Alice Pugh looks at the impact of the cost-of-living crisis on the Christmas season.

Whether you view Christmas as a religious or commercial holiday, for most households in the UK it should be a beautiful time of the year filled with joy. However, this year the cost-of-living crisis is the grinch which is stealing Christmas for many households. Many are facing a somewhat subdued Christmas, as families worry about whether they will be able to afford their usual Christmas traditions.

The economic impact of a reduced Christmas will be significant. Many businesses are highly dependent on Christmas spending to see them through the dips in the financial year. With many businesses already struggling under the weight of rising energy prices, inflation and recovery from the pandemic reduced consumer spending will severely impact businesses’ profitability and financial stability this year.

Currently, UK households are struggling with several cost-of-living factors, which will likely dampen consumer spending during the busiest time of the year. Cost-of-living factors that consumers are battling with are:

1 – Inflation

Inflation has hit 11.1% in the UK, with food and drink inflation rising 16.4%. Far outstripping wages rises, with the OBR forecasting a 7% fall in living standards over the next 2 years.

2 – Energy price rises

Energy bills have more than doubled between October of this year and last year, and families face a further hike in energy bills come April, when if the cap is removed energy bills could reach more than £6,600 for the average England household. So, families are not only worrying about current bills but bills which will be set to hit them in Spring.

3 – Mortgage rises

Mortgage rates rose dramatically following the ‘mini budget’, Joseph Rowntree Foundation found that new mortgage rates of 5.5% would see the average monthly mortgage payment increase by £250, from £610 a month to £860. Seeing households spend 54% of their monthly income on their mortgage up from 38%.

4 – Interest rate rises

Interest rate rises will make it more expensive for people to get credit, as a result, many may reduce their spending using credit to avoid greater debt.

How will the Cost-of-living crisis impact Christmas Festivities?

Christmas Dinner and food inflation

Food inflation has been rapidly rising over the year, largely because of the invasion of Ukraine driving up energy prices and prices of goods such as fertilizer. However, this has been compounded in the UK by labour shortages leading to wasted food goods, as farms had a lack of capacity to harvest food stuffs in recent months. With food and non-alcoholic beverages inflation rising prices by 16.4% between October 2021 and October 2022.

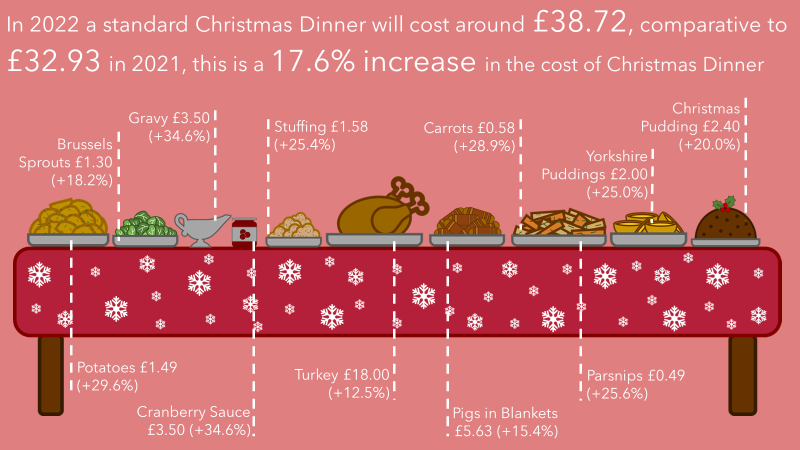

Using the Grocery Price Index by Trolley.co.uk, to look at the price of the UK’s 12 favourite Christmas dinner trimmings, the price of a traditional Christmas dinner (for a family of 4 or 5) has increased by 17.6% from £32.93 in November 2021 to £38.72 in November 2022. As seen in the infographic below, every single item on this basic Christmas dinner increased above the UK CPI 11.1% inflation rate, vastly outpacing wage increases. The trimmings which have seen the largest increase in prices are gravy and cranberry sauce, with the prices of both having risen by 34.6%. Frozen turkey had the lowest price increase at 12.5%.

Whilst a £5.79 increase in the cost of a Christmas dinner may sound small, to many, this will place a strain on their Christmas budget. Plus, there are hidden costs that we don’t necessarily all think about that will affect the price of the meal. This analysis includes all the main trimmings, but it does not include the cost of seasoning or cooking oil, for instance, the price of olive oil alone has increased by 41.7%. It does not cost in the energy to cook the meal, the cost of which will vary dependent on whether you have a gas or electric oven, with electric ovens being more expensive to run. There are also no beverage costs factored into this. This is just the cost of food for one meal over Christmas, children are on school holidays for 2 weeks and in that time, there are 41 other meals that need to be bought and made, with food inflation impacting the cost of these meals as well.

