A new report by Alice Pugh, Dr Abigail Taylor, and WMREDI intern Charlotte Tomlinson examines changes in Birmingham City Council’s income and expenditure over the decade between 2010/11 and 2019/20. In this blog, Alice and Abigail summarise the aims of the report, the methodological approach adopted and they key findings. They also discuss key messages from the report and set out a series of policy recommendations. View the report.

Introduction

This project began when Stan’s Cafe approached City REDI for help with developing an educational and statistically accurate play, based on Birmingham City Council’s budget.

Stan’s Cafe wanted to understand:

- Where does Birmingham City Council (BCC) income come from and how this has changed over time.

- What services does BCC spend its income on, and why and how has this changed over time

- What budgetary challenges has BCC faced when trying to set a budget and how does this impact decision making?

Our report aims to answer these questions, by examining and analysing changes in Birmingham City Council’s income and expenditure over the decade between 2010/11 and 2019/20. It reviews and evaluates budgets and financial plans between 2010/11 and 2019/20, alongside reviewing evidence and analysis from supporting research from the National Audit Office (NAO). We focus on trends relating to the revenue funding for and expenditure on services that local authorities, such as Birmingham City Council, have to provide.

Methodology

The financial data used in this report, around income and spending, was principally drawn from the 2021 National Audit Office (NAO) Financial Sustainability of Local Authorities Visualisation between 2010-11 to 2019-20 and Birmingham City Council’s (BCC) Budgets for 2010/2011 and 2019-2020. The data in the NAO report is based on data releases collected by the Department for Levelling Up, Housing and Communities, on how local authorities spend their money over the financial year.

This data was used instead of the financial data within BCC budgets, as it was difficult to compare across BCC’s budgets. Difficulties in comparing budgets across multiple years arose from significant changes in spending priorities, which resulted in the main revenue spending streams changing over the period.

In addition, BCC budgets were used to understand the policy context and budgetary pressures that BCC had faced, when trying to set budgets over this period. This gave an extensive insight into how budgetary pressures had impacted BCC, and thus how this has impacted on decision making.

This was supported by two qualitative interviews with local authority representatives with knowledge of Birmingham City Council’s funding and expenditure over the last decade. Analysis of the interviews enables a deeper understanding of the reasons behind key changes in Birmingham City Council’s income and expenditure during this period.

