42.3% after 5 years, which is an improvement, although still behind the UK curve.

Supporting Thriving Places and Communities

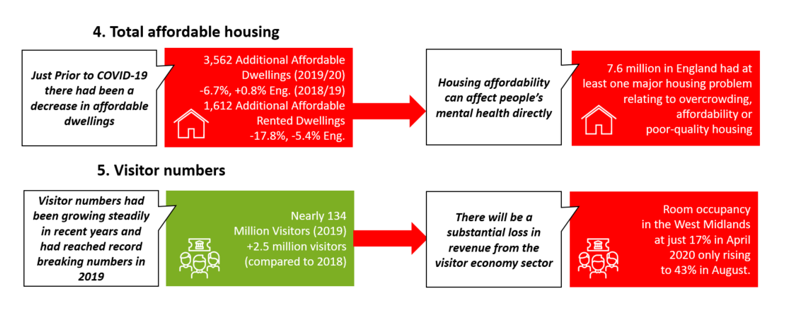

The next challenge to focus on was ‘Supporting Thriving Places and Communities’. The report outlined:

- The region is building houses at a good rate, but house prices continue to rise through the pandemic, leading to prices outstripping affordability.

- Wages, overtime and income has been hit which is also affecting housing affordability.

- Evidence suggests that many people are nearing eviction due to COVID impacts of reduced income.

- Visitor numbers were growing steadily to 134m visitors, worth £13.1bn in 2019, with recreation seeing highest growth up by 43m.

- The region relies heavily on business tourism which has stopped and the room occupancy in April 2020 was 17% and 43% in August.

- The long term change to business travel post-COVID may be a major structural or long impact.

Embedding our Green Ambitions

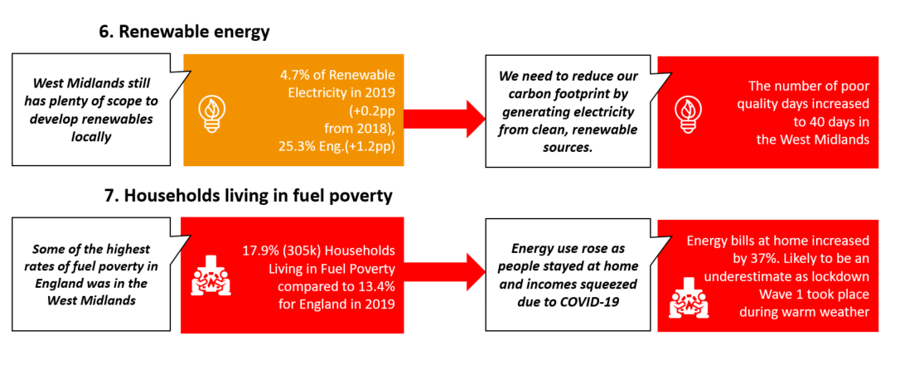

Next, Rebecca summarised the key challenge of ‘Embedding our Green Ambitions’. The region is a net importer of energy, due to a lack of natural assets for renewables, which accounts for only 4.7% generated in the area. Therefore, low carbon energy solutions are vital for the region, to help bring our manufacturing costs. Additionally, energy prices in the last 12 months have increased by 37% nationally. This is pushing more and more people into fuel poverty, so the efficiency of homes and how we generate our energy is vital, not just for green ambitions but to help the poorest in our communities and in terms of tackling inequality. The State of the Region however shows positive signs of progress – outlining how the region’s low carbon industries grew by more than 7% in 2020, whilst the rest of the economy suffered a 9% downturn.

Tackling Inequality and Levelling-up

The fourth key challenge facing the West Midlands and outlined in the State of the Region report is ‘Tackling Inequality and Levelling-up’. For example, there are pay gaps between men and women in the UK and WMCA. This is partly down to the sectors women are employed in. There are also marked differences in employment rate by ethnicity, with variations across different groups, mirroring wider trends nationally. Pre-COVID healthy life expectancy was improving, with men at 59.9 years and women at 60.7 years. However, this may change in coming years with over 11k deaths from COVID in the region, the unknown effects of long-COVID and other delays to treatment and mental health effects.

Preventing a Lost Generation

The final challenge outlined by Rebecca and discussed in the report is ‘Preventing a Lost Generation’, relating to qualification levels amongst young people. Prior to COVID, there was a strong apprenticeship performance at 32k, growing faster than England at +8.7%. However, last year this dropped to -19% as businesses couldn’t take young people on. Furthermore, although there are considerable gains in skills levels, the WMCA area still lags behind the UK average for NVQ level 4 numbers, needing another 165k people at level 4 to bridge the gap. This is important, and retaining graduates and creating good jobs can fuel recovery, as better-educated economies cope better with shocks and rebound quicker.

Can the West Midlands Bounce Back?

Overall the report highlights the challenges we face in the near term, but uncertainties still exist as the current programme of national support is withdrawn and the pandemic continues to play out, alongside the impact of trade disruption and change. However, there are positive signs, both in terms of business perceptions and also successful opening up and also the growth in skills levels recently. The region also has the unique opportunity of the Commonwealth Games and the positive perceptions and impact that being on a global stage can bring.

This blog was written by Dr Chloe Billing, Research Fellow, City-REDI / WM REDI, University of Birmingham.

To sign up for our blog mailing list, please click here.

Disclaimer:

The views expressed in this analysis post are those of the authors and not necessarily those of City-REDI / WM REDI or the University of Birmingham