On Wednesday the UK Government released the Creative Sector Vision a highly anticipated update to creative policy. Dr Matt Lyons provides a summary of the document and some initial reflections on what it could mean for the region.

The Creative Sector Vision published yesterday is the much-anticipated latest iteration of the UK Government’s policy for supporting the growth of the creative industries. The policy represents the first significant update to creative policy since 2018 replacing the Creative Industries: Sector Deal.

Culture Secretary Lucy Fraser had this to say:

“The government is backing our creatives to maximise the potential of the creative industries. This Sector Vision is about driving innovation, attracting investment and building on the clusters of creativity across the country. And from first days at school to last days of work, we will nurture the skills needed to build a larger creative workforce to harness the talent needed for continued success.”

The key goals of the Creative Sector Vision are outlined as:

- Promote Growth: The Government has set specific targets for Gross Value Added (GVA) and employment growth by 2030 supported by £77 million of new investment.

- Creative Research and Development (R&D: Four new advanced screen and performance technology research labs are to be established across the UK.

- Skills Pipeline: Plans to build a pipeline of skills and talent through a new creative career promise.

At the top level, there doesn’t appear to be a major shift in the goals of The Vision compared to its predecessor in 2018 which listed three major areas of focus:

- Places of the future – by funding leading creative clusters to compete globally

- Technologies and content of the future – via research into augmented reality and virtual reality

- Creative skills of the future – via a careers programme that will open up creative jobs to people of every background

However, there does appear to be a significant difference in the funding made available. The Creative Industries: Sector Deal touted a £150 million investment into the sector compared to the £77 million listed in the latest version.

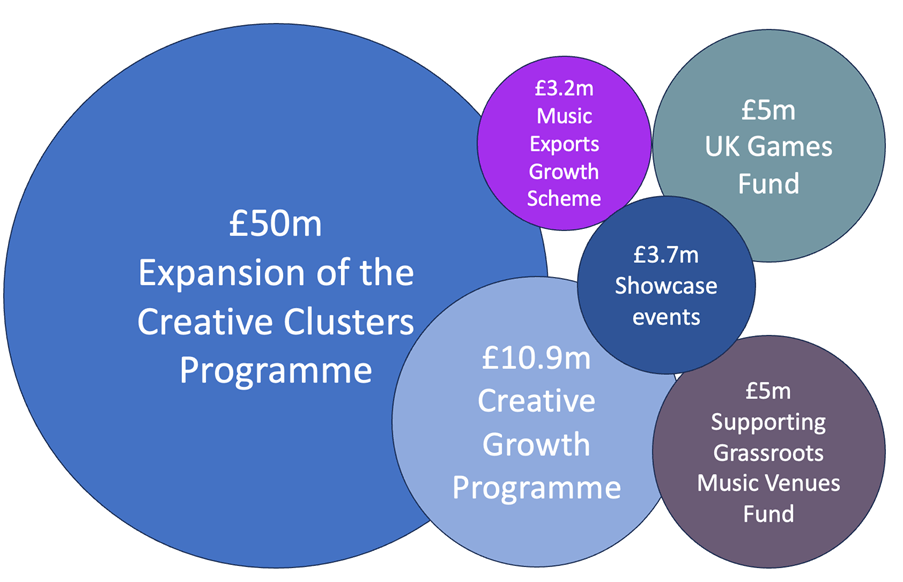

Where is the £77 million in new money for the creative industries going?

The vision announcement sets out a breakdown of where the new public expenditure will go (see below). The vast majority, some £50m will be going on an expansion of the Creative Industries Cluster Programme.

The programme was originally set up in 2018 and included an £80m investment across 9 creative clusters with different sub-sectors of focus, listed here:

- Bristol + Bath Creative R&D

- Business of Fashion, Textiles and Technology (London & South East)

- Clwstwr (Cardiff)

- Creative Informatics (Edinburgh)

- Future Fashion Factory (Leeds)

- Future Screens NI (Northern Ireland)

- InGAME (Dundee)

- StoryFutures (London & South East)

- XR Stories (Yorkshire & Humber).

It is not yet clear whether the next stage will include these same clusters, new clusters or a mix of the two.