In November an EY survey found consumers were planning to cut back on celebratory alcohol and food by 29%, with just over 1 in 10 (12%) planning to invite fewer people to celebrations. Another survey conducted by Savanta Comres on behalf Salvation Army found that around 7 in 10 people (67%) are worried that they might not be able to afford Christmas dinner this year. They also found nearly 1 in 6 expect they will be using food bank items as contributions to their festive meal. Deloitte found that 1 in 3 (35%) of consumers plan to do at least part of their food shop at a discounter supermarket. It is likely, therefore, that given the cost-of-living crisis and rising food inflation, many households will be having a more frugal Christmas dinner this year, as well as switching to cheaper retailers to save money.

Gift giving

Giving gifting is set to change this year. Finder commissioned Censuswide to carry out a survey on Christmas gift giving, they found that the average British adult will spend £430 on Christmas gifts in 2022, a decrease of 22% from 2021’s budget. It is a decrease of £47 (10%) from 2020’s budget and £84 (16%) less than Christmas spending in 2019. There are also generational differences in spending, generation X (those born between 1965 and 1981) is expected to spend the most, however, their spending will still be down 10% from last year and Millennials (people born from 1981 to 1996) are planning to spend 28% less than last year. The silent generation (born between 1928 and 1945) were the biggest spenders last year, but this year their spending is expected to have dropped by 40%.

Overall, people in the UK are expected to spend £20.1 billion this year on Christmas gifts, this is 21% (£5.5bn) less than 2021’s figure of £25.5 billion. This spend is also 33% lower than the 2019 pre-pandemic spend of £26.9 billion. Even during the lockdown over the 2020 Christmas period, UK spending was 21% higher at £24.3 billion.

Research commissioned by Oxfam and the British Heart Foundation found that more than a third of Christmas shoppers (35%) will spend less on gifts this Christmas typically cutting their budget by half. It was also found that 28% of people feel pressure to buy gifts at Christmas, with nearly a quarter (24%) relieved they have agreed with family and friends to cut back on giving this year. 34% of those buying for others plan to spend less per person this year compared to last. The average number of people on a Christmas gift list reducing by one person, from 10 in 2021 to nine this year. 33% of consumers are adjusting their Christmas shopping plans by shopping with charity retailers. Additionally, regardless of household income, everyone is set to feel the squeeze this year, as 41% of shoppers with a household income of £20,001 to £25,000 want their money to stretch further, compared to 42% of households with an income of £60,001 to £70,000.

Deloitte conducted a similar survey of consumers regarding their expected spending over this Christmas period, and they found that 38% of consumers will switch to cheaper brands or stores when seeking out Christmas gifts. With 1 in 10 consumers also intending to purchase gifts second-hand. 8% of respondents to the survey stated that they wouldn’t be buying Christmas presents at all.

Overall, what is clear is this year households are going to struggle to afford gift-giving. Research shows that households are becoming more frugal and thriftier with gift-giving, by buying discounted, second-hand, or non-branded goods. Gift buyers will be hunting through second-hand retailers such as CEX, eBay, gumtree, depop, for branded second-hand discounted quality gifts. Sentimentalities to second-hand gifts have also changed, with them being seen as environmentally positive. Most households will be cutting back on gift giving and this will severely impact the economy, especially those middling high street retailers which will likely see consumers switch to cheaper competitors.

The cost-of-living crisis that stole Christmas

This year Christmas will be somewhat subdued compared to the celebrations we might have been expecting especially as this is the first time in 3 years that we won’t have lockdown restrictions, limiting celebrations.

Overall, the cost-of-living crisis will have reduced consumer spending during the golden quarter (The months between October and December that are critical to retail). Families will be cutting back across all areas of Christmas spending. They will also become more frugal, hunting for the cheapest deals, as well as switching to second-hand goods when it comes to presents. The high risk over this period will be consumers increasingly turning to ‘buy now pay later’ payment options and increased credit use, this may lead to some serious debt build-ups in the coming months, which might become unmanageable if interest rates increase.

Firms will most certainly see a reduced Christmas period both compared to before and during the pandemic. This will make many businesses nervous, especially as the golden quarter is usually the period which helps to see them through the rest of the financial year. Businesses are also facing the added pressure of the energy price cap removal in April, and many may have been depending on the Christmas period to help them with their energy bills come April. In the coming months to attract consumers businesses will have to continue to offer value for money, as this cost-of-living crisis is not just for Christmas but likely for the next 2 financial years at least according to OBR forecasts.

This blog was written by Alice Pugh, Policy and Data Analyst at City-REDI / WMREDI, University of Birmingham.

Disclaimer:

The views expressed in this analysis post are those of the authors and not necessarily those of City-REDI / WMREDI or the University of Birmingham.