Wednesday 15th March 2023 was Budget Day. Jeremy Hunt delivered his first spring budget, and first major economic policy reveals since the revoking of policies outlined in Liz Truss’ mini-budget in September 2022. Alice Pugh and Hannes Read take a look at some of the key announcements from the budget.

OBR Forecasts for the economy

As the OBR has pointed out we will narrowly avoid entering a technical recession this year, but the economy will still shrink (-0.2% GDP), however, we are not totally out of the woods yet. High-interest rates, gas prices remaining double what they were before the pandemic, stagnation of business investment since 2016, rising labour market inactivity and lowering productivity since the financial crisis, are all going to weigh down on growth.

Inflation is now likely to fall further than forecast in the Autumn Budget to 2.9% by the end of the year. Falling inflation is partly a result of wholesale gas prices rapidly reducing, with annual energy prices for the average household expected to fall below £2,200 by the end of the year.

Real disposable household incomes will fall by a cumulative 5.7% over the next 2 financial years. Which whilst lower than previously forecasted is still the largest fall since records began in the 1950s.

Overall, the OBR figures are indeed more positive than the November forecasts, however, they are only marginally better. The economy will still contract this year, though it won’t enter a technical recession and inflation will reduce on its own without any real government intervention. Over the medium-term households will become poorer and by 2027-28 your money will be worth less than it was before the pandemic. The UK is plagued by some serious structural issues which will place significant downward pressure on economic growth going forward if not actively tackled by the government.

Key Announcements

Below sets out the key announcements made by the Chancellor within the monitor to tackle the ongoing economic turmoil in the UK:

Taxation and wages

- The cap on the amount workers can accumulate in pensions savings over their lifetime before having to pay extra tax (currently £1.07m) to be abolished

- Tax-free yearly allowance for pension pot to rise from £40,000 to £60,000

- Fuel Duty will remain frozen, with the 5p cut remaining for a further year

- Alcohol taxes are to rise in line with inflation from August, but there will be reliefs for pubs on beer, cider and wine

- Taxes on tobacco will increase 2% above inflation, rising to 6% above inflation for hand-rolling tobacco

Energy

- Energy Price Guarantee limiting the average household energy bill to £2,500 a year to be extended until the end of June

- £200m to bring prepayment meter energy charges into line with prices for consumers paying via direct debits

- Commitment to invest £1bn per year for the next two decades on low-carbon energy projects

- Nuclear energy to be reclassified as environmentally stable for investment purposes

- £63m to help leisure centres with rising energy costs for heating pools and investment in energy efficiencies

Jobs and Work

- 30 hours of free childcare for working parents in England expanded to cover children from aged nine months to four years old by September 2025

- Families on universal credit will receive childcare support up front instead of in arrears, with the per child cap raised to £941 from £646 per month

- £600 “incentive payments” for those becoming childminders, and relaxed rules in England to let childminders look after more children

- New fitness-to-work testing regime to qualify for health-related benefits

- Funding for up to 50,000 places on a new voluntary employment scheme for disabled people, called Universal Support

- Tougher requirements to look for work and increased job support for lead child carers on universal credit

- More places on “skills boot camps” to encourage the over-50s who have left their jobs to return to the workplace

- Immigration rules to be relaxed for five roles in the construction sector, to ease labour shortages

Business and Trade

- The main rate of corporation tax, paid by businesses on taxable profits over £250,000, is confirmed to increase from 19% to 25%

- Companies with profits between £50,000 and £250,000 to pay between 19% and 25%

- Companies able to deduct investment in new machinery and technology to lower their taxable profits

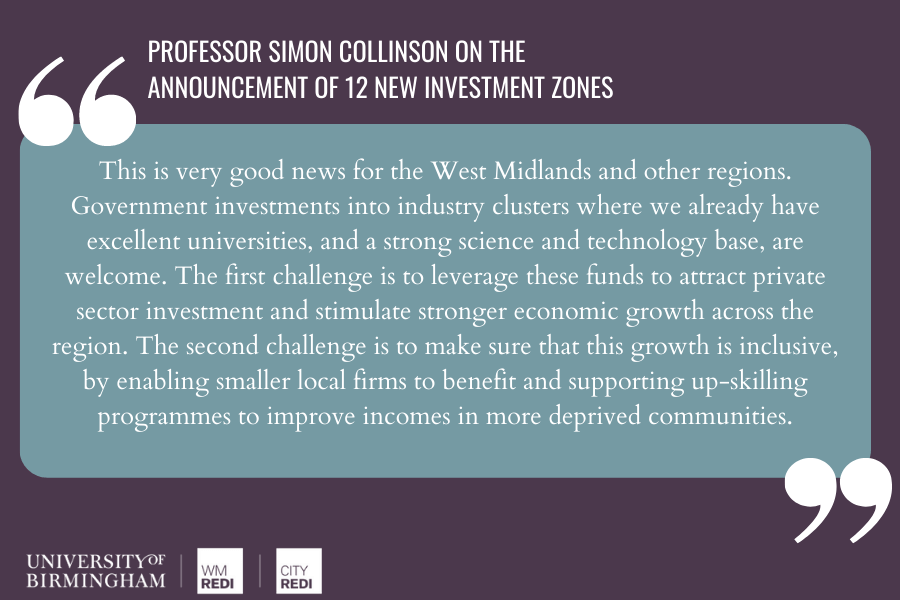

- Tax breaks and other benefits for 12 new Investment Zones across the UK, funded by £80m each over the next five years

