Alice Pugh looks at the potential impact of the removal of the energy price cap for households in the West Midlands.

The removal of the energy price cap from April 2023 will have a massive impact on energy bills for households within the WMCA area. The West Midlands region has the largest number of fuel-poor households within England, at 17.8%.

Current Cap

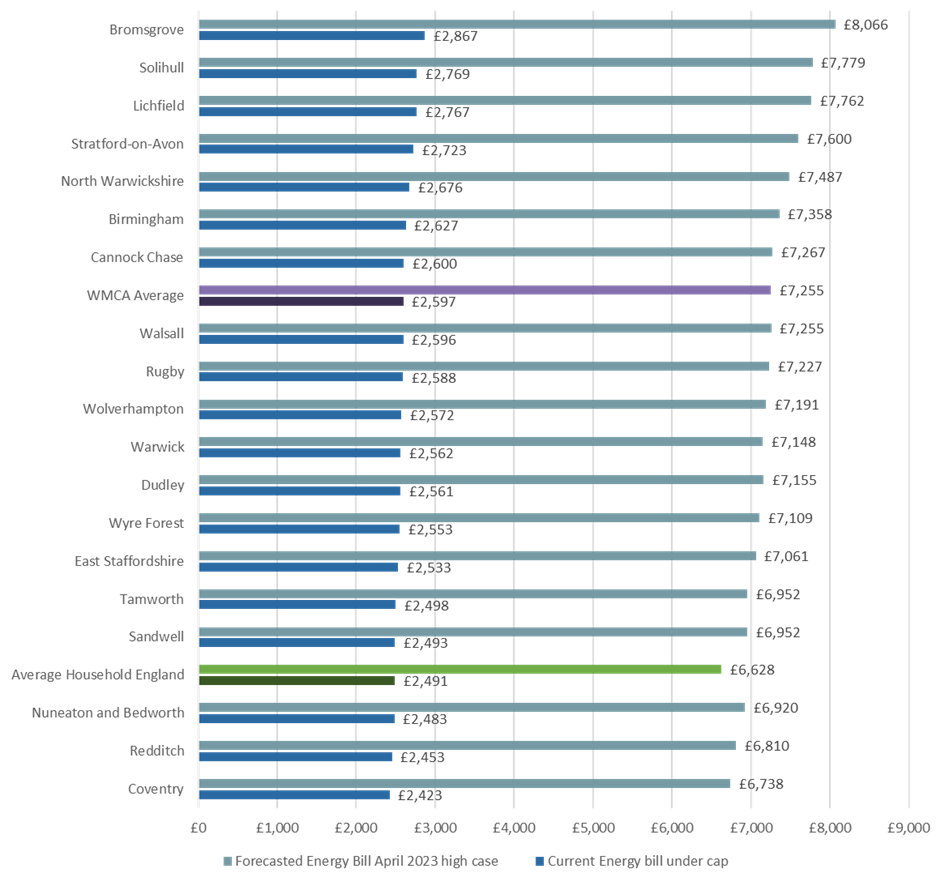

The current cap on electricity prices for the Midlands is around 32.121p per/kwh and for gas, it is 9.842p per/kwh. Currently, the UK average for cap on electricity usage is 34p per/kwh and 10.3p per/kwh for gas according to OFGEM[1]. Including the standard charge, under the current price cap the average UK household pays around £2,491 per year on energy bills, based on the average gas usage of 12,000kwh per meter and electricity usage of 2,900kwh per meter. In the WMCA the average household under the current cap for regional prices pays around £2,597 per year, based on an average gas usage across the region of 12,455 per/kwh per meter and electricity an average electricity usage of 3,430 per/kwh per meter[2].

Energy Bills under the current price cap by Local Authority

[1] These calculations are based on direct debit payments; rates will vary by payment method as well as region and meter type.

[2] 2019 consumption was used for this analysis, as it was thought the average 2020 (latest update) usage would be unusually high for domestic dwellings, due to lockdowns during the pandemic period. Figures energy usage estimates are from ONS Sub-national electricity consumption statistics from 2005 to 2020 and Sub-national gas consumption statistics from 2005 to 2020.

Average usage varies across the region by local authority. In Bromsgrove, for instance, average gas usage is 13,941kwh per meter with 3,816kwh per meter for electricity usage, leading to the average household in Bromsgrove paying around £2,867 on their average annual energy bill. In contrast, the average usage for Coventry is much lower at an average gas usage of 11,773kwh per meter and electricity usage of 3,096kwh per meter – therefore the average bill in the region is currently around £2,423.

