Mike Lewis, Senior Policy Officer at the West Midlands Combined Authority provides a breakdown of HMG’s Budget announcement 2021 and highlights some of the key points of interest to the West Midlands.

Mike Lewis, Senior Policy Officer at the West Midlands Combined Authority provides a breakdown of HMG’s Budget announcement 2021 and highlights some of the key points of interest to the West Midlands.

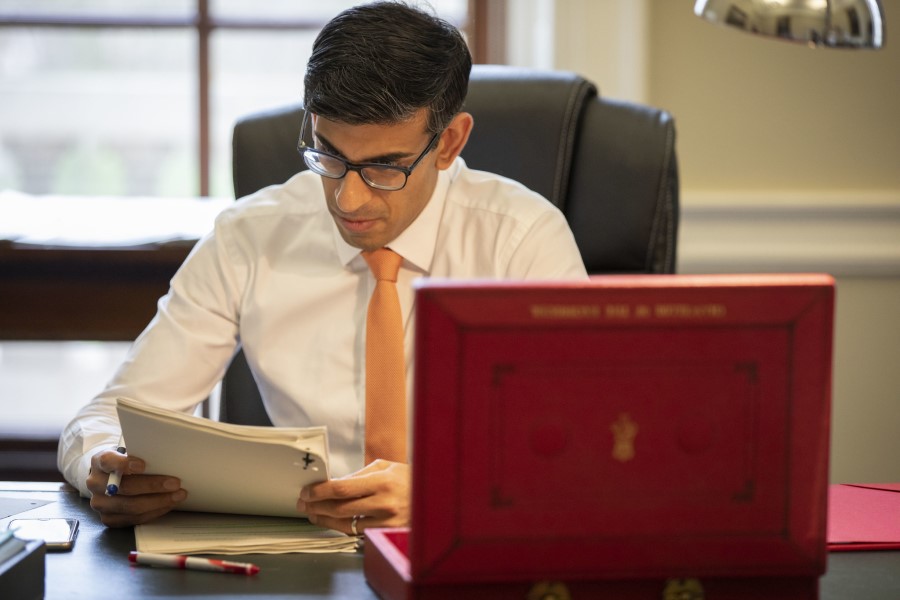

Chancellor of the Exchequer Rishi Sunak presented HMG’s Budget 2021 to the House of Commons on 3 March 2021. The Chancellor outlined measures in the Red Book aimed at supporting jobs and businesses and stabilizing public finances. The plan for growth strategy appears to supersede the Industrial Strategy and is led out of HMT rather than BEIS.

The Chancellor prefaced his announcements by highlighting some of the challenges facing the country, including a 10% fall in growth in the last year and a 700k rise in unemployment. The announcements were made across three themes;

- Business and people

- Fixing public finances

- Building the future economy

Business and people

Key business-related announcements made by the Chancellor were:

- £126m to fund 40,000 more traineeship places and employer incentives for apprenticeships will rise to £3,000, regardless of the age of the apprentice.

- New restart grant to help businesses re-open – nonessential retail to receive up to 6k per premise and up to £18k for hospitality and leisure businesses (replacing rather than in addition to additional business grant support measures).

- A £300 million Cultural Recovery Fund.

- A £300 million Sports Recovery Fund to focus on cricket.

- An extension to the £500m Film and TV restart scheme.

- The Recovery Loan Scheme will replace CBLIS and CBBLS. Firms will be able to borrow £25k to £10m and the Government will guarantee 80% of individual loans made to businesses.

- The 100% business rate holiday for retail, hospitality and leisure businesses will continue until the end of June 2021. This will then be followed by a reduced concession rate of 66% until March 2022.

- Hospitality and tourism businesses will pay a 5% VAT rate until September 2021 and then an interim rate of 12.5% until April 2022.

Key measures to support employment, income, home ownership and mental health:

- The Job Retention Scheme is to be extended until September 2021. Government contributions will fall to 60% in July, 60% in August, from its current level of 80%. A similar process is to be put in place for the Self-Employment Income Support Scheme.

- The Universal Credit uplift of £20 per week will be extended for another six months. Claimants on Working Tax Credit will get a one-off payment of £500.

- Stamp duty holiday will be extended until June 2021 for property sales under £500,000. The nil rate band will be £250,000 until the end of September, returning to the usual level of £125,000 from 1 October 2021.

- A new Government mortgage guarantee will enable 95% mortgages.

- £19m for domestic violence programme which includes piloting “respite rooms” for victims of domestic violence.

- £10m will be allocated to support army veterans dealing with mental health issues.

Public finances

Key taxation measures:

- Personal tax thresholds will stand at 12,570 and 50,270 next year (until April 2026).

- Corporation tax on company profits is to increase to 25% and will start in April 2023. It is estimated that 10% of firms will pay this rate due to profit levels, with smaller firms paying lower rates.

- The Government will introduce a “Super Deduction” meaning that companies will have a capital investment allowance of 130%.

- Planned duty increases all alcohol products and fuel are to be cancelled.

Building the future economy

The Chancellor introduced this section of the budget by emphasizing the Government’s green growth ambitions:

- Budget 2021 confirmed the creation of the UK Infrastructure Bank (located in Leeds) that will invest across the UK in public and private projects. Beginning this spring, the bank will have an initial capitalisation of £12bn and is expected to support at least £40bn of total investment in infrastructure.

- Support for small and medium-sized enterprises to grow through two new schemes to boost productivity. These will launch in the autumn, and appear to be managed centrally rather than through regional business support infrastructure, with businesses being invited to express interest through Gov.uk.

- Help to Grow: Management, a new management training offer

- Help to Grow: Digital, a new scheme to help 100,000 SMEs save time and money by adopting productivity-enhancing software, transforming the way they do business.

- To launch a consultation on tax relief, alongside the budget.

Levelling up

- The Government is launching the prospectus for the £4.8 billion Levelling Up Fund alongside Budget. This will be delivered through LAs, with a 3-tier system indicating levels of support and need. MPs will play a role in championing projects. Combined Authorities (CAs) will be able to put forward 1 transport proposal of up to £20m.

- £1bn new town deals confirmed – this includes funding for Wolverhampton, Rowley Regis, Smethwick and West Bromwich.

- £150m Community Ownership Grant to allow communities to take ownership of pubs at risk.

- A number of Freeports announced, the closest to the region is East Midlands Airport.

- Detail on Community Recovery Fund – CAs in lead role with £3m pilot bids for priority places (Birmingham, Dudley, Sandwell, Walsall, Wolves), to inform future Shared prosperity fund.

- Review on the geography of LEPS (reporting later in the year).

Potential for funding regional priorities

The Chancellor also announced a further £225m of investments to back some of the region’s key schemes. These include:

- £59m for five new stations in the region in the Black Country and south Birmingham.

- £50m will go to Solihull Council’s Urban Growth Company to help fund transport improvements around the HS2 Birmingham Interchange Station.

- £116m for the regeneration for Rowley Regis (£19m), Smethwick (£23.5m), West Bromwich (£25m) Wolverhampton (£25m) and Nuneaton (£23.5m).

- A £10m Wolverhampton-based Government taskforce to work with the WMCA in developing new construction technologies including low carbon, energy efficient homes

This blog was written by Mike Lewis, Senior Policy Officer at the West Midlands Combined Authority.

Disclaimer:

The views expressed in this analysis post are those of the authors and not necessarily those of City-REDI or the University of Birmingham.