During his summer placement with WMREDI, Robert Lynam has been working with the rest of the Theme 3 Regional Innovation Ecosystems research team on the initial phase of a project which City-REDI/WMREDI are delivering on “Universities’ STEM Assets: Commercial and Non-Commercial Pathways and Aggregate Impacts“. In this blog, Robert tells us about his contribution to the project.

During his summer placement with WMREDI, Robert Lynam has been working with the rest of the Theme 3 Regional Innovation Ecosystems research team on the initial phase of a project which City-REDI/WMREDI are delivering on “Universities’ STEM Assets: Commercial and Non-Commercial Pathways and Aggregate Impacts“. In this blog, Robert tells us about his contribution to the project.

About the Overall Project

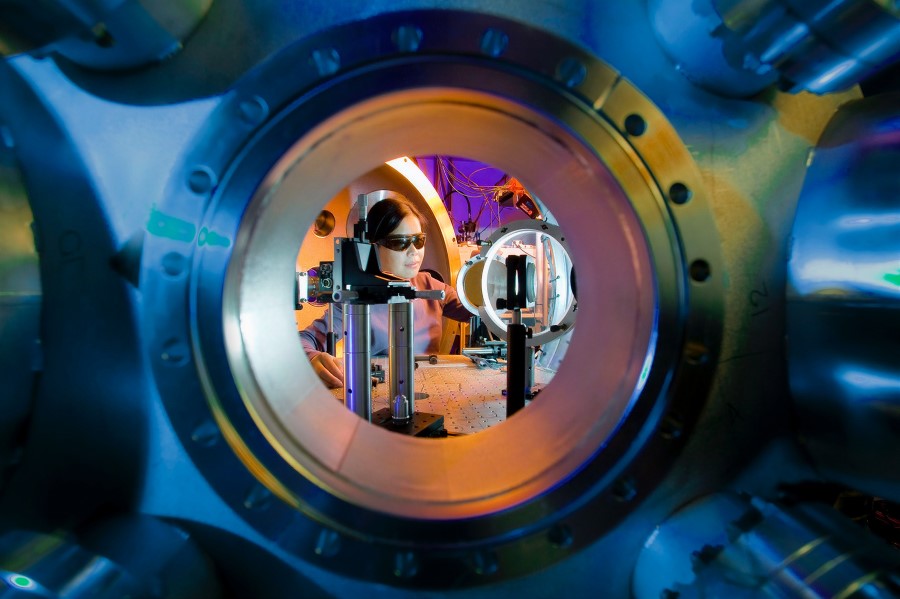

This project sits within a theme that examines regional innovation ecosystems and the relationships between universities, local firms, entrepreneurship, innovation, technology transfer and knowledge exchange as contributors to different kinds of growth. We know that strong regional innovation systems underpin stronger economic growth pathways, tend to be more competitive and resilient and tend to benefit both firms and local communities. Understanding the relative impact of various interventions and investments for regional economic growth, sustainability and the reduction of social inequality in the West Midlands underpins policies to attract more public R&D investment and guide better growth in the region.

The aim is to track and compare different interventions or investments, as micro-level pathways to impact, which in aggregate produce macro-level growth patterns. Commercial and non-commercial types of innovation will also be studied in order to understand the trade-offs between productivity growth and improvements in sustainability or inclusivity at the regional level.

There are two key phases of this project. The first is to map the region’s university infrastructure, focusing specifically on fixed STEM assets. Examples include (i) Warwick Manufacturing Group; (ii) the Manufacturing Technology Centre; (iii) Energy Systems Catapult; and (iv) Tyseley Energy Plant. The project will work to identify the size, scale, employment, turnover, and growth of each of these assets, in direct and indirect terms using proxy measures and multipliers.

The second phase of the project is to compare the commercial and non-commercial impacts of the assets, identifying any social/ environmental/ economic trade-offs. Examples of non-commercial impacts are healthcare interventions, public sector and social innovations. This impact analysis will help identify different forms of regional economic growth that can be attributed to university-related investments. The aim is then to model what the impact would be if the assets did not exist, as well as estimating the regional impact of the adoption and diffusion of specific commercial and non-commercial innovations in the pipeline.

Robert’s Role in the Project – Phase 1 Infrastructure Mapping

Support with Systematic Literature Review

During the initial weeks of my placement, I contributed to the systematic literature review by reading 19 relevant academic papers and extracting any relevant information and lessons learned that could help with the project’s research design and methodology. Specific information that the team were looking for included: what type of asset the paper focused on, the asset’s relationship and involvement with universities, inputs – such as resources, outputs – such as activities, the type, level and duration of impact, useful methodological approaches, and available data sets.

The team began by searching for all relevant research papers, based on a set of search terms and exclusion criteria, which found 1000+ papers. This list was narrowed down to a selection of the 144 papers that were considered to be most relevant.

Case Study Development

Case Study Development

I spent the second half of my placement contributing to the scoping work which will provide a foundation for the rest of the primary research moving forward to establish the existing ‘state of the art’ in this field. Such work has involved collecting basic data for two of the project’s case studies – Warwick Manufacturing Group (WMG) and the Manufacturing Technology Centre (MTC) – to add to an evidence base consisting of relevant information about the asset’s capabilities and impact, as well as identifying any gaps.

I’m currently using the information I’ve researched to produce two 10-page briefing documents on the case studies, describing what knowledge is already known about the assets’ governance structure, size, scale, employment, funding structures, turnover, growth, capability, and impact. Such documents will then be used to inform the subsequent empirical research.

What’s next?

The ‘Theme 3’ team will now use my evidence base and contribution to the systematic literature review as a foundation for the next phase of the project. This will involve a ‘deep dive’ case study on WMG and MTC, aimed at building an understanding of the specific regional contribution the fixed asset makes and the factors that constrain its innovation and productivity growth. This will be achieved through interviews with key stakeholders, which will focus on:

- ‘How’ and ‘in what way’ STEM assets generate impact: exposing the relationship between inputs, activities, output, and outcomes, and considering their relative contribution alongside other factors and ‘third mission’ activities

- The impact of STEM assets, beyond commercial/ economic impacts: focusing on understanding the complete picture of value created by STEM assets, which can help inform funding strategies.

- The factors that constrain the innovation/ productivity growth of these STEM assets and to what extent they are region or university specific. The impact of STEM assets will be dependent on their ability to overcome different local challenges in relation to the availability of specific kinds of skills, R&D assets, and infrastructure.

This blog was written by Robert Lynam, an intern at City-REDI / WMREDI, University of Birmingham.

Disclaimer:

The views expressed in this analysis post are those of the authors and not necessarily those of City-REDI or the University of Birmingham.