Alice Pugh looks at what impacts cuts to National Insurance Contributions, raising the high-income child benefit charge, and public spending will have on households in the UK.

Cuts to National insurance Contributions (NICs)

The NIC main rate has been cut by 2p in the pound (from 10% to 8%) for an expected 27.6m employees and 2.2m self-employed workers. The table below shows the impact that a 2% cut in NIC will have based on income levels, as can be seen, the more you will benefit from the cut.

Annual savings by salary by cutting NICs from 10% to 8%

Source: BBC, 2024 based on data from AJ Bell, 2024

For the average worker on £35,400, this will be a tax cut worth £450 per year from April 2024. When combined with the cuts to NICs in the Autumn budget, this is a total annual tax cut of around £900 for the average earner.

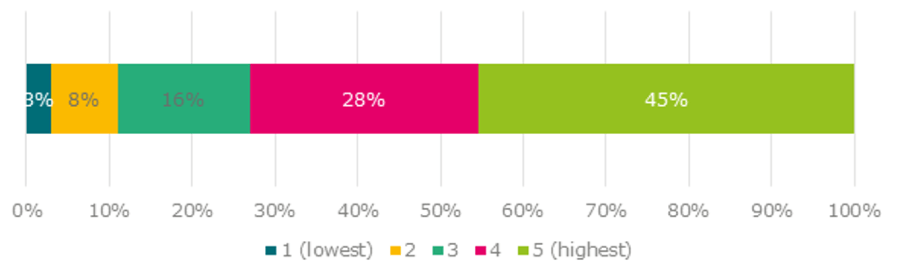

The IPPR has found that the majority of the benefit from the NICs will be gained by the richest households, with for every £1 of the NICs cut, 45p will go to the richest 20% of households with the highest income, whilst only 3p will be gained by the lowest-earning fifth of households.

Distribution of reduced tax across household income quintiles

Source: IPPR tax and benefit model, 2024

Fiscal drag, however, will trap even more people into paying higher taxes. Fiscal drag means that when the income tax thresholds are frozen and do not increase with inflation whilst earnings do, more and more people can be dragged into paying a higher rate of tax. The Institute for Fiscal Studies has found that due to the multi-year freezes on income tax thresholds, including a time of high inflation, overall for every £1 given back to workers in cuts to NICs, £1.30 will have been taken away in income tax threshold freezes between 2021 and 2024, potentially rising to £1.90 in 2027.

High-Income Child Benefit Charge (HICBC)

Increasing the point at which families start losing child benefits from £50,000 a year (for the highest-income earner) to £60,000 will benefit around 170,000 families. The taper rate has also changed, so rather than child benefits being completely withdrawn at £60,000, it will begin to taper at £60,000, until the highest earner is earning £80,000 at which point child benefits will be withdrawn. Together these changes are expected to increase child benefit by an average of £1,260 a year to 485,000 families in 2024-25. This change will be a great relief to many households as since the government changed the child benefit policy back in 2013, the £50,000 earnings for the highest earner had been frozen, this means as wages went up with inflation many families began to lose their child benefits, even though in real terms they weren’t necessarily earning more.

Public Spending

The Chancellor has largely retained his post-election spending plans effectively unchanged, despite the anticipation that that he would be making cuts. This will be tight to deliver as the government has little headroom left following the budget, with only £8.9bn headroom with the average in previous years from 2010 has been around £26.1bn. Sticking to the planned spending will require cuts to unprotected services of around 3.3% per year or around £20bn by 2029, which is expected by the IFS.

The NHS was guaranteed greater funding at an additional £2.5bn of day-to-day spending for 2024-25, though this was inevitable otherwise there would have been a real-term cut in NHS spending. Plus, the NHS will also receive an additional £3.4bn of capital funding to fund investments in technology and productivity-enhancing service improvements.

Conclusion

This Spring Statement was highly anticipated, as it was expected to be the last budget before the 2024 general election. However, the budget was largely underwhelming (not necessarily a bad thing given the 2022 ‘mini-budget’), though partly because the big announcement of NICs cuts had already been leaked earlier in the week. The changes to NICs will benefit many however, the policy will largely help higher income earners and households will still not see their incomes return to pre-pandemic levels till 2025-26.

However, over the entire parliamentary period of this government, the government has indeed shifted the majority of state support offered from the rich to the poor. The Resolution Foundation found that whilst 78% of the personal tax cuts announced in the Spring 2024 budget will go to the richest half of households, across the wider tax and benefit changes made over this parliamentary period (2019-2024), a typical household will gain £420 a year on average, the poorest fifth will gain £840 and the richest fifth will lose an average of £1,500.

The IFS highlighted that the largest problem with this budget overall is that it is not a budget which addresses the real challenges facing the economy because it has not been transparent about what those challenges are. The IFS accuses both the government and the opposition of not acknowledging the true scale of choices and trade-offs that will be facing us in the next parliamentary period, which will become a problem when those choices become unavoidable.

This blog was written by Alice Pugh, Policy and Data Analyst City-REDI / WMREDI, University of Birmingham.

Disclaimer:

The views expressed in this analysis post are those of the author and not necessarily those of City-REDI / WMREDI or the University of Birmingham.