2022 saw the largest number of firm insolvencies (bankruptcies) since 2009 in England and Wales. Professor Simon Collinson, Dr Huanjia Ma and Dr Matt Lyons discuss the impact of this on the Birmingham city-region.

In 2022 we saw the largest number of firm insolvencies (bankruptcies) since 2009 in England and Wales. Building on previous analysis of UK-wide, interregional patterns of insolvencies we examined the impacts of this on the Birmingham city-region.

We found very different effects in different sub-regions, with the manufacturing sector and low-income communities hit hardest, and long-term consequences for the region.

Greater Birmingham is particularly impacted by firm insolvencies

In the Greater Birmingham city-region, the number of insolvent firms in 2022 reached 1,077, accounting for 4.69% of total firms that failed in the UK. This is disproportionate to the 2.69% of UK firms located in this region, showing that it was affected more than many other regions.

We define the Birmingham city region in this analysis as the Greater Birmingham and Solihull Local Enterprise Partnership (GBSLEP) area.

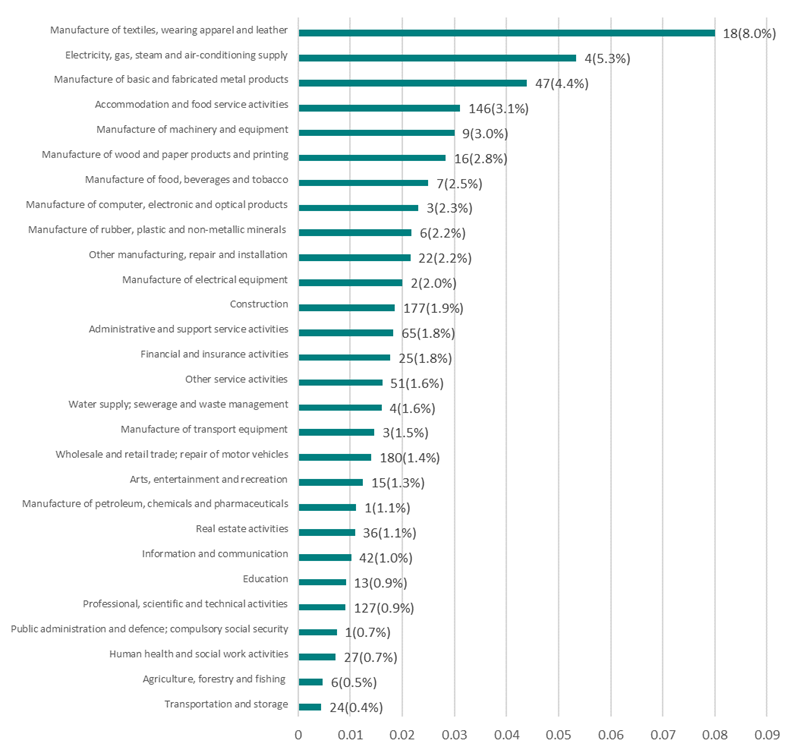

Manufacturing industries have been hardest hit (see figure below), similar to the national level pattern. The four industries, as classified under the SEIM-UK industry classification based on SIC 2007, that experienced the highest percentage of insolvencies in 2022 were: Manufacture of textiles, wearing apparel and leather (8%); Electricity, gas, steam and air-conditioning supply (5.3%); Manufacture of basic and fabricated metal products (4.39%) and Accommodation and food service activities (3.11%). Conversely, the top four industries in terms of the total number of firms were: Wholesale and retail trade; repair of motor vehicles, Construction, Accommodation and food service activities and Professional, scientific and technical activities.

The total number of firms was obtained from the Nomis by the Office for National Statistics, using data with a reference date in March 2022 and sourced from the Inter-Departmental Business Register (IDBR).

