The International Labour Organisation (ILO) estimates that COVID-19 will have far-reaching impacts on world labour market outcomes. The virus and the subsequent economic shocks will impact the world of work across three key dimensions:

The International Labour Organisation (ILO) estimates that COVID-19 will have far-reaching impacts on world labour market outcomes. The virus and the subsequent economic shocks will impact the world of work across three key dimensions:

- The number of jobs (both unemployment and underemployment)

- The quality of work (e.g. wages and access to social protection)

- Effects on specific groups who are more vulnerable to adverse labour markets.

In these difficult circumstances, many countries in the world are finding ways to support their workers and companies with the aim of reducing unemployment and improving business resilience in response to the COVID-19 outbreak.

Many British companies have been forced to stop working and have had to lay off or temporarily suspend their employees. It is estimated that thousands of British companies will not be able to cope with this pandemic and will have to close for good. The impact of the lockdown is uneven across sectors and worker sub-groups – as discussed in an IFS report published this week and discussed elsewhere in this report.

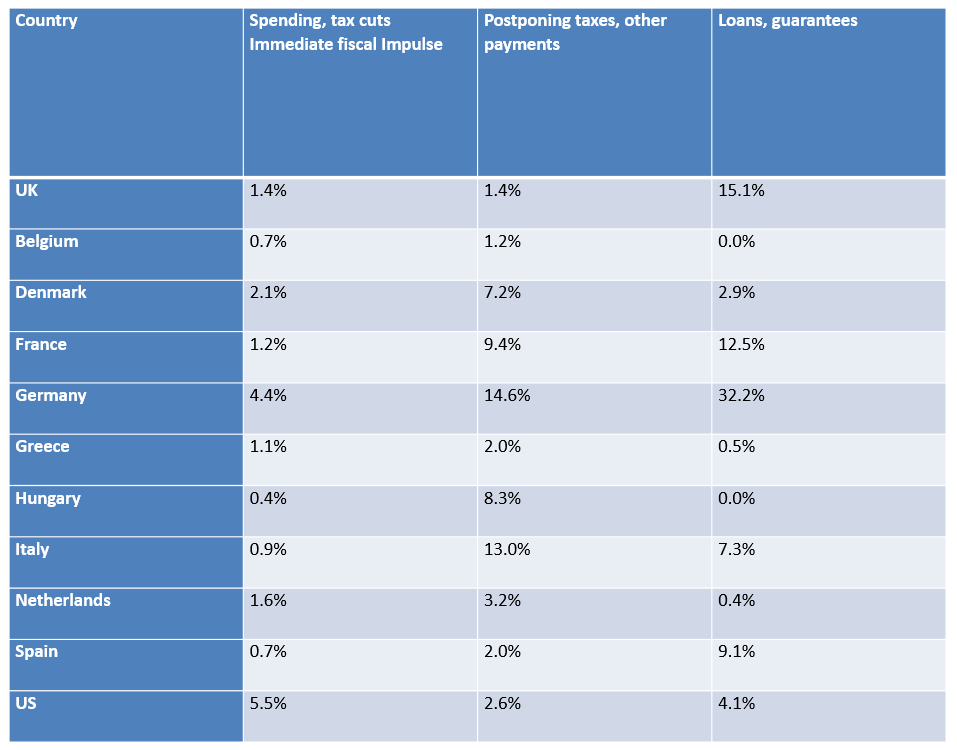

Many countries in the world are creating measures to support their economies. Table 1 shows 2020 fiscal measures adopted in response to Coronavirus by 26 March 2020 as a percentage of 2019 GDP.

Table 1. Coronavirus Stimulus Overview. Discretionary 2020 fiscal measures adopted in response to coronavirus by March 26 2020, as a percentage of 2019 as GDP

In the UK, in order to support these workers from being laid off, several measures have put in place by the government. These measures are aimed at supporting the effect that COVID-19 may have had in companies and workers due to the lockdown, the interruption of the value chain and the reduction of personnel affected by the virus.

To support all UK employers, the Coronavirus Job Retention Scheme will continue paying part of the employees’ salary for those employees that would otherwise have been laid off during the crisis. These payments will be backdated to 1 March and initially will be open for three months, to be extended if necessary. The UK government will pay the associated Employer National Insurance contribution and minimum automatic pension contributions of a subsidised wage up to 80% of a worker’s wage, up to a total of £2,500 per worker each month.

Other measures that apply to all firms are to reclaim up to two weeks of Statutory Sick Pay (SSP) per eligible employee who has been off work as a result of COVID-19.

Firms with outstanding tax liabilities and financial distress may seek some support with their tax affairs through HMRC’s Time to Pay service. Businesses will have their VAT payments automatically deferred for three months and the ones affected by COVID-19 will have more flexibility in submitting their accounts to Companies House.

To support larger firms, the HM Treasury and the Bank of England will operate a new lending COVID Corporate Financing Facility (CCFF) to provide a quick and cost-effective way to raise working capital via the purchase of short-term debt. It will be a credit easing scheme unlimited in size targeted at addressing the disruption to cash flows of companies resulting from COVID-19. Eligibility is based on the firms’ credit ratings prior to the COVID-19 shock. Long-term viable large firms with an annual turnover between £45m and £500m, excluding a series of sectors such as banks and building societies, insurers, public sector organisations or trade unions, can benefit from the Coronavirus Large Business Interruption Loan Scheme which provides a government guarantee of 80% to enable banks to make loans of up to £25m.