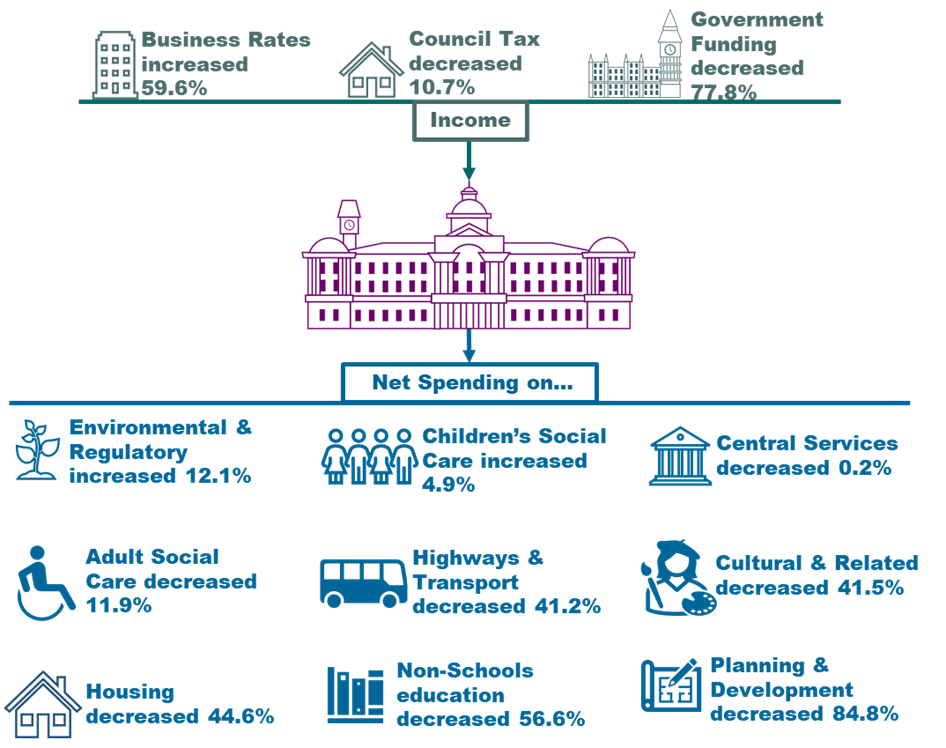

Income

Income and Spending for BCC have dramatically changed between 2010/11 and 2019/20. BCC has three main sources of income, these being Government Spending, Council Tax and Business Rates. As seen in Figure 1 below, whilst Business Rates income has increased 59.6% over this period, Council tax has decreased by 10.7% and Government funding has decreased by 77.8%. This has reduced overall spending power for BCC by 36.3%, though per capita spending power has decreased by 40.8%.

Government Funding has seen such a significant decrease, due to austerity policies introduced by successive governments, which have slashed local authority budgets BCC alone had to make austerity cuts of £736 million.

We found that government funding had become extremely competitive, with 32% of the funding available to local authorities between 2015/16 and 2019/20 being competitive funding. This has created tensions between local authorities. Competing for the same pots of funding has made it increasingly difficult for councils to work in partnership.

Council Tax income decreased, due to BCC freezing council tax for 3 years between 2010/11 and 2012/13. This saw the value of council tax decrease in real terms, as the Council were unable to raise council tax in line with inflation whilst the freeze was in place.

Also, even though an area may become more or less affluent over time, the council has no power to change council tax bands. Additionally, the Council is restricted by law to a 2% rise in council tax, with BCC to have a vote of the population to increase it above, which of course most constituents are not in favour of.

BCC saw a particularly large increase in business rates as it engaged in a trial with other West Midlands Combined Authority (WMCA) local authorities to retain 100% of business rates.

A key challenge with the rates is that they are based on the property valuation of the non-domestic space; however, the last non-domestic property valuation was in 2017 based on 2015 rateable values. Since then, the pandemic has led to significant decreases in non-domestic property values, nevertheless, business rates do not currently reflect this change. Additionally, as business rates are based on property valuations, online retailers often pay significantly less than their high-street counterparts. Online retailers pay around 6% of total UK business rates, even though they account for around 20% of total retail sales.

Spending:

Overall, net service revenue spending for BCC has decreased by 26% between 2010/11 and 2019/20. Of the nine main spending streams on which BCC spends its income, only two streams saw an increase in spending in real terms, as seen in Figure 1.

The dramatic changes in funding income over the period have significantly impacted BCC’s ability to fund services, and as a result spending in most areas has fallen over the 10-year period. Largely, statutory services have seen the smallest decreases in spending, with discretionary services seeing the largest decreases. This is likely to be because by law local authorities must provide statutory services, whereas the Council have greater flexibility over providing discretionary services.

Budgetary Pressures

Aside from austerity, the BCC has faced other significant budgetary pressures between 2010/11 and 2019/20. The main issues which BCC cited within their budget as a significant pressure were:

| Inflation | Inflationary pressures between 2014/15 and 2018/19 alone saw the BCC lose over £50m, as the cost of providing services becomes increasingly expensive.

|

| Demographics | Whilst funding income has been falling in real terms, the size of the Birmingham population has increased by 7.6%. This means that whilst spending power overall has decreased by 36.3%, per capita, it has decreased by 40.8%.

Birmingham, like much of the UK, has an ageing population. This is increasing the pressure on adult social care, as demand from people with long-term complex needs increases. Additionally, the BCC highlighted that the cost of adult social care had also increased substantially when the living wage was introduced, historically the BCC had expected these jobs to be low wage. The BCC also stated it was facing significant demand pressures on children’s social care, due to an increasing population of children and young people with complex needs. Birmingham has a higher proportion of pupils than the UK average, with an Education, Health and care (EHC) Plan or Special Education Needs statement. Increasing cost pressures are incurred as these children and young people need additional support. |

| Redundancies | BCC has had to reduce its workforce over the period in order to compensate for budget cuts incurred as a result of austerity. By the end of 2019, BCC had reduced its workforce by almost 48%. Whilst this has reduced long-term costs for BCC, in the short run they have to make high numbers of redundancy payments, which places added pressure on budgets.

