Darja Reuschke looks at the impact the pandemic had on self-employment in Birmingham and the West Midlands. This article was written for the Birmingham Economic Review 2023. The review is produced by City-REDI / WMREDI, the University of Birmingham and the Greater Birmingham Chambers of Commerce. It is an in-depth exploration of the economy of England’s second city and a high-quality resource for informing research, policy and investment decisions.

The pandemic had a large adverse impact on self-employment in the UK, reflecting restrictions on trading, reduced revenues, cashflow difficulties, and other uncertainties faced by many micro businesses.

Across the UK, self-employment fell from 4,971,000 workers in the first quarter of 2020 to 4,393,000 in the first quarter of 2023, a decline of 578,000 individuals in contrast to an increase of 607,000 among employees (ONS, 2023).

Changes in local labour markets over this period can thus only be understood with explicit reference to self-employment.

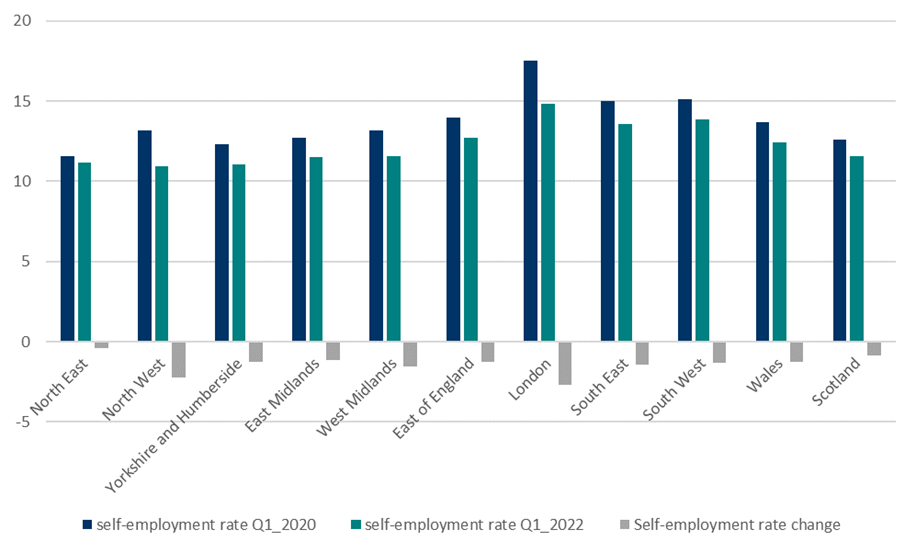

Self-employment shrunk across all regions in England, and also in the devolved nations, in absolute and relative terms. The West Midlands has seen one of the greatest reductions in the self-employment rate (the proportion of workers who are self-employed). Between the 12 months up to March 2020 (the period before pandemic lockdowns) and the 12 months up to March 2022 (a period when lockdown laws were phased out and finally came to an end), the self-employment rate dropped in the West Midlands from 13.2% to 11.6% (figure below). The fall of the regional self-employment rate in England was only higher in London and the North West.

Self-employment rate change, 12 months up to March 2020 to 12 months up to March 2022

