Last week, NESTA launched a report on government spending on R&D and regions. The report was written by Tom Forth (Open Data Institute Leeds) and Richard Jones (University of Manchester) and was commissioned to present analysis on where and how R&D (public and private sector) is distributed across the UK.

Last week, NESTA launched a report on government spending on R&D and regions. The report was written by Tom Forth (Open Data Institute Leeds) and Richard Jones (University of Manchester) and was commissioned to present analysis on where and how R&D (public and private sector) is distributed across the UK.

This blog pulls out key findings from the report that specifically relate to the West Midlands economy and provide further context, based on research that we are undertaking at WM REDI. The link to the report can be found here and their online data tool here.

Background to the Report

Investment – or rather the lack of investment – in Research and Development (R&D) and innovation, has been at the forefront of public policy in the last few years, with the 2017 Industrial Strategy pledge to increase public expenditure on R&D from 1.7% to 2.4% of GDP by 2027. More recently, Science Minister Chris Skidmore set out his vision on how to level up research and development “so that it benefits every corner of the UK” (Gov.uk, 2020). Subsequently, in the March 2020 Budget, the Government pledged to increase public R&D investment to £22 billion per year by 2024‑25. This would be the largest ever expansion of public financial support for UK R&D and is a response to the fact that the UK’s overall R&D intensity been historically low compared to other competitor countries.

OECD stats show that (pre-COVID-19 crisis) R&D spending averaged 2.37% of GDP across OECD countries, while the UK spends just 1.66 per cent. On his twitter page, Tom Forth explained that if the English football leagues represented R&D spending, the UK would find itself in EFL League 2, alongside Italy and Spain:

- Premiership = Korea, Sweden…

- Championship = Germany, USA…

- League 1 = Belgium, France…

- League 2 = UK, Italy, Spain…

This significant difference is partly explained by the fact that countries such as Germany and France have been increasing their R&D spending for the past two decades, whilst UK R&D investment has stood still. Therefore, the government’s target of 2.4% of GDP by 2027 is long overdue.

The NESTA report aimed to examine this “longstanding gap in UK investment”, whilst also exploring “regional imbalances in public and private funding”. R&D spending matters because it leads to innovation, which creates productive industries and well-paid jobs. Furthermore, there is good evidence that R&D investment correlates with economic growth, reduced regional inequalities and better health outcomes for local populations. City-REDI research on ‘Productivity and Prosperity: Inclusive Growth for the West Midlands’ is also exploring this link.

Public Sector R&D – Regional Imbalances

Research published by UKRI in 2020 shows that the so-called ‘Golden Triangle’ benefits disproportionately from public investment, compared with other regions of the UK. The headline stat is that 52% of gross domestic expenditure on R&D (GERD) goes to London, the South East, and East of England regions (ONS, 2020). In 2018-19, the West Midlands received only 9%. (ONS, 2020).