An additional £75.6m for national and regional creative R&D labs

UKRI’s Convergent Screen Technologies and performance in Realtime (CoSTAR) programme is another significant announcement for the sector. The initial announcement is for four labs with the preferred bidders named as:

- National Lab – led by Royal Holloway, University of London with a series of partners in industry, Government and HE

And three regional labs

- West Yorkshire – Led by York University. Located at Production Park Studios, West Yorkshire. Core partners: Production Park, Screen Yorkshire, Vodafone, Wakefield Council, North Yorkshire LEP.

- Dundee – Led by Abertay University. Located at Waters Edge Studios. Core partners: Codebase, Edinburgh University, Interface, Scottish Enterprise, 4J Studios

- Belfast – Led by Ulster University. Located at Studio Ulster. Core partners: BBC Northern Ireland, Belfast Harbour, Humain Ltd, Northern Ireland Screen, Studio Ulster

The labs aim to provide insight into what skills and infrastructure will be required to remain globally competitive in the film & TV sector. This includes a particular focus on computer-generated imagery (CGI), post-production alongside other physical high-tech infrastructure for live performances.

Creative Skills and Education

One of the key goals of The Vision is to address skills supply issues in the creative industries. Three of the main skills headlines are:

Recognition of the Good Work Review – The review evidenced the challenging conditions in the sector with issues of diversity, working conditions and representation in need of improvement. The Vision sets out that the Creative Industries Council (CIC) will launch a Charting Progress Tool to monitor the effectiveness of interventions to support equality, diversity and inclusion.

Creative Careers Pipeline – The Vision recognises that skills shortages are a feature of the creative industries that need to be addressed to unlock growth in the sector. The government states that it will “develop new datasets to provide consistent and comprehensive evidence” on skills shortages to inform interventions through to 2030. This is hugely welcome and has been a recommendation of recent City-REDI research.

The Creative Careers Pipeline also makes reference to the need to better collaborate with industry on:

i) developing creative apprenticeships

ii) Better utilizing skills bootcamps (national and regional) benefiting from the newly established Local Skills Improvement Plans (LSIPs).

These initiatives are also likely to be welcomed by industry which has been calling for greater agility in education to provide the latest skills required.

Education – A key theme of the skills provision is the emphasis on lifelong learning and building in creativity at the curriculum level aiming to publish the Cultural Education Plan later this year. It is important to note that this is for England only, the Welsh curriculum, for example, has important differences with the inclusion of Expressive Arts as an area of learning and experience. The document also includes support for the rollout of T-Levels and employer-led Level 3 qualifications in the sector.

How Might the Midlands Benefit?

The creative industry is an important and fast-growing sector in the West Midlands. There is a growing video game cluster in the so-called ‘Silicon Spa’ area which has produced internationally successful games such as Forza Motorsport. There is a significant Film & TV cluster best known recently for the success of the TV series Peaky Blinders.

While Birmingham* and the West Midlands aren’t specifically mentioned in the Creative Sector Vision there are two main ways in which the policy initiatives might benefit the region.

*Reframe, a groundbreaking partnership to support Black creatives in the UK, which is based in the West Midlands, is mentioned as a case study.

More funding for the creative sector

The East Midlands has been named alongside 13 other clusters as a beneficiary of the Creative Growth Programme. The UK Games fund could benefit the growing Silicon Spa sector through direct investment. There is potential that the West Midlands or wider region could be a future part of the next stage of the Creative Clusters Programme.

Greater alignment of skills needs and vision for growth

A central issue facing the growth of the creative cluster in the West Midlands (and the creative industries more broadly throughout UK clusters) is the issue of skills gaps and mismatches, a phenomenon we have reported on in a previous blog.

The ambitions stated for greater collaboration between industry, government and education is welcome and align with a key recommendation of our recent research. The emphasis on bootcamps and creative apprenticeships is likely to help address some of the key challenges facing the talent pipeline in the sector.

Concluding Remarks

This blog is an initial take on what the Creative Sector Vision says and what it could mean for the sector in our region.

In short, there is a lot to be supportive of even if the scale of the funding is less than expected. In the coming weeks, we will dig deeper into the policy document and stay tuned for any further announcements on the future of The Creative Industries Cluster Programme.

This blog was written by Dr Matt Lyons, Research Fellow, City-REDI / WMREDI, University of Birmingham.

Disclaimer:

The views expressed in this analysis post are those of the authors and not necessarily those of City-REDI / WM REDI or the University of Birmingham.