Firm insolvencies by sector (GBSLEP)

Number of insolvent firms and percentage of total firms in the region (in parentheses)

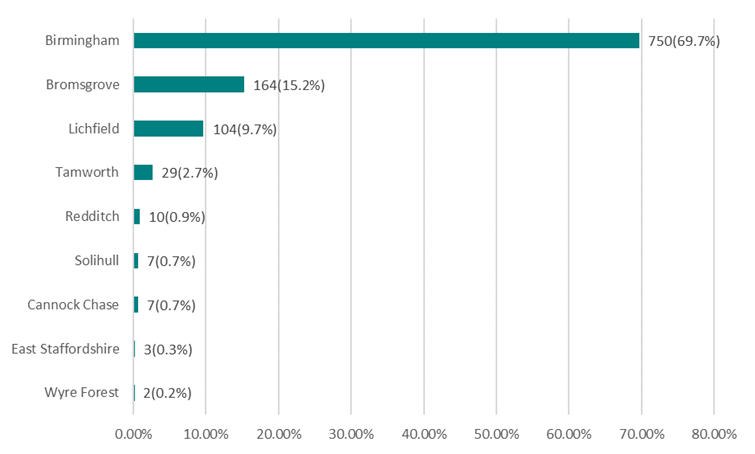

The geographic distribution of insolvent firms is shown in the bar chart below, across the Greater Birmingham area. 69.7% of firms that failed in the Greater Birmingham city region in 2022 are located in the city of Birmingham. Again, this is disproportionate, given that 50.2% of all firms in the GBSLEP area are based in Birmingham.

Bromsgrove and Lichfield were also significantly impacted. Solihull, however, one of the wealthiest sub-regions did not feel much of the impact. While it houses over 10% of all firms in the Greater Birmingham city region, only 0.65% of the firms that went insolvent in the GBSLEP area in 2022 were in Solihull.

Firm insolvencies by Local Authority (Greater Birmingham)

Number of insolvent firms and percentage of total insolvent firms in the region (in parentheses)

Knock-on effects on the economy and households

When firms fail there is a direct loss of the added value they contributed to the economy. However, there is an additional ripple effect across industries and regions through their upstream and downstream links to customers and suppliers. This can be more or less local, depending on the spatial geography of these industry and firm-specific value chains. We examine these (negative) multiplier effects, created when firms go into bankruptcy, on industries and households in the Greater Birmingham city region using the extended SEIM-UK model, developed at City-REDI.

The wider economic shocks from firm insolvencies are estimated in terms of the percentage change (fall) in final demand, which is approximated by the ratio of the number of employees of insolvent firms and the total number of jobs of each region-industry cell of the model. The model operates on the International Territorial Level 1 (ITL). The overall economic impact on the Greater Birmingham city region is then inferred from the proportion of Gross Value Added (GVA) of the West Midlands (ITL1) region. This also allows us to break down the impact by industry sector.

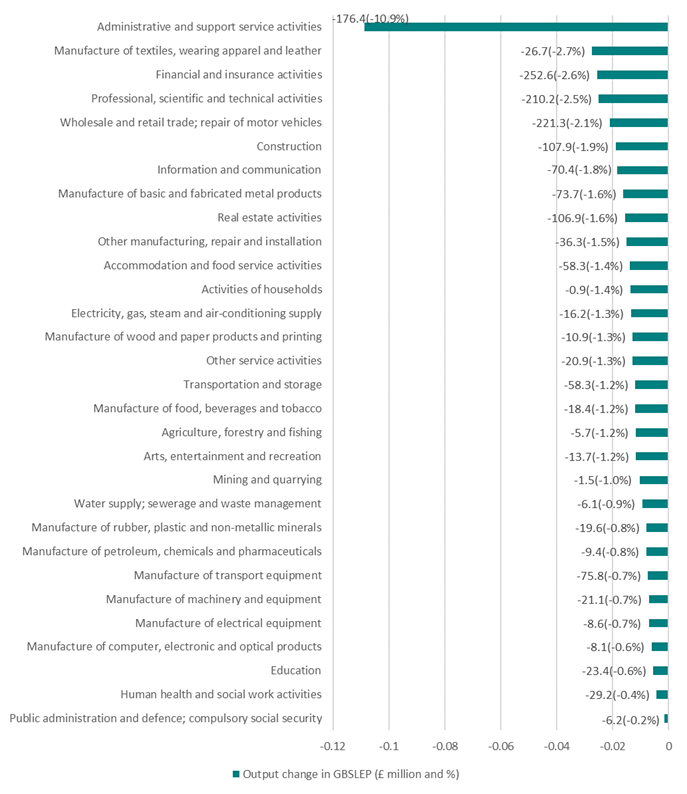

As shown in the figure below, the sectoral view of the impact provides interesting insights into the wider effects of insolvencies. Despite manufacturing sectors seeing the highest rise in insolvencies, the simulation shows that in the Greater Birmingham region, the administrative and support service activities sector is impacted hardest, experiencing a £174.6 million (10.9%) decrease in output.