To support small businesses, the UK government will provide additional funding for local authorities. A one-off grant of £10,000 to businesses currently eligible for small business rate relief (SBBR) or rural rate relief. Small and Medium Enterprises will be able to benefit from a Coronavirus Business Interruption Loan Scheme offering loans of up to £5 million in value for SMEs through the British Business Bank. Finally, the Bank of England has created the Term Funding Scheme with additional incentives for SMEs (TFSME) will offer four-year funding of at least 10% of participants’ stock of real economy lending at interest rates at or very close to Bank Rate.

To support the most affected sectors, all large and small businesses in the retail, hospitality and leisure sectors will pay no business rates in England for the tax year 2020/2021. This will apply to the next council tax bills issued in April 2020. Additionally, to support small businesses in these sectors the UK government will provide additional funding for local authorities to support small businesses that pay little or no business rates. A £25,000 grant for businesses operating from smaller premises with a rateable value between £15,000 and £51,000 or between £18,001 and £50,999 for Scottish businesses.

The self-employed or a member of a partnership that has lost trading profits due to COVID-19 will be able to benefit from the self-employed income support scheme, a cash grant scheme worth 80% of their average monthly trading profit over the last three years.

Other business support measures covering Mortgage Holidays or Insurance can also be of benefit for different types of businesses and workers in the UK.

In Europe, several measures have been put in place at different governmental levels: European, member states, regional and local. These measures have the aim to generate short-term support on the liquidity of the COVID-19 outbreak and long-term support to increase the resilience of places.

At the European scale, the European Commission has set up an EU Temporary Framework under the EU State aid rules. The Temporary Framework of business support measures covers direct grants, selective tax advantages and advance payments, state guarantees for loans taken by companies from banks, subsidised public loans to companies, safeguards for banks that channel State aid to the real economy and short-term export credit insurance. These measures aim to cover all the fabric of businesses in Europe covering entrepreneurs, micro, SMEs and large companies.

At the European scale, the European Commission has set up an EU Temporary Framework under the EU State aid rules. The Temporary Framework of business support measures covers direct grants, selective tax advantages and advance payments, state guarantees for loans taken by companies from banks, subsidised public loans to companies, safeguards for banks that channel State aid to the real economy and short-term export credit insurance. These measures aim to cover all the fabric of businesses in Europe covering entrepreneurs, micro, SMEs and large companies.

Also at the European scale as well, the European finance and economy ministers plan to approve a new package of measures to alleviate the economic impact of the coronavirus, which, at the moment, excludes the option of issuing the “corona bonds” that nine EU countries have demanded. The Eurogroup has created a three pillars plan: the opening of a credit line from the European Stability Mechanism – the eurozone rescue fund – specific to the pandemic, the mobilization of 200 billion euros in investments by the European Investment Bank and the creation of a European fund against unemployment with 100 billion available for loans.

Insights from Spain and Ireland

The Spanish government has set up two State guarantee schemes for companies affected by the Coronavirus outbreak on new loans and refinancing operations taken by companies from banks. These measures are in line with the conditions set out in the EU Temporary Framework under the EU State aid rules. The schemes have a total budget of approximately €20 billion. They limit the risk taken by the State to a maximum of 80% for self-employed workers and SMEs and 70% for larger companies. The guarantee measures aimed at limiting the risks associated with issuing operating loans to companies that are severely affected by the economic impact of the coronavirus outbreak. The objective is to ensure that these companies have the liquidity to help them safeguard jobs and continue their activities faced with the difficult situation caused by the coronavirus outbreak.

As in the UK, Spain has also implemented a tax moratorium for VAT, SME corporation tax and social security payments. The Spanish government has also put in place a series of measures for the most affected sectors. Businesses belonging to the tourism sector including transport, hotels or travel agencies, will be granted with an increase in the line of financing. All companies with workers with temporary contracts within the tourism, commerce and hospitality sectors will have a 50% discount for five consecutive months on Social Security contributions for common contingencies, joint collection of monies related to unemployment and vocational training. Other additional measures have been implemented by the private sector and the regional and local municipalities.

Enterprise Ireland has published a checklist guide to assist affected Irish businesses in transitioning through the immediate and critical challenges that COVID-19 pandemic presents and to outline the latest support available from the Irish government due to COVID-19 pandemic. Among the measures adopted by the Irish government, a €200m package for eligible businesses impacted by COVID-19 – The Strategic Banking Corporation of Ireland SBCI working capital scheme with loans at a maximum interest rate of 4% from 1 year to 3 years between €25,000 to €1.5m per eligible enterprise or the Microfinance Ireland loan scheme for microenterprises currently trading.

An income support payment for employees who have been temporarily placed on a shorter working week will be covered by the Short-Time Work Support or the Temporary Wage Subsidy schemes intended to support employers during periods of temporary difficulty. Other examples of COVID-19 support by the Irish Government are the non-financial schemes – e.g. the COVID-19 Act on Support that helps companies to decide on specific actions over a short period to address some of the risk and opportunities of COVID-19 focusing on three areas of capability: financial management, strategic sourcing and transport and logistics.

Sources

Bruegel (2020), The fiscal response to the economic fallout from the coronavirus.

Euronews (2020), What are corona bonds and how can they help revive the EU’s economy?

IFS (2020), Sector shutdowns during the Coronavirus Crisis

UK Government (2020), Business rates: expanded retail discount – guidance

Scottish Government (2020), Business Support Fund Opens

This blog was written by Professor Raquel Ortega-Argiles, Chair, Regional Economic Development, City-REDI / WM REDI, University of Birmingham

Disclaimer:

The views expressed in this analysis post are those of the authors and not necessarily those of City-REDI / WM REDI or the University of Birmingham

To sign up for our blog mailing list, please click here.