Simon Collinson, Fengjie Pan and Pei-Yu Yuan examine Research and Development (R&D) funding in the UK. Does it create equal regional growth across the country? This blog post was produced for inclusion in the Birmingham Economic Review for 2022. The annual Birmingham Economic Review is produced by the University of Birmingham’s City-REDI and the Greater Birmingham Chambers of Commerce. It is an in-depth exploration of the economy of England’s second city and a high-quality resource for informing research, policy and investment decisions. This post is featured in Chapter 2 of the Birmingham Economic Review for 2022, on business and disrupted markets. Read the Birmingham Economic Review. Visit the WMREDI Data Lab to find out more about Birmingham.

The UK government has expressed a strong commitment to ‘levelling up’, including a focus on place-based policy interventions and investments to drive more equal regional growth across the country. UKRI is the main funding agency responsible for promoting R&D and innovation, with an annual budget of £8 billion. This involves a balancing act to keep the UK at the forefront of key areas of R&D, science and technology while improving our capacity to leverage University-based R&D for economic growth and social change. We have historically been better at the former than the latter, and the ‘valley of death’ between invention and innovation is still a feature of the UK economy.

Funding

The UK Research and Innovation (UKRI) 2022-2027 delivery strategy features a central focus on the place-agenda, with an aim to “…support thriving research and innovation clusters across the UK, creating diverse high-value jobs and local economic growth.” A key objective is also to “…support the development of evidence to inform local, regional and national policies and interventions to address regional disparities and enhance place-based livelihoods and economies.”, which is where City-REDI plays a leading role.

Much of UKRI funding is channelled through Innovate UK. It has a specific remit ‘to support business-led innovation in all sectors, technologies and UK regions, helping businesses grow through the development and commercialisation of new products, processes, and services.’ Increased funding for public-private / university-business collaborations, knowledge transfer partnerships, local innovation accelerators and other schemes to improve regional innovation ecosystems are planned. It is also committed to investing £100 million into ‘Innovation Accelerators’ as pilot projects in Birmingham, Glasgow and Manchester.

Analysis of past UKRI investments into R&D collaborations involving universities and businesses shows significant variation in local sector ‘specialisation’ and interregional collaboration. The distribution and impact of past funding need to be understood to guide the current government agenda, and to catalyse better economic growth.

The Distribution of Innovate UK Funding

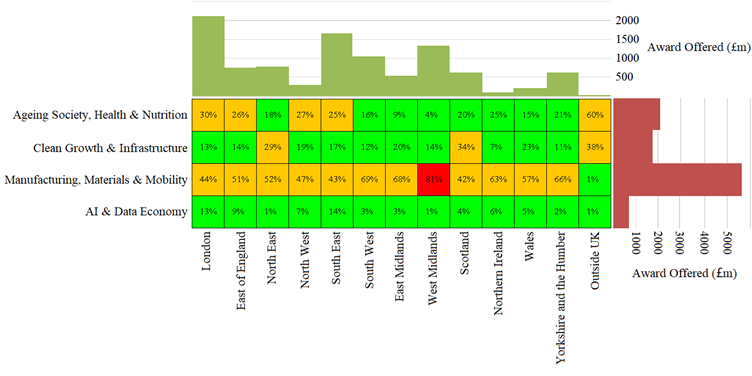

Figure 1 shows a breakdown of Innovate UK funding from 2004 to 2021, including the percentage of awards received by each of the 12 regions across its four main thematic areas: Ageing Society, Health & Nutrition (Health); Clean Growth & Infrastructure (Clean Growth); Manufacturing, Materials & Mobility (Manufacturing); AI & Data Economy (Data). Total funding for each region is denoted by the green columns at the top, with London and the South East, followed by the West Midlands receiving the dominant shares. The percentages relate to this overall figure, per region. The red bars along the rows show the total amount of funding dedicated to each key theme, with Manufacturing receiving the dominant share (almost three times the investment in Health).

This provides a portfolio view of each theme and each region, and it shows that the West Midlands has the most concentrated portfolio of all the regions. 81% of West Midlands funding is in the Manufacturing theme and less than 5% in two of the remaining three areas.

Figure 1: Innovate UK funding from 2004 to 2021, by region and theme

Like Scotland, the North West region, centred on Manchester, has a more evenly distributed funding portfolio, although the top category is Manufacturing with 47% followed by Health (27%) and Clean Growth (17%). Clearly, there are trade-offs between a more specialised and focused portfolio, like the West Midlands, following its automotive manufacturing legacy, and a broader range of capabilities across thematic areas, like the North West.

Collaborations

What kinds of collaborations between universities and businesses underlie these regional and thematic patterns of funding?

Analysis of overall UKRI funding, including but beyond Innovate UK investments, reveals which regions work with each other and shows how specialist networks have evolved to connect local clusters of activity. The data shows that almost all collaborations involve firms, and 34% involve only firms and no other partners. More than half (59%) involve firms and universities working directly with each other and less than 7% of all collaborations funded by UKRI involve intermediaries such as research and technology organisations (RTOs) or catapults.

Focusing again on the West Midlands, data on public-private collaborations in 2019 (Figure 2) show that London is the main location of partners on UKRI funded projects with West Midlands-based participants. This pattern dominates over intra-regional collaborations in the West Midlands, and relatively little collaboration takes place with other UK regions.

Figure 2: Collaboration between West Midlands-based partners and those based in other UK regions via public-private projects funded by UKRI.

These patterns of publicly funded R&D collaborations raise several questions in light of the government’s future agenda and UKRI’s delivery strategy. These investments appear to be reinforcing long-term patterns of growth, focusing on past strengths, like automotive manufacturing in the West Midlands. They also seem to be maintaining the dominance of London.

Should these market interventions be more ‘mission-led’ and target new areas of growth, focusing on the future potential of regions? Should they also be stimulating collaborative networks across regions outside of London, leveraging university-based R&D to strengthen regional innovation ecosystems and enabling more balanced economic growth across the UK?

This blog was written by Prof Simon Collinson, Dr Fengjie Pan and Dr Pei-Yu Yuan, City-REDI, University of Birmingham.

Disclaimer:

The views expressed in this analysis post are those of the authors and not necessarily those of City-REDI or the University of Birmingham.