Energy Price Guarantee

Much to the relief of many households there will be no increase in the energy price guarantee cap. Originally the cap for the average household was expected to increase to £3,000 from £2,500, now it will be remaining at the £2,500 level, for the next 3 months. After this, the OBR has forecasted wholesale prices will continue to fall which means the average household will pay below the current cap from July, so it is expected the cap will either be removed from September or lowered.

Childcare

The announcement was dubbed a ‘back to work’ budget. One of the most significant announcements was the changes to childcare, with one- and two-year-olds becoming eligible for 30 hours of free childcare per week. Previously, the allowance was available for three- and four-year olds but this has now been expanded. The childcare changes have come amidst a backdrop of the core hourly funding rate provided by the government falling by 14% in real terms since the high point of 2017/18. The announcement of the funding is an important step, but the take-up and implementation is another. With only 20% of eligible families taking up the support in 2021, work is needed to break down barriers to increase take-up and the effectiveness of the policy. One such change is the ability for Universal Credit recipients to claim the funding in advance rather than arrears, which is intended to remove a barrier to entry for working families claiming the support.

Whilst some of these measures are welcome such as the changes to childcare allowances, which should help some parents restricted by childcare become more economically active. However, there are some serious concerns as to how this will work. The IFS outlined that whilst this reform will leave Whitehall in charge of the price of 80% of all preschool childcare in England (up from just under 50% now), it is entirely dependent on its implementation. If the government fails to get the funding rate right, I could worsen the childcare market: price the funding rate too low and providers could opt out of delivering the new entitlement or even exit the market entirely, reducing supply and thus increasing costs. However, it should be noted that there is a delay to this policy of 2 and a half years, so don’t get too excited about this policy yet, by then the government might have been voted out and be the shadow government.

There is also the ‘wraparound childcare pathfinder scheme’ which is aimed at parents of primary school-aged children. The scheme will provide funding of £289 million to schools and local authorities to provide wraparound childcare from 8am to 6pm, enabling parents to work longer hours. Again, this policy will only start from the next financial year. Plus, I cannot imagine many teachers will be too happy to see this additional workload given that is part of the reason they were striking today and especially given the fact no pay rise was offered to teachers today.

Pensions

Changes to pensions were also announced. The total amount that workers can accumulate in their pension savings before paying extra tax is to be increased. People are expected to be able to save up to £1.8m over a lifetime, up from £1.07m currently. This is intended to encourage high earners in the 50-64 age group to continue working rather than taking early retirement, as the post-pandemic trends have seen an increasing number of early retirees. However early analysis from the Resolution Foundation indicates this is an expensively targeted policy for already wealthy people, where only 10,000 of the richest people are able to save above this amount costing £835m per year.

Business Investment

From April, and for the next three years, businesses will be able to deduct 100% of all plant and machinery investment spending immediately when calculating taxable profits. This increased generosity of capital allowances will boost business investment in the short run, as reported by the IFS. However, as the IFS pointed out there are significant concerns around the short-termism of the policy and without long-term certainty, the timing of investments will be distorted and the overall boost to investment lower than expected.

Investment Zones

12 investment zones are set to be created across the UK boosting growth and supporting links between universities and businesses in five priority sectors. The investment zones will have the opportunity to choose from £80 million of funding for skills, business support and infrastructure, or £35 million in funding and a set of tax reliefs that the government estimates will cost £45 million over five years. The reliefs include full relief from stamp duty land tax on property sales of commercial property, business rates on new or extended properties and enhanced capital allowances. However, the success of such zones can be ‘iffy’ generally they do boost investment in the areas, research has found that the investment would have happened anyway, just not necessarily in those areas before they were made into investment zones. So, there is an issue of creating winners and losers with such policies.

However, one topic that was not mentioned as much as others, was public spending. Despite unresolved issues with public sector pay and with tight spending plans for after the next spending review, there was relatively little mention of how these would be resolved, potentially leading to a further dispute in the near future.

This blog was written by Alice Pugh and Hannes Read, Policy and Data Analysts for City REDI and WM REDI.

Disclaimer:

The views expressed in this analysis post are those of the authors and not necessarily those of City-REDI or the University of Birmingham.