Alice Pugh looks at the impact of the Autumn Budget on households, businesses and public services. View Alice's previous blog on this topic - Key Announcements Autumn Statement 2023

Household Impact

The Institute for Fiscal Studies (IFS) has found that the changes to National Insurance Contributions (NICs) for employees and the self-employed, will only give back less than £1 for every £4 that has been taken away from households through changes to NICs and income tax since 2021. For example, for an employee on average full-time earnings (£35,000 per year), the cut in NICs offsets the freeze in income tax thresholds for their income in 2024-25. However, the freeze in income tax will cause fiscal drag to continue to eat away at incomes each year and by 2017-28 they will be paying £249 a year more in direct tax overall.

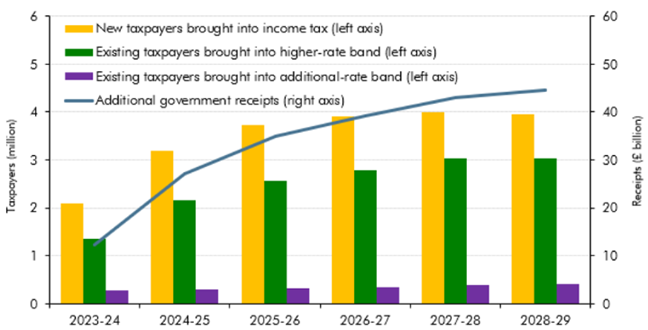

The graph below from the OBR demonstrates fiscal drag and the number of people being dragged into higher tax brackets. From 2021 income tax was and NICs thresholds were frozen, rather than raising them in line with inflation. This means as wages have increased, as they chase inflation, greater numbers of people are tipped into the tax system or higher rates of tax, this is a fiscal drag. The OBR anticipates that between 2022-23 and 2028-29, as a result of the freeze on thresholds nearly 4 million additional individuals will be expected to pay income tax, a further 3 million more will move into a higher tax bracket, and 400,000 more onto the additional rate. Representing an increase in the number of taxpayers in each band of income tax by 11% for the basic rate, 68% for the higher rate and 49% for the additional rate.

Figure 1: Effect of threshold freezes on additional taxpayers and tax receipts.

As a result, in reality, whilst the government rhetoric states that taxes are coming down, this isn’t true, as the tax burden on workers is increasing, due to the freeze of NICs and Income tax thresholds. Tax receipts will now make up 37.7% of GDP by 2028-29, this is largely a result of the freezes in thresholds to income tax and NICs.

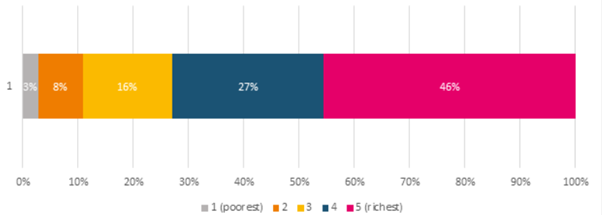

Furthermore, IPPR found that for every £100 that the Chancellor has spent on personal tax cuts, £46 will benefit the richest fifth of households. Only £3 of every £100 of tax cuts will go to the worst-off families, as can be seen in figure 2 below. The Resolution Foundation, also had similar findings, anticipating that 40% of the gains from tax and benefit measures announced, would go to the richest fifth of the population. With the top 20% gaining £1,000 on average, compared to £200 in gains seen by the bottom fifth.

Figure 2: Distribution of gains by equivalised income decile

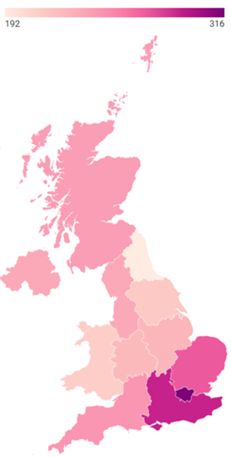

Figure 3: Average Annual Impact per working-age person by region (£)

Figure 3 above from IPPR, shows that the IPPR also found that the biggest gains from reductions in NICs would be felt in London and the South East, with an average annual gain of £316 and £290 respectively. With those in the North East, Yorkshire and the Humber, and Wales seeing the smallest benefit, with average gains of £192, £214, and £211 respectively.

Whilst the richest stand to gain the most from this Autumn Budget. If you take into account all policy decisions taken over parliament as a whole (2019 to 2025), this parliament has been relatively progressive. Largely reflecting the increase in people being drawn into paying more in income taxes and NICs. The Resolution Foundation has found that taking all tax and benefit measures announced since 2019 together, the richest fifth have lost £1,100 a year, whilst the poorest 20% has gained £700.

This does not though mean that people are better off than they were before in 2019. Real Household Disposable Income (RHDI) is still falling, quickly eroding living standards. The OBR forecasts that by the anticipated end of this parliament (Quarter 1 2025), living standards as measured by RHDI, will be 3.5% lower in 2024-25 than their pre-pandemic 2019 level. The Resolution Foundation estimates that on average this means households will be £1,900 poorer at the start of the parliament than at the end.

Business Impact

The business rate relief scheme, which is a 75% discount on business rates up to £110k for retail, hospitality and leisure businesses, is to be extended for another year. This will be a relief for many small businesses within these sectors, which have been struggling on many fronts since the pandemic. They have faced reduced footfall since the pandemic (upon which many in these sectors are highly reliant); falling sales as households have lower disposable income; and rising input costs as energy, raw materials and wages have all increased. This extension of this scheme will, therefore, be a relief to many businesses, particularly given inflation is set to remain high through 2024 and energy bills are expected to increase in Quarter 1 of 2024.

In the Spring Budget 2023, a temporary full expensing relief was introduced for main rate expenditure on plant and machinery for a period until 1 April 2026. This will now be made permanent in order to incentivise increased capital investment by companies. These measures will be warmly welcomed by large manufacturers and other capital-intensive businesses. KPMG noted that despite the description as a tax cut, this measure essentially provides an acceleration of the relief and so is an upfront cash tax saving rather than a permanent tax reduction.

Public Services

No new funding was made available to public services in this Statement. Department settlements which once looked relatively generous when announced in 2021, have quickly been eroded by inflation and higher-than-expected wage deals. Resulting in day-to-day spending now due to rise by only 1.9% per year in real terms between 2021/22 and 2024/25, compared to 3.6% when the settlements were first agreed. This will make it much harder for services to return to pre-pandemic performance levels, particularly given the OBR has forecast for inflation to remain above the target 2% till 2025. The commitments already made therefore, on the NHS, defence, foreign aid and childcare, imply there will likely be real terms cuts for unprotected areas of spending, with the OBR forecasting a 2.3% to 4.1% fall in day-to-day spending in real terms from 2025-26.

This blog was written by Alice Pugh, Policy and Data Analyst, City-REDI / WMREDI, University of Birmingham.

Disclaimer:

The views expressed in this analysis post are those of the authors and not necessarily those of City-REDI, WMREDI or the University of Birmingham.