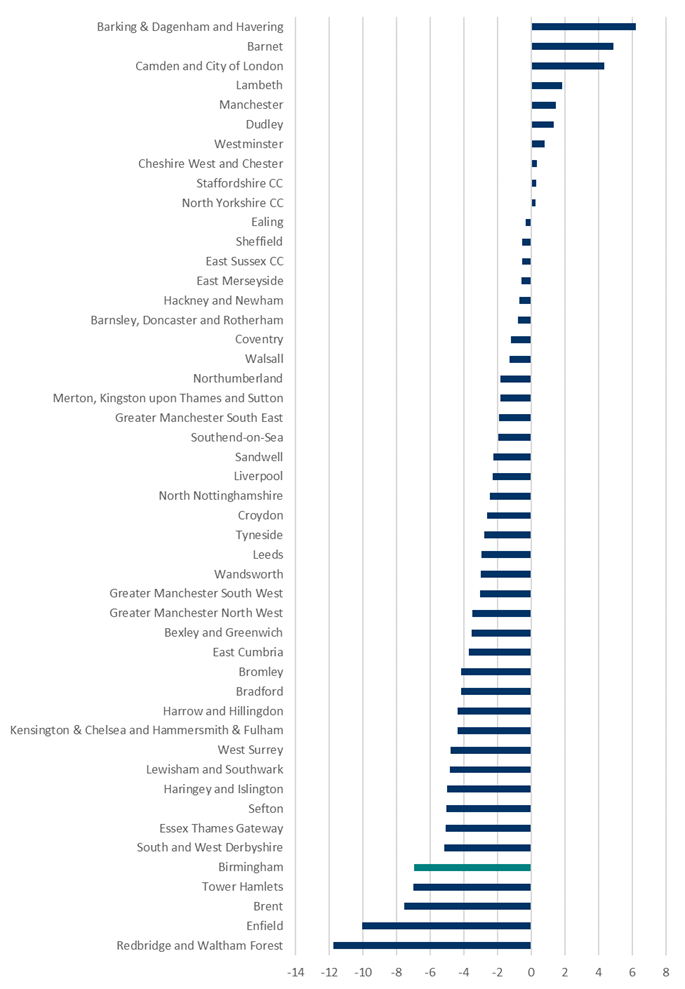

When further considering self-employment in major conurbations in England (at NUTS3 area level), Birmingham clearly stands out (figure below). Before the pandemic outbreak, between April 2019 and March 2020, Birmingham’s self-employment rate was at 15.4% which was marginally above the average self-employment rate of major conurbations in England of 15.2%.

Across major conurbations in England, the self-employment rate fell on average to 12.9% between April 2021 to March 2022 as a direct consequence of the COVID-19 pandemic. However, in Birmingham, the self-employment rate dropped to 8.5% which is not only well below the average of major England conurbations but is also one of the greatest falls in local self-employment seen by major conurbations in England over this period. The fall in self-employment was only higher in some London boroughs.

Self-employment rate change in major English conurbations, NUTS3 areas

How can this exceptional fall in self-employment in Birmingham be explained and what does this mean for the labour market and future economic growth of the city?

On the positive side, Birmingham has seen over this period a strong increase in its employment rate by 6% while the unemployment rate sunk by -2.5%. The inactivity rate only marginally increased by 0.3% so the dramatic fall in the self-employment rate seems to relate to the increase in paid employment and overall employment growth (approx. 3,200 jobs including self-employed jobs) over this period. Birmingham is similar in this overall trend to other major urban conurbations although the scale of impact has been more extreme than elsewhere.

It appears then that the paid employment sector attracted many previously self-employed although the data do not allow further investigation of the kinds of jobs that the self-employed have taken up. It is also likely that Birmingham with its high proportion of ethnic minority groups, had more self-employed who were not eligible for the Self-Employment Income Support Scheme (SEIS) which was administered in a total of five tranches by the HMRC. The scheme itself was considered as similarly generous as the furlough scheme.

However, the first tranche of payment was made much later than the furlough scheme. Moreover, a numerically large group of the self-employed was excluded from income support. The scheme was designed for the more established self-employed with regular tax returns. The newly self-employed with no previous tax returns were not covered by the scheme. Both young individuals and those on lower incomes are less likely to have filed tax returns as required by the scheme. This will also disproportionately affect ethnic minorities.

It is important to understand whether the significant reduction in self-employment may mean a loss in entrepreneurial capacity in the city and lower economic growth and innovation potential in the future. Particularly for younger people, the pandemic may have made self-employment more unattractive compared to paid employment, specifically in the context of rising energy, food and housing costs. The longer-term effects of the radical change in the labour market in Birmingham need to be monitored.

Read the Birmingham Economic Review in full.

This blog was written by Darja Reuschke, Professor of Regional Economic Development, City-REDI / WMREDI, University of Birmingham.

Disclaimer:

The views expressed in this analysis post are those of the authors and not necessarily those of City-REDI / WMREDI or the University of Birmingham.