In a series of blogs, Simon Collinson, Fumi Kitagawa and Tomas Ulrichsen examine the role of universities in regional development.

The blogs are co-authored by the Policy Evidence Unit for University Commercialisation and Innovation (UCI) at the University of Cambridge Institute for Manufacturing (IfM) and the West Midlands Regional Economic Development Institute (WMREDI at City-REDI), University of Birmingham.

In the second blog from the series, the authors reflect on how particular kinds of local engagement between universities and firms can contribute to regional economic growth.

Read the other blogs from the series:

Place Matters: Universities and Local Innovation Systems

Unleashing the Regional Innovation Potential of Universities

Universities’ Role in Helping Regions Transition From Legacy Industries Into New Areas

Our series of blogs examines the different challenges and approaches to harnessing universities more effectively for better, more balanced economic growth across UK regions. Although the evidence shows that universities add significant value to regional economies, much of this contribution is arguably automatic or ‘unconscious’, or at least not precisely targeted. One area where universities are encouraged to play a stronger role is in support of local industrial strategies, through more or better engagement with firms in their regions. Related commentary and analysis, however, usually fail to clarify which firms should be the focus of this engagement, and why. This is also a challenge faced by other stakeholders including government business support agencies and public R&D funders. Failure to accurately target those firms and sectors that have the most potential to contribute to local economic growth risks wasting public funds which are in short supply already.

Local industrial strategies ‘comprising a range of measures to build on local strengths and deliver on economic opportunities’ (HM Government, 2018, and similar iterations before and after this version), have suffered from the same problem (Shutt and Liddle, 2020). When asked to put forward lists of industries or clusters which represent distinctive, local development opportunities for targeted support, regional agencies struggle. They tend to provide very similar lists of target industries, such as advanced manufacturing, life sciences, creative and digital, for central government investment. The selected priority areas can sometimes just mirror the thematic preferences of central government agencies, as investors, rather than the outcome of a locally driven selection mechanism. However, regional and national agencies also acknowledge that the data and evidence available to base such decisions on currently lacks the level of depth and robustness to guide a more precise approach.

There are some clear starting points for improving on this and the following discussion focuses on two: (1) creating more promising growth prospects by shaping the regional industrial structure and underlying portfolio of firms and, (2) targeting sectors and firms which have higher local multiplier effects and more local value appropriation. Throughout we will reflect on how particular kinds of local engagement between universities and firms can contribute to these outcomes.

1) Regional Industry Structures and Firm Portfolios

Universities’ engagement with local firms varies by place, partly because each region hosts a unique combination of firms. This place-specific industry portfolio in turn influences the future potential growth trajectory of any region. Firm size, age and sector are important, and fairly simple indicators can help characterise regional variation in these terms.

Location quotients and measures of regional specialisation or economic complexity provide one set of insights into how different kinds of combinations of firms give rise to different kinds of growth. Briefly, research shows that ‘UK local authorities with higher economic complexity (but not necessarily diversity) will tend to have higher per capita earnings, growth rates and greater ability to develop further industries with greater earnings potential’ (Mealy and Coyle, 2022). Higher complexity and higher growth places also tend to specialise in knowledge-based services industries, such as finance, insurance, ICT, professional, scientific and technical activities. These contrast to lower growth regions which are more likely to have concentrations of agriculture, manufacturing or mining activities.

The key point here is that sector specialisation and particular kinds of economic complexity matter, and some lower-growth regions would benefit from significant changes to their local industry portfolio. Arguably, industrial strategies that focus on ‘building on existing local strengths’ are contributing to the path-dependencies underlying the ‘Matthew Effect’, i.e., the rich places are getting richer, and the poorer places are increasingly worse off. This is one area where more precise targeting could enhance the contribution of universities to local growth, by directing particular kinds of engagement with particular kinds of firm. Collaborative research, specific teaching programmes and efforts to retain students in the local region, with a particular focus on knowledge-based services industries, could all be aligned with local growth strategies.

The Role of Universities in Supporting Local Industry Transitions

Lester (2005), amongst others, outlined a series of ways that universities can contribute to the shaping of industry portfolios. We discuss this framework (see Figure 2 in blog number 3 in this series) in which university contributions to local economies undergoing different types of industrial transformation are broken down into:

- Support for emerging industries (Type 1), through leading science and technology development, technology transfer and licensing, promoting start-ups and spin-outs in emerging sectors etc.

- Importation/transplantation of industries (Type 2), through skills development and retention, and technical support for local firms.

- Diversification of existing industries into technologically related new ones (Type 3), perhaps using assets and capabilities from mature or legacy industry sectors to create an advantage in new sectors.

