Michal Gierat, Managing Director of WM International discusses the logistics industry since 2021, where a variety of factors including the pandemic and fuel prices have made for challenging times. This article was written for the Birmingham Economic Review 2023. The review is produced by City-REDI / WMREDI, the University of Birmingham and the Greater Birmingham Chambers of Commerce. It is an in-depth exploration of the economy of England’s second city and a high-quality resource for informing research, policy and investment decisions.

The prices of our services are heavily impacted by the operating costs that road hauliers, shipping lines or airlines have to face. The first post-pandemic economic bounce back made the situation in logistics even more challenging since the customers’ demand exceeded the transportation capacities available worldwide.

Road haulage

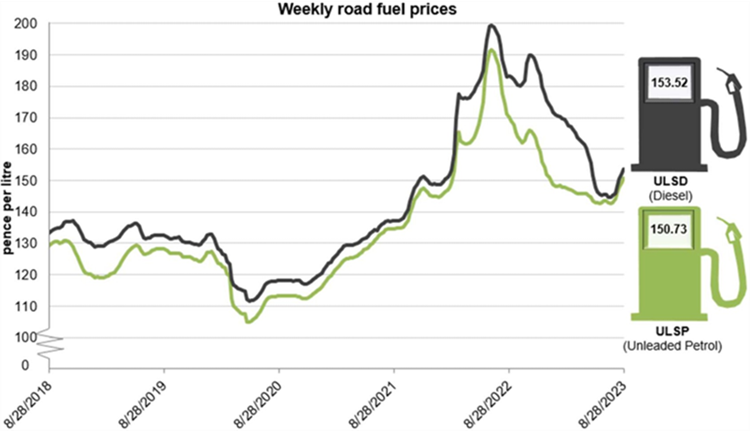

Fuel prices and drivers’ wages are the biggest costs for transport companies. Transportation cost has a direct impact on the products’ final price and the fuel prices and inflation rate are linked very closely.

Weekly Road Fuel Prices

The years 2021 and 2022 were very challenging for the logistics industry due to the significant fuel cost, high demand and the shortage of HGV drivers. Since Autumn 2022, we have observed that fuel prices have been stabilising, having reached almost the pre-pandemic levels. This summer, however, they started rising again. In the last couple of years, the fuel surcharge (FSC) fluctuated from 3% to 19%. In 2023 up to July 2023, most hauliers’ FSC was approximately 5%. Since July, it hit 10% and it is likely to continue increasing. Time will show if this increase has simply been a blip, a slight correction or is another crisis linked with the current geopolitical tensions.

Shipping Containers

Not only has road haulage been struggling, but the cost of shipping containers from far east Asia skyrocketed in 2021. It reached the level where – according to various sources – the cost of transport exceeded the value of the commodities being transported. Since early 2022, we have observed a slow but steady decline in the cost of container shipments and this trend continued in 2023. Our analysis suggests that in 2023 we reached the cost level of 2018. In addition, in 2022 the UK ports implemented extra charges such as the Energy Adjustment Levy (EAL) and the Green Energy Transition Levy. These charges have increased in 2023 and subsequently become an additional cost to our customers.

Level of orders dropping

Our main observation in 2023 is that the level of orders from suppliers and customers is decreasing. The hauliers now have spare vehicles and spare drivers available. For the last couple of years, it was the freight forwarders struggling to find hauliers available to work and now the situation has changed. We are receiving more offers with vehicle availability from all over Europe, including the UK.

We estimate that 20-30% of the European hauliers who used to operate between the UK and the continent, were redirected towards mainland Europe. One of the possible reasons for this could be the new post-Brexit regulations that resulted in more hassle due to the Customs requirements. Those European hauliers who prepared themselves for the Brexit changes and remained on the market increased their fleets and filled up the capacity gap. Interestingly, this gives the UK hauliers an opportunity to start considering operating more European tractions.

By the end of 2023 as initially planned, or more likely in 2024, HM Revenue & Customs (HMRC) is going to move from Customs Handling of Import & Export Freight (CHIEF) to Customs Declaration Service (CDS) system on exports which may potentially create difficulties for some freight forwarders in terms of staff training.

Acid test for the economy

Some argue that the logistics industry could be considered the acid test for the rest of the economy. In the past, the decline in transportation demand was the beginning of the recessions whereas increased demand was an indication of the start of economic growth.

At WM International, we suspect that the possibility of economic slowdown is significant, and we are focusing on the automation of our processes and diversifying our portfolio of hauliers and shipping companies to optimize costs.

Read the Birmingham Economic Review in full.

This blog was written by Michal Gierat, Managing Director of WM International.

Disclaimer:

The views expressed in this analysis post are those of the authors and not necessarily those of City-REDI / WMREDI or the University of Birmingham.