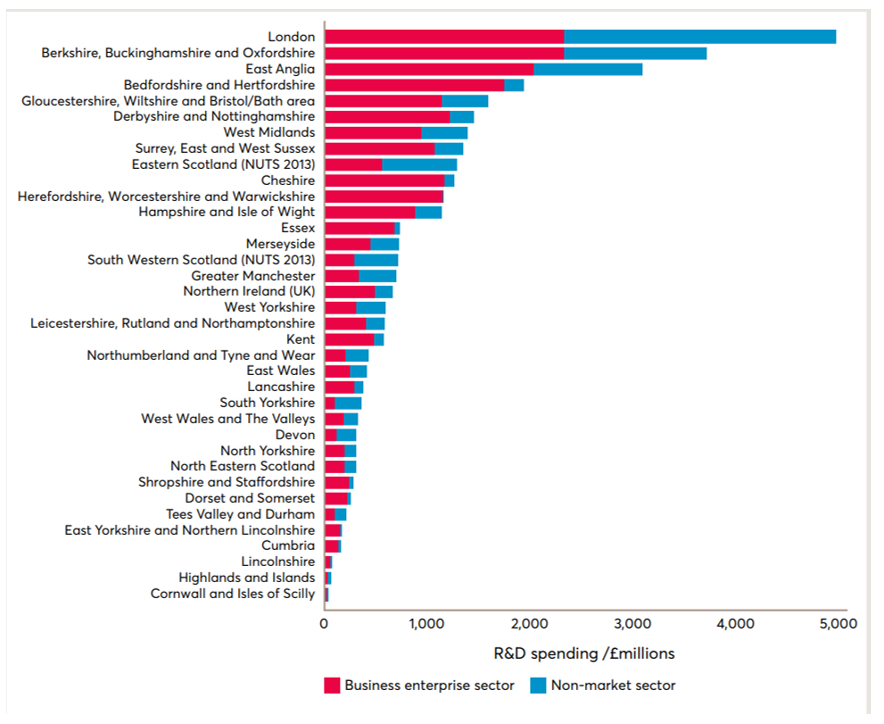

Furthermore, the NESTA report found that the relationship between public and private sector R&D at the regional level is highly variable, with significant geographical imbalances (Figure 1). For example, London and the two sub-regions containing Oxford and Cambridge account for 46 per cent of all public and charitable spending on R&D, but just 31 per cent of business R&D and 21 per cent of the population. Similarly, of a series of major capital investments in research infrastructure between 2007 and 2014, 71 per cent were made in London, the East and South East of England.

These regional imbalances are explained by the natural tendencies to concentrate funding in particular places that already have a strong science base. This works against the axiom of science funding in the UK that it should be ‘place-blind’, supporting excellence, wherever it is found.

Figure 1: Business and public sector R&D by NUTS2 region (except for London, presented at NUTS1 level).

West Midlands = A Business-Led Innovation Region

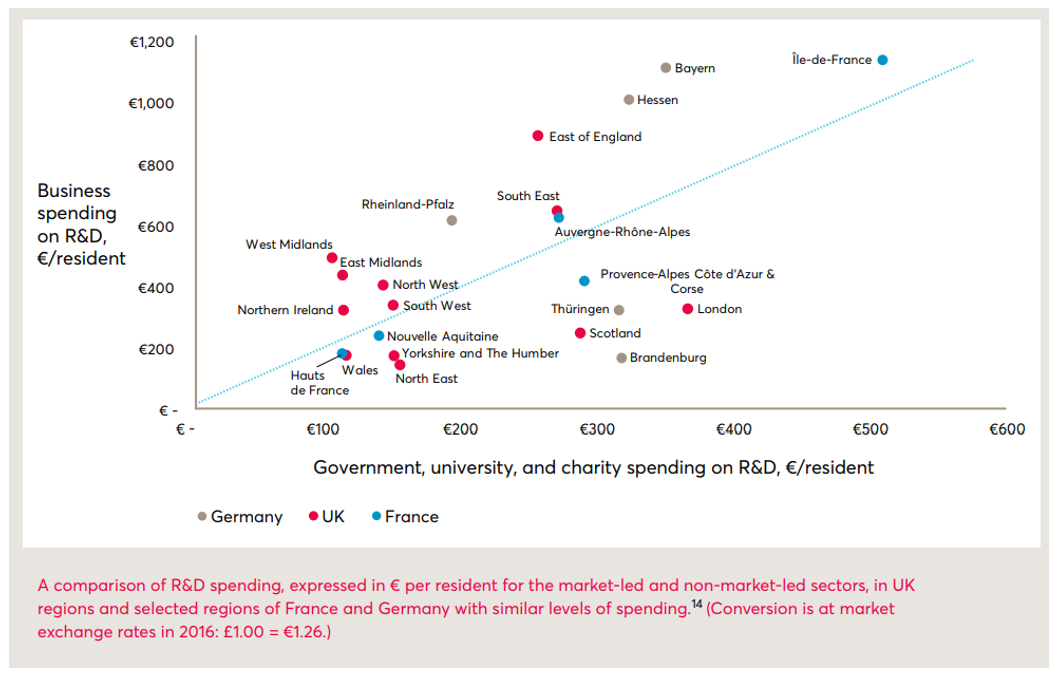

The West Midlands (together with the East Midlands and North West England) is identified as a ‘business-led innovation region’. This reflects the above-average levels of business investment in R&D in the region, but this is not matched by public sector investment. As shown in Figure 2, similar regions in France and Germany enjoy two to three times the state investment. These key regions appear to be attractive to businesses looking to invest in high-quality science and technology expertise, so why not Government investment?

The report argues that, if public sector investment in the West Midlands is not increased, the danger is that the private sector will respond to the better availability of innovation resources and skills elsewhere by relocating their own investment. This also limits the region’s ability – and potentially that of the UK more generally – to attract new R&D investment from abroad. The report highlights the example of Tesla, choosing to locate its ‘European Gigafactory’ in Berlin as opposed to a UK city such as Birmingham, where there is six times more public R&D money available. The private sector has contributed more, and more quickly, in Berlin. But in England’s West Midlands, private sector R&D per head has matched the growth of Berlin and grown by more than in Paris and London put together. And yet public sector R&D has remained static. Forth and Jones observe how “we will never know how much more growth in private sector R&D and private sector productivity we would have seen in the West Midlands had the UK public sector invested as heavily in the region as the German public sector invested in Berlin” (NESTA, 2020).