- Upgrading of existing industries (Type 4), by increasing investment and skills and enhancing innovation-related capabilities to move up the value chain in current industries.

The abovementioned research on portfolio diversity and complexity (Mealy and Coyle, 2022) suggests that Type 4, building on local strengths, is far less promising than Types 1-3, which entail some level of intervention to change the mix of firms in the region.

Although this has not been measured accurately, there is evidence suggesting that technology transfer offices (TTOs), innovation ‘intermediaries’, ‘catapults’ and ‘accelerators’ which connect universities and firms can support industry transitions. We have examined the activities of two examples in the West Midlands, the Manufacturing Technology Centre (MTC, in Ansty) and the Warwick Manufacturing Group (WMG, Warwick University) in an attempt to develop the evidence base and contribute to a wider literature on the impacts of these organisations. (See Billing et al., 2023).

2) Maximising Local Value Appropriation

To further improve the targeting of interventions for local economic development we need to consider which industry sectors, clusters or firms give rise to growth benefits that stay in the region as opposed to flowing out to other regions (or out of the UK entirely). This might seem an odd question to anyone unfamiliar with the dynamics of regional growth. But we know that, depending on the context, £1 of investment can result in more or less than £1 of local added value.

Other research studies have observed this and called for more place-based approaches and the need for local ‘capture of co-created value’ (Bailey, Pitelis and Tomlinson, 2018) but lack the empirical methods to support targeted interventions. We are developing and combining two promising approaches at City-REDI, which could help differentiate regions and support more precise interventions.

Modelling

The first approach involves using interregional input-output models to examine net gains and losses across connected local economies. The City-REDI SEIM, or Socio-Economic Impact Model, for example, provides estimates of net benefits from local investments or policy interventions, comparing across regions. It has been used to examine a range of events, investments and interventions, from the economic impact of the Commonwealth Games on the Birmingham city-region (Lyons, 2022), to the impact of a rise in corporate insolvencies on West Midlands households (Collinson, Lyons and Ma, 2023) and the different levels of local economic contribution across regions that results from student spending.

The latter provides a simple example, where the model was used to estimate the local economic impacts of £1 (or £1 million) of student expenditure, it has shown significant differences by UK region. The largest direct Gross Value Added (GVA) multiplier is 17% higher than the smallest one, and jobs multipliers show wider variations with the maximum at 12.5 jobs per £1 million expenditure being more than twice the minimum. Greater Manchester, the West Midlands and parts of London and the South East benefit the most. Spill-over effects are also significantly different with Cornwall and the Isles of Scilly receiving under £0.2 locally for each £1 spent and Inner London receiving almost the entire £1. London comes out top in most of these kinds of analysis in the UK as a major beneficiary of added value from economic activity in other regions because it hosts the most firms, including suppliers and contractors as well as business owners (Carrascal Incera, Kitsos and Gutierrez Posada, 2022). In effect, this means either (a) that supporting growth in student numbers should be higher on the priority list for some regions than others, and/or, more relevant for this discussion, (b) places that have large numbers of students should aim to appropriate more value from their spending by developing local supply chains.

Overall, inter-regional models provide insights into which regions benefit most (or least) from flows of goods, services and capital, and how this varies by industry sector. It provides strong insights into how place-based policies can be customised to be more effective in terms of securing more added value locally.

Multipliers

Our second approach complements the above models by estimating local employment multiplier effects created by particular investments. It can also be used to estimate future changes in regional output and productivity. There is significant variation between sectors, firms and particularly the specific functions or activities of firms, in terms of local impacts. A new distribution depot will employ lower-skilled, lower-paid workers compared to a new R&D centre, but usually more. The former can help reduce unemployment but does not improve average productivity. The latter creates higher-average productivity and larger consumption multipliers through employing higher-paid workers, but it can also displace lower-income workers (e.g., through house-price inflation) and therefore enhance inequality.

Another important dimension of these multiplier impacts is the degree of local ‘embeddedness’ of a firm, including upstream and downstream linkages (Collinson et al., 2020). Local impact varies according to both the total volume of direct and indirect economic activity, including employment, generated by a firm / an investment, and the proportion of this activity which takes place within the regional economy. It can be helpful to think about four key ratios, which we combine to produce a ‘Local Contribution Index’ (LCI):

- Local employees as a percentage of total employees

- Local sales as a percentage of total sales

- Local customers as a percentage of total customers

- Local ownership as a percentage of total ownership

A weighted average provides a ranking of firms in terms of their local embeddedness and expected multiplier effects. The direct and indirect employment and spending that result from the economic activity created by a new investment, and where this spending takes place, are key factors determining local economic contribution. This comes directly from jobs in the firms that are part of the cluster, and indirectly from local companies contracted by firms in the cluster (suppliers, cleaