The latest edition of REDI-Updates is out now - providing expert data insights and clear policy guidance. In this edition, the WMREDI team investigates what factors are contributing to the cost-of-living crisis and the impact it is having on households, businesses, public services and the third sector. We also look at how the crisis in the UK compares internationally. Alice Pugh looks at how businesses are managing and changing their business operations to deal with rising input costs and falling consumer demand. View REDI-Updates.

Introduction

As stated in the previous chapter, UK businesses have suffered intensely in the cost-of-living crisis. Businesses have been facing rapidly rising input costs whether it be rising energy costs; fuel costs; rising wages; labour shortages; supply shortages increasing the costs of materials; and increased trading barriers with the EU rising import/export costs. Consumer demand has also fallen. Businesses are being squeezed on many sides with Small and Medium Enterprises (SMEs) suffering the most.

SMEs

There have been many consequences of rising costs on businesses, on average, 80% of SMEs have reported higher costs, with operating costs on average having increased by 18% (Santander, 2023). Tide found that 24.1% of SMEs that they surveyed were considering bringing them a close, due to the cost-of-living crisis, finding that this equated to an estimated 1.4m businesses (Tide, 2022). Researchers at the London School of Economics (LSE) found that around a quarter of SMEs anticipate their business won’t last the next few months, with rising costs being the main reason for the closure.

If a quarter of SMEs were to collapse in the West Midlands Combined Authority (WMCA), this would mean a loss of 23,244 firms in the region. However, there will likely be higher business losses in some sectors than in others. For instance, manufacturing, hospitality, transport and construction, have all been heavily impacted by rising input costs, whether that be energy, fuel or supply shortages, these are 4 of the largest sectors within the WMCA as seen in Figure 1 chapter 4. SMEs in the region are currently highly vulnerable, especially those with high energy costs given the support that was extended to them to reduce energy costs, has been removed, now again paying the market rate for energy.

| British Chambers of Commerce (2023) found 52% of businesses would be increasing prices due to rising costs, a rise from the previous quarter. |

| JPMorgan (2023) found in their business leaders survey that 48% are increasing prices when adapting to inflation. |

| Lloyds (2023) also made similar findings with 59% of businesses forecasting they would be rising prices. |

| NFIB (2023) found that 50% of SMEs had raised prices to help mitigate rising costs. |

This is concerning as these surveys were conducted in quarter one of this financial year, this means that any price rises that SMEs have implemented may not have filtered through to inflation figures yet. Prices, therefore, have not yet finished increasing. In the latest inflation update for March, CPI was 10.4%, given energy support finished in March, SMEs may have since increased prices in April passing on the increase in energy prices to consumers.

The changing use of finances

Many SMEs are having to change how they utilise their finances, to deal with the cost-of-living crisis. A survey by Santander found that 41% of SMEs are having to dip into company savings; 29% are having to borrow money; 28% are dipping into personal savings; 23% of SMEs are running out of funds at the end of each month (Santander, 2023).

However, UK Finance (2023) found that falling demand and rising interest rates are dampening borrowing by SMEs, as it becomes more expensive to invest, with low returns due to falling demand. Whilst gross lending is reducing, in 2022 there was a 22% increase in overdraft applications than in the previous year (UK Finance, 2023). This is probably caused by the need to manage cost pressures, particularly energy bills, with it being found that from April 30% of SMEs will be at risk of being unable to afford their energy costs (Experian, 2023). The sectors which have seen the largest decline in lending have been the real estate sector and construction sector. This is due to falling demand driven by increasing interest rates. which makes borrowing money to buy a house or do construction work, more expensive.

Staffing

29% of business leaders surveyed by Boston Consulting Group (2023), had increased remote working in order to help deal with labour shortages. Tide (2023) found that in their survey that 12% of business owners were also being forced to reduce contractor hours and 10% had to lay off staff. Across the wider West Midlands, roughly 999,000 people are employed within SMEs, if all SMEs in the region were to reduce their staffing numbers by 10% this would be a loss of 99,900 jobs. Whilst this is unlikely it is a reality that businesses are reducing opening hours and therefore, the time that staff members can work. As a result, SMEs may start to see employees leaving to join businesses which can provide sufficient hours for them to be able to support their families. Particularly for staff who are paid by the hour.

Supply and Suppliers

Santander (2023) found that when trying to reduce costs, 29% of businesses were holding tougher negotiations with suppliers. JPMorgan (2023) found that 37% were making changes to purchasing and 32% were stockpiling supply and then updating their pricing models.

SME Business owners

Santander found that the most common adaptations made by business owners in response to the cost-of-living crisis have been, 31% taking home less pay; 28% reducing marketing budget; 27% working unpaid hours; 27% switching to cheaper energy suppliers; 25% delaying new IT equipment purchases (Santander, 2023). Tide also found that 71% of SME business owners were also increasing their own hours; 35% were relying on family and friends for support and 28% had taken on an additional job elsewhere.