Figure 2: Spending on R&D in NUTS1 region of the UK compared with selected regions of France and Germany

The Role of Universities

The report argues that the West Midlands has a “straightforward” opportunity to “supercharge” its innovation ecosystem, by backing the decisions of the private sector with additional public sector funding. It suggests that this expansion of R&D capacity should be aimed at areas with strong sectoral specialisations and existing innovative businesses that already create a demand for skilled people. However, this is dependent on “institutions where research will be carried out, well-equipped research facilities, and a supply of skilled people, technicians, researchers and support staff” (NESTA, 2020). This aligns with the City-REDI research conducted by Dr Abigail Taylor, which outlined the critical role that local universities play in attracting investment to a region. This research examined the experiences of Local Enterprise Partnerships (LEPs) and their partners in securing funding. The research found that the presence of research-intensive universities is a central factor in a LEP’s ability to attract funding.

At WM REDI, we are working hard to understand the importance of Universities as major anchor institutions and a source of the skills, science, technology and knowledge which underpin successful regional economic growth. Our aim is to:

- Develop an integrated, regional data hub and tools for analysis and monitoring, to improve how we select, shape and promote particular economic investments and social innovations. This process will be informed by evaluations of the likelihood, timescale and scope of their eventual commercial or social impact, and the likely beneficiaries.

- Conduct comparative benchmarking to assess the relative strengths and weaknesses of UK regions, focusing explicitly on regional systems of innovation and the relative alignment of university R&D with user-needs at the local and national levels.

- Provide policy support to help shape and implement Local Industrial Strategies (LIS).

- Deliver workshops and training programmes to accelerate three types of economic and social impact: technology commercialisation, innovation in services firms, non-commercial innovation to support improvements in local public services, health and welfare.

Recommendations for Change

Specific recommendations from the report, to connect R&D investment with the levelling-up agenda and help rebalance the national economy, include:

- A commitment to greater transparency on how funding decisions are made in the government’s existing research funding agencies, and an openness to a broader range of views on how this might change.

- A substantial regional devolution of innovation funding at a sufficient scale to achieve a better fit with local opportunities.

- The creation of new science and technology institutions outside London, the South East and the East of England, including translational research centres, City Centre Innovation Districts and Advanced Manufacturing Innovation Districts

- For the UKRI to take a lead in driving regional R&D rebalancing, including:

- Block grant funding for research and knowledge exchange in universities should be regionally weighted to reflect current regional public underfunding of R&D. The longstanding explicit preference to London in the Quality Research funding formula should be removed.

- The Strength in Places Fund should be developed and expanded

The report also presents five potential future scenarios for how the distribution of R&D investment could be approached in the future. In all five, they have increased public sector spending by £4.9 billion per year, consistent with the UK government’s stated ambition of increasing national R&D intensity to 2.4 per cent of GDP. In most of these scenarios, the West Midlands would receive more additional funding than any other region:

The report also presents five potential future scenarios for how the distribution of R&D investment could be approached in the future. In all five, they have increased public sector spending by £4.9 billion per year, consistent with the UK government’s stated ambition of increasing national R&D intensity to 2.4 per cent of GDP. In most of these scenarios, the West Midlands would receive more additional funding than any other region:

- Everyone is equal: The UK government commits to investing in R&D equally in every nation and region of the UK. The West Midlands would need an additional £0.91billion of Govt. and HE investment (Table 5. P.54), more than any other region but equal to the N. West.

- Excellence above all: The UK government commits to investing in R&D in proportion to research excellence as defined by the REF 2014. £0.43billion extra to the W. Midlands, less than some other regions.

- Follow the business money: Matching business R&D spending regionally would mean an additional £1.06billion of Govt. and HE investment in our region. More than any other region.

- Levelling up: UK government commits to investing in R&D in inverse proportion to the GVA per resident of each region or nation of the UK (with parallels to Germany). Again, an additional £1.06billion of Govt. and HE investment to the W. Midlands. More than any other region.

- March of the makers: UK government commits to investing in R&D in proportion to the GVA produced by manufacturing in each region or nation. W. Midlands would gain an additional £1.38billion, second only to the N. West (£1.51b).

This blog was written by Dr Chloe Billing, Research Fellow, and Professor Simon Collinson, Director, City-REDI / WM REDI, University of Birmingham.

To sign up for our blog mailing list, please click here.

Disclaimer:

The views expressed in this analysis post are those of the authors and not necessarily those of City-REDI / WM REDI, University of Birmingham.