Welcome to part four in our new series “What is…?” where we explain the language, terms and ideas used in our day-to-day work. Other blogs from the series include:

Definition and description

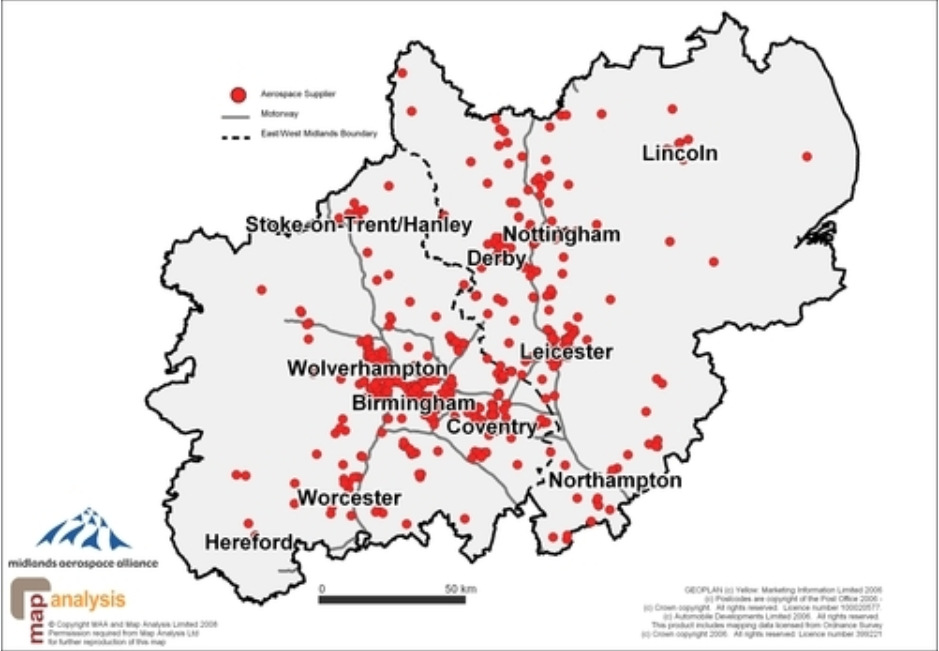

A business cluster or industrial cluster is an umbrella term that describes the geographical concentration of firms. Economists tend to prefer the broader notion of spatial agglomerations to stress that they include different forms of industrial organisations, which benefit from advantages that stem from spatial proximity. Since these advantages are external to single firms who neither chose nor paid for such benefits, they also called externalities, external economies or spillovers.

The basic tenets of the economies of agglomeration are presented and discussed in Alfred Marshall’s (1920[1890]) seminal contribution “Principle of Economics”, which features the Marshallian triad:

- Demand and cost spatial effects – Being close to a large final market (on the demand side) and being close to other firms lying upstream and downstream along the same value chain entails clear competitive advantages in terms of travel and transaction costs.

- Specific and thick labour markets – The concentration of firms operating in the same productive sector attracts skilled workers and facilitates the training of new ones, thus ‘thickening’ the local labour market and making it more efficient and reactive to change in prices or evolution of demand.

- The ‘industrial ‘atmosphere’ – Clusters produce something intangible in the air, the idiosyncratic ability of the local system in developing its own tacit cognitive structures created by replicable and cumulative routines, but also by the unique combination of human and social capital.

Economies of agglomeration in regional studies

In regional studies, these neo-Marshallian forms of agglomerations have been customarily identified with industrial districts, focusing on a small range of specialised and highly complementary productions and value chains. Economies of specialisation (also called localisation economies) show their effects in three ways:

- A reduction of productive costs (i.e. transport cost, labour market, etc.)

- A reduction of transaction costs (rules, relational capital, etc.)

- An increase in productivity (labour division, entrepreneurship, cooperation, etc)

Neo-Marshallian districts or clusters typically develop at the sub-urban or sub-regional level and show a concentration of Small and Medium Enterprises (SMEs) within the same industry or same value-chain.