Santander found owners have had to make decisions which they would usually be uncomfortable with including, 23% trialling different opening hours; 22% paying to promote their business on local social media groups; 21% using ‘buy now, pay later’ to purchase business supplies (Santander, 2023).

Business Investment

The weaker outlook for profits and a marked fall in business confidence underpins a planned slowdown in capital investment growth. The latest survey results show a 3.2% annual rise in spending on capital assets over the past 12 months, but only a 1.5% increase planned in the 12 months ahead. Except for the sharp contractions during the pandemic, this would be the slowest rise in capital investment in over a decade (ICAEW, 2023).

Business investment is defined by the Office for National Statistics as investment made by a company in its transport, information and communication technology (ICT) and other machinery and equipment, other buildings and structures, and intellectual property products (ONS, 2019). The Office for Budget Responsibility (OBR) noted in November 2022 that business investment in the second quarter of 2022 was still 8% below its pre-pandemic peak, and it forecast “much weaker” business investment in the coming years than it had forecast in March 2022. The OBR also anticipated that by the end of 2024, business investment would be 12% lower than it had forecast in March 2022 (House of Commons, 2023).

The same can also be said of R&D budgets. After rising by 2.2% in the latest survey period, growth is set to slow to just 1.4%, which would mark the weakest rise in over 10 years. These plans for both capital spending and R&D budgets are concerning, particularly given their importance to future productivity gains and, thus, competitiveness in global markets. This has become more crucial for businesses as they deal with record-high input price inflation and challenges in the post-Brexit trading environment (ICAEW, 2023).

Insolvencies

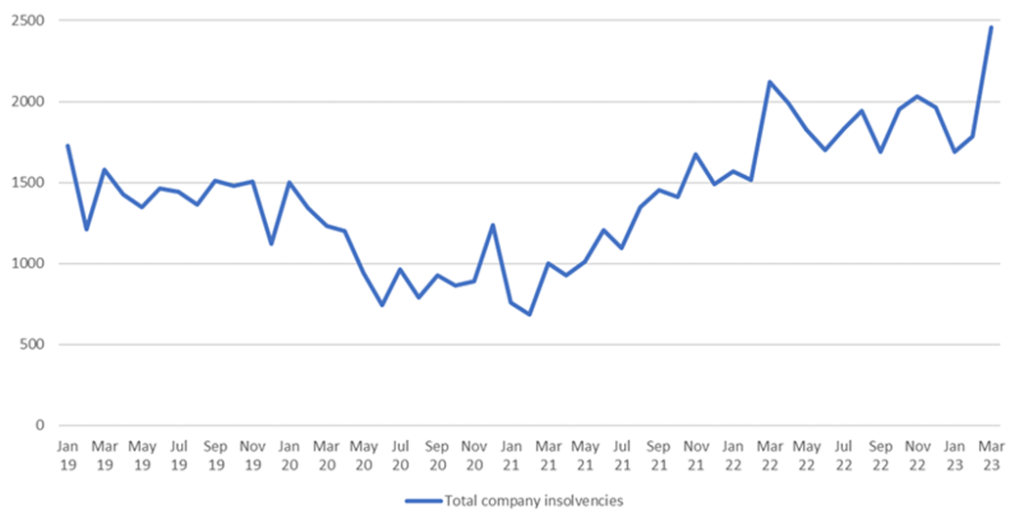

Figure 1: Total company insolvencies UK

March 2023 saw the highest number of company insolvencies since ONS started collating the data from January 2019, as seen in the figure below. There were 2,457 company insolvencies in March 2023 16% higher than in March 2022, when there were 2,120. With March 2023 seeing more than double the number of insolvencies in March 2019. As can be seen in the graph above insolvencies have been creeping up since March 2021, accelerating upwards from the beginning of January and remaining high.

However, whilst these figures are negative, firms were receiving energy support from October 2022 to March 2023. Since the end of March 2023, energy support for most businesses was removed and only high energy-intensive firms are still receiving some form of support. In April therefore, there will likely be an increase in insolvencies, as businesses are hit by higher energy bills, especially given inflation on materials still remains high.

Summary

Overall, SMEs are currently very vulnerable to price rises and it is severely impacting how they manage their business operations. Many SMEs are having to change how they fund and manage their businesses. Many businesses choose to reduce investment, whilst consumer confidence falls, and the cost of borrowing remains high with interest rates rising. Business owners are also being forced to pass the cost of price rises onto consumers, given the loss of business energy support in April, these prices may continue as business costs continue to rise.

Some businesses are already being pushed into insolvency, with a 16% increase in insolvencies between March 2022 and March 2023. With the potential for this to worsen as businesses lose their energy support and interest rates continue to climb. If a greater number of businesses do start to fail in the current high-risk economic cycle it could also lead to rising unemployment, which would further worsen consumer confidence feeding the economic downturn.

View and download the full REDI Updates report.

This blog was written by Alice Pugh, Policy and Data Analyst for City REDI and WMREDI.

Disclaimer:

The views expressed in this analysis post are those of the authors and not necessarily those of City-REDI or the University of Birmingham.