Hannes Read looks at the intentions and outcomes of the Small Business, Retail Hospitality & Leisure, and Discretionary Grant Funds in England from March 2020 to September 2020.

Hannes Read looks at the intentions and outcomes of the Small Business, Retail Hospitality & Leisure, and Discretionary Grant Funds in England from March 2020 to September 2020.

The UK government response to support businesses in England following the coronavirus pandemic included the £11.7bn Small Business Grant Fund (SBGF), Retail, Hospitality & Leisure Grant Fund (RHLGF), and supplementary Discretionary Grant Fund (DGF).

This blog will firstly analyse the intentions and outcomes of the policies over their lifespan from inception in March 2020 until closure on 30th September 2020.

Second, the blog will describe approaches to evaluating the economic and social value impact of the grant funding on the regional economy.

Although the UK government have announced numerous business support packages in light of the Covid-19 pandemic, this blog will focus on the Small Business, Retail Hospitality & Leisure, and Discretionary Grant Funds paid out from March – September 2020 in the first stage of the pandemic.”

| Business Support Available | Grant Funding Available | Notable Eligibility Criteria | Limitations |

| Small Business Grant Fund | £10,000. One grant per business. | – Only small or micro-businesses eligible.

– Businesses required to occupy property receiving small business rates relief. |

– Small businesses occupying not receiving small business rates relief missed out. |

| Retail, Hospitality and Leisure Grant Fund | £10,000. If rateable value of property less than £15,000. | – No limit on business size.

– One grant per property; a business with multiple properties can get multiple grants. – Retail, hospitality, and leisure (RHL) services to be provided in-person at the property. |

– Suppliers of RHL sector missed out. Eligibility based on whether the property was used for RHL purposes, instead of if the business was in RHL sector. |

| £25,000. If rateable value of property £15,000 or more but less than £51,000. | |||

| Discretionary Grant Fund | Variable. West Midlands average: £7,000 | – “Primarily and predominantly” for small or medium-sized businesses with ongoing fixed property costs and suffered a significant fall in income.

– Criteria to be decided by each local authority to support businesses not in the business rates list. – National government asked to prioritise four business types: those in shared offices; regular market traders; B&Bs paying council tax; charities. |

– The DGF was a notional 5% uplift on the value of SBGF and RHLGF. Little funding available beyond the priority business types.

– Less generous than SBGF and RHLGF. 87% of local authorities paying £10,000 or less per business. |

Table 1: Overview of the SBGF, RHLGF and DGF. (UK Government, 2020a)

Analysing Policy Intentions, Limits, and English Devolution

The policy intentions of the SBGF, RHLGF and DGF were to “help small, rural, retail, leisure and hospitality businesses with their ongoing business costs in recognition of the disruption caused by COVID-19” (UK Government, 2020b). Eligible businesses were easily identified via the national business rates system, with the level of grant funding being linked to the rateable value of their business premises. The relative simplicity to access the SBGF and RHLGF through national business rates lists showed levels of success of the grants in meeting its intentions. From the onset of the lockdown period on 23rd March 2020 until the grant scheme closure at the end of September 2020, grants worth £496m across the SBGF and RHLGF were distributed to over 42,000 properties in the West Midlands, the third-highest of the 11 combined authorities in England. (UK Government, 2020b).

Yet, the centralised approach to meet the gaps in SBGF and RHLGF support, designed through the DGF, brought criticism from politicians from devolved English regions. Andy Burnham and Steve Rotheram, Mayors for Greater Manchester and Liverpool City Region respectively, were vocal representatives of the estimated three million people excluded from the wider financial support. The Discretionary Grant Fund was intended to meet the needs of businesses missed out by the business rates system. But the limited funding, provided as a 5% uplift on the SBGF and RHLGF allocations, left little scope to go beyond the business types government looked to prioritise. The centralised DGF policy, and the SBGF and RHLGF being heavily reliant on the centralised business rates list, left little room for devolved decision making to have an economic and social impact on the regional economy in the aftermath of the pandemic.

Evaluating Economic and Social Value of the SGBF, RHLGF and DGF in English Regions

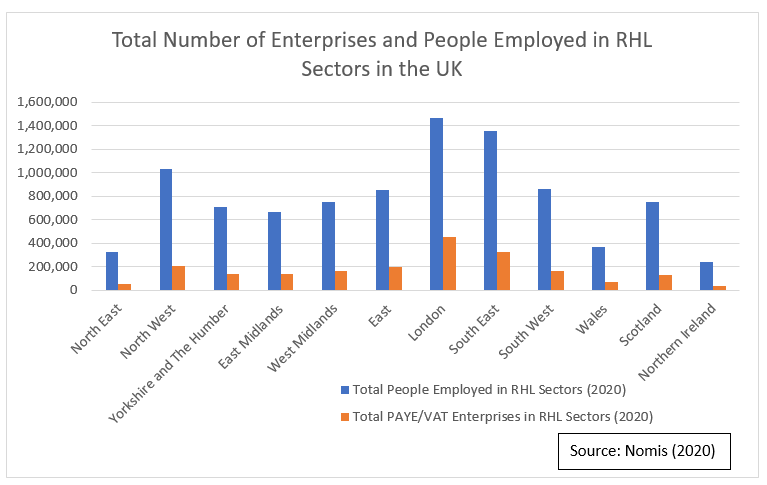

Across the UK, 9.4 million people are employed by 2.1 million businesses in the retail, hospitality, and leisure (RHL) sectors (Nomis, 2020). Across the West Midlands region, over 750,000 people are employed in almost 170,000 RHL businesses exemplifying the importance of the sector to the regional economy (ibid.).

Research by Dr Andre Carrascal using the Socio-Economic Impact Model for the UK (SEIM-UK) shows RHL industries contribute to a significant 5.9% of the regional economy in the West Midlands. Whilst the West Midlands is the 25th most exposed region in the UK from the shut-down in hospitality and recreational activities, there is a clear spatial disparity in exposure across the UK with Cornwall and Isles of Scilly having 10.1% of their economy being exposed in the RHL sectors. As Dr Fengjie Pan and Professor Simon Collinson wrote in their blog for City-REDI, regions with embedded sectors have greater resilience. Tracking and comparing the performance of regional economies over time, similar to Carrascal’s research using SEIM-UK, could provide insights into the regional resilience of regional economies and provide insights into the economic impacts of the SBGF, RHLGF and DGF in supporting the RHL sectors.

The intentions of the government policies were to support the ongoing property-related costs of businesses. Yet the impacts of the pandemic stretch far further. The Birmingham Economic Review 2020 clearly recognises the pandemic has an interconnection of economic, health and social impacts. Evaluating the social value of business support interventions can be considered by using the National TOMs social value framework. Conducting a social value survey of businesses that have received grants from the SBGF, RHGF or DGF can consider the broader impact of supporting businesses to stay open and to provide secure, well paid jobs. Providing insights into the social value of the SBGF, RHLGF and DGF, beyond the economic impacts, would provide a clearer picture of evaluating how the business support interventions in a pandemic that has had far-reaching effects on the economy, health, and society.

This blog was written by Hannes Read, Policy and Data Analyst, City-REDI / WM REDI, University of Birmingham.

Disclaimer:

The views expressed in this analysis post are those of the authors and not necessarily those of City-REDI or the University of Birmingham.