High Case

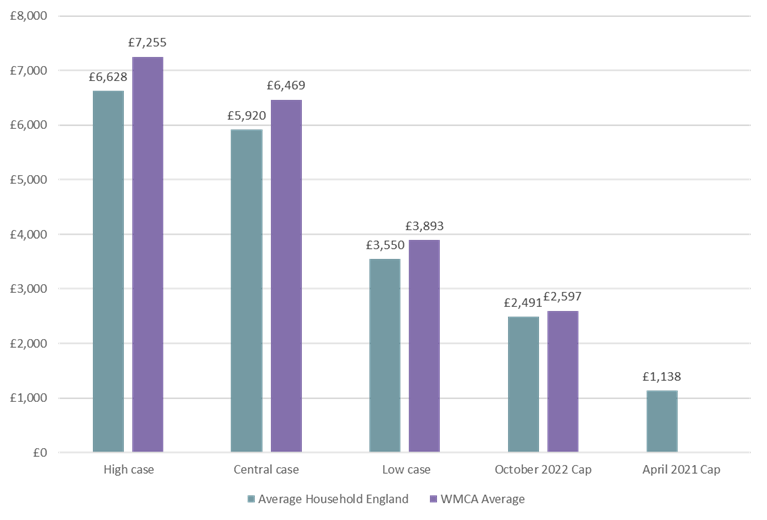

Cornwall Insight forecasts that by April 2023 the average price for gas could rise to 30.8p per/kwh in April and 91.8p per/kwh for electricity. Taking this as the high case, this would raise the average annual household energy bill in England to £6,628, based on the retention of the same household usage and current standing charges[1], as seen in the figure below. This would be a 166% increase in energy bills compared to under the cap, and a 482% increase on the £1,138 price cap in April 2021. The average annual household energy bill for the WMCA will be £7,255 based on current usage and standing charges. This is a 179% increase in the average annual bill compared to under the price cap and a 538% increase from on the England average £1,138 price cap in April 2021. A large part of the reason that there is expected to be a greater increase in the energy bill for the WMCA is due to higher electricity use, which is more expensive per/kwh than gas, with electricity expected to be 61p per/kwh more expensive than gas. On average electricity usage in the WMCA is 18.3% higher than the England average and gas usage is only around 3.8% higher than the England average.

[1] It is likely that the current standing charge will increase, but there is uncertainty around the change in the rate, so the current rate was retained.

Energy bills in the High Case comparative to energy bills under the current cap

Comparison across different cases

However, this is at the top end of the forecast. Comparisons of different price increases can be seen below in the figure below. Different forecasted capped unit prices from Cornwall Insight were applied to compare potential price increases. These were the unit prices under the 3 cases:

- High Case: Cornwall Insight predict April prices could be as high as 91.8p per/kwh for electricity and 30.8p per/kwh for gas, these figures were used to forecast the high case.

- Central Case: Cornwall Insight has forecasted the October 2023 prices will be around 79.8p kwh/per for electricity and 27.8p per/kwh for gas.

- Low Case: Current Autumn 2022 energy prices without the cap, Cornwall Insight have forecasted would be around 51.9p per/kwh for electricity and 14.8p per/kwh for gas, this was used as the low case.

Comparison of Energy bills by high, central, and low cases, WMCA vs England Average

The current average yearly earnings for the WMCA area is £29,737 annually, the average WMCA energy bill under the cap is £2,597; this is equivalent to 8.7% of current earnings. If the cap is removed in April 2023, and energy bills increase to the low case of £3,893, this would be equivalent to 13.1% of annual earnings. The central case of £6,469, then energy bills as a proportion of earnings would be equivalent to 21.8% and in the high case of £7,225, it would be equivalent to 24.4% of earnings. The average England cap was £1,138 in April 2021; this was equivalent to 3.8% of earnings.

If energy bills reached the high case this would devastate many households in the region, especially given almost 1 in 5 are already fuel-poor. There is a serious question as to how households will realistically afford this. Whilst there is expected to be targeted support from April to help those most in need, marked rises in energy bills will likely leave even middle-income households struggling from April.

It should also be noted that the price per kwh for both electricity and gas is expected to decrease from July; however, the extent of the decrease will largely depend on the conflict in Ukraine. If Russia continues with its invasion, then sanctions will remain in place and gas and electricity prices will remain high, as energy prices are set against the global market prices. The government faces limited options on interventions that can be implemented, given global energy prices and the fact that investment in new energy supplies will be too long-term to have an immediate impact. A further extension of the energy price guarantee (cap) would be expensive. This will leave the government with little room to manoeuvre in the coming months.

This blog was written by Alice Pugh, Policy and Data Analyst for City REDI / WMREDI, University of Birmingham.

Disclaimer:

The views expressed in this analysis post are those of the authors and not necessarily those of City-REDI or the University of Birmingham.