|

| Equal Pay Compensation | Back in 2012, BCC was taken to court by women launching a pay equality compensation scheme. 170 women were among the female workers denied bonuses, in general, these women were in traditionally female-dominated roles such as cooks, cleaner and care staff, over a number of years. Whilst similar bonuses were awarded to employees in traditionally male-dominated roles such as refuse collectors, street cleaners and gravediggers. The equal pay liabilities totalled £1.2bn. This led to the BCC being forced to sell the new National Exhibition Centre (NEC), to help to pay for a large proportion of the bill. This led to further losses for the BCC, as they lost an income stream, as well as still having to pay the debt associated with the capital build of the NEC. |

Key messages

Income and spending for BCC has dramatically changed over the 2010/11-2019/20 decade.

Overall, BCC has faced increasing pressures and difficulties when setting budgets over this decade. Austerity and funding changes have vastly reduced the spending power of the council and placed greater pressure on local authorities to pull income from other revenue sources. However, local authorities have little to no control over how either council tax or business rates are implemented. The highly centralised nature of how these funding streams are controlled restricts the council’s ability to actively pursue increasing income through these streams. As central government funding continues to fall, with little change or uplift from other income sources, BCC will face increasing pressure, especially as demand for adult social care increases alongside an ageing population. BCC has also already seen a reduction in spending power of 40.8% per capita over this period. Going forward this will likely continue to increase unless the government reforms funding for local authorities.

Policy Recommendations

Based on the findings in this report, the following policy recommendations are suggested:

| Single Pot Funding | This would create a reliable and consistent source of income for the BCC. It could also reduce competition between local authorities, who instead may be more willing to work in partnership on interventions. Costs associated with having to bid for competitive funding pots would also decline. |

| Devolution of the control of council tax to local authorities | This would allow local authorities to re-assess the value of properties and be able to change council tax on properties, which reflects the actual levels of wealth today. This may also help local authorities address inequalities within their local authorities. |

| A review of the effectiveness of the current Business Rates system | Business rates are becoming increasingly outdated as more of the UK economy increasingly moves online. The business rates system needs to be reviewed to understand whether it is truly the most effective way to collect tax from businesses. |

| A Corporate function | This would help to facilitate more income into the city whether it is through the existing bidding process or through the shared prosperity fund. We would suggest, in the West Midlands that this function is controlled by the West Midlands Combined Authority (WMCA), with the various LAs acting as delivery agencies. This collective engagement would not only ensure increased investment but improve regional collaboration and coordination. |

Policy Context Update

In recent weeks there have been significant economic and policy developments, which will exacerbate the issues highlighted in this report. BCC will be set to now face the following additional budgetary pressures, which will impact budget income and spending over the next few years:

| Inflation | Inflation has already cost BCC tens of millions of pounds over the decade. However, this year councils such as BCC will face inflationary budgetary pressures, likely not seen since the 1970s. This will constrain spending even further, as the cost of funding services increases. It will likely also drain emergency reserves for many councils across the country. |

| Austerity 2.0 | Since the ‘mini budget’ left a £40 billion hole in government finances, it looks like the UK is set to face a second austerity period. Local authorities are expected to face further cuts to their already diminished budgets. Further information on how these cuts will be distributed is expected in the coming months, and ministers have already said that local authorities will be expected to further tighten their belts. |

| Business Rates | New business rates are set to be used from April 2023. Whilst this will make business rates more representative of the current market, it will also likely mean a reduction in income from this funding stream. Properties were last valued in 2017 based on 2015 property values, when property rates were higher than they currently are, following the impact of the pandemic. Therefore, councils will also need to prepare for a fall in business rates, to match the current market of non-domestic properties. |

View our new report “Insights into Birmingham City Council’s Spending Power, Revenue Funding and Spending between 2010-11 and 2019-2020“.

This blog was written by Alice Pugh, Policy and Data Analyst and Abigail Taylor, Research Fellow, at City-REDI / WMREDI, University of Birmingham.

Disclaimer:

The views expressed in this analysis post are those of the authors and not necessarily those of City-REDI / WMREDI or the University of Birmingham.