This demonstrates the cross-sector interdependencies that are a feature of the value chains mapped by the model. The remaining industries in the top 5 most affected industries are: The manufacture of textiles, wearing apparel and leather (£26.7 million and 2.7%), Financial and insurance activities (£252.6 million and 2.6%), Professional, scientific and technical activities (£252.6 million and 2.6%) and Wholesale and retail trade (£221.3 million and 2.1%).

Although the figure does not show this, it is important to also note that the Greater Birmingham city-region is also impacted very heavily, relative to other regions. The output decreases by a larger percentage across almost all industries compared to the national level.

For national estimates, see The Poorest UK Households are Hit Hardest by the Highest Rate of Firm Failure.

Simulated Impact on the Output (Greater Birmingham)

Output change in £million and percentage (in parentheses)

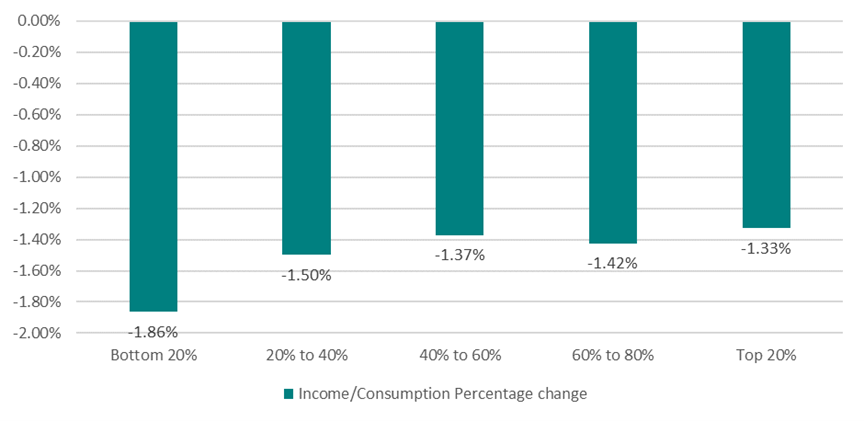

The extended SEIM-UK model also provides important insights into how economic shocks could influence the income and consumption of different income quintile households. The figure below shows the simulated impact of insolvencies on the percentage change in household incomes in the Greater Birmingham city region. The income and consumption of households in the bottom 20% is projected to decline by 1.86%, which is the largest decrease among all groups. While the top 20% income group would experience a loss of 1.33%, the smallest among all groups.

Impact on household income and consumption across income groups (Greater Birmingham)

Income and consumption changes in percentage

Our estimates also indicate that, compared to the national level, households in this region would lose a higher percentage of their income and consumption across all income groups.

The knock-on effects of firm-level insolvencies, simulated using the extended SEIM-UK model, showed decreased output across almost all industries and a significant impact on household incomes and consumption. However, it is clear that lower-income households in the GBSLEP region suffer the most in terms of percentage loss of income and consumption. In simple terms, this kind of shock, as with so many others, makes poor communities poorer.

This blog was written by Professor Simon Collinson, Dr Matt Lyons, Research Fellow, Huanjia Ma, Research Fellow, City-REDI / WMREDI, University of Birmingham.

Disclaimer:

The views expressed in this analysis post are those of the authors and not necessarily those of City-REDI / WMREDI or the University of Birmingham.

A sincere thank you to Professor Simon Collinson, Dr. Matt Lyons, Huanjia Ma, and the entire team at City-REDI / WMREDI, University of Birmingham for shedding light on the significant impact of firm insolvencies in the Greater Birmingham city-region. 🙏💼 Your research underscores the intricate economic interdependencies and the ripple effect these insolvencies create, affecting both industries and households, with a disproportionate burden on lower-income families.Avukat Denizli; Denizli Avukat; Denizli En iyi Avukat;👨👩👧👦💰 This insightful analysis serves as a valuable resource for understanding regional economic dynamics and their implications for communities. 📈🏙️ #EconomicImpact #BirminghamEconomy