Following Giacomo Becattini (2017 [1989]), the industrial district is a “socio-economic paradigm” characterised “both a community of people and a population of firms in one naturally and historically bounded area”. In fact, external economies of localisation are based on a combination of organisational processes and knowledge, which set a methodological shift from the mainstream utilitarian individualism as the basis of the economic thought to a more collective style behaviour. Localised knowledge, shared values, cohesive local communities and supportive institutions are key factors to boost local economic development based on a mix of cooperative and competitive behaviours.

Scholars and policymakers have debated at length whether specialisation is the only source of local advantages. Unlike the economic literature, from a sociological perspective, Jane Jacobs (1961) suggested quite the opposite idea. Since the density and diversity of human activities are the engines of the rapid growth of cities, according to Jacobs (1961: 145), urban settings are “natural generators of diversity and prolific incubators of new enterprises” because they are dense and, therefore, offer “small manufacturers” a wider variety in commerce, services and entertainment.

While in the Marshallian tradition market power underpins innovation because it allows firms within an industry to incorporate innovation revenues through their localised monopoly, Jacobs externalities rely on the competitive stimulus of creative and unpredictable environments. The paradigm shift from traditional clusters based on incremental innovation and vertical integration to new (urban) clusters fuelled by radical innovation seems to correspond to a shift from Marshall to Jacobs, assigning an unprecedented role to knowledge integration and creativity-intensive production. In the current rapidly changing economic scenario, knowledge externalities have become pivotal in the local development discourse stressing the role of innovation dynamics, digital skills and the learning processes.

How to measure specialisation and diversification

Regional economies are analysed in terms of the distinctiveness of their industrial composition. Probably the most popular technique adopted to describe the dynamics of industrial mix from a comparative perspective is shift-share analysis. This analysis breaks down differences between values of a chosen variable as observed at the regional and national level. Although the analysis has many limitations, it has been used in regional studies since the 1960s and it has recently resurged in the analysis of industrial resilience. Fothergill and Gudgin (1979) suggest that shift-share is simple and, without unrealistic expectations identifies the three main components of growth in employment:

- National change

- Structural change

- Change in competitiveness

In particular, the structural effect measures the advantage (or disadvantage) of the specific combination of industries, whilst changes in competitiveness show the differential effect between the actual and the expected employment change. Although there are several ways to estimate the economic base of a locality, the location quotient (LQ) approach is the most popular method. LQs measure the relative concentration of a given industry in a given locality compared to a larger area such as the whole nation, the state, or the region. Used in tandem, the location quotient and shift-share techniques provide an economic base analysis that concentrates on industries in which the local economy specialises as well as those which are experiencing growth.

Most of the statistical measures of localisation, concentration and specialisation are borrowed directly or indirectly from the income inequality literature and quantify differences in value-added or employment across geographical units (cities, regions, countries) and/or industries. In the process of measurement, it is very important to distinguish between two families of indexes that cannot be compared since their focus is totally different:

- Absolute specialization (e.g. Hirschman-Herfindahl Index, Absolute Gini-Index Shannon Entropy Index). Using such an index, a geographical unit is considered specialised if a small number of industries exhibit high shares of the overall employment of that unit.

- Relative specialization (e.g. Krugman Specialization Index, Relative Gini-Index, Theil Index). Such an index measures the deviation of a unit’s industry structure from the average industry structure of the reference group of units and reveals units’ comparative advantages in relation to the reference group.

Indexes must be carefully interpreted since one possible limitation to their use is their sensitivity to industrial classification and geographical boundaries. Although we all recognise some benefits of agglomeration, scholars still struggle to identify a spatially-blind rule to plan successful clusters. Whether it is more desirable to specialise in one single production or invest instead on a broader portfolio of activities depends also on historical and institutional conditions and other external factors a city-region is not necessarily able to control.

Download a copy of “What are Industrial Clusters and Economies of Agglomeration?“.

This blog was written by Massimiliano Nuccio, Research Fellow, City-REDI.

Disclaimer:

The views expressed in this analysis post are those of the authors and not necessarily those of City-REDI or the University of Birmingham.

To sign up to our blog mailing list, please click here.

3 thoughts on “What are Industrial Clusters and Economies of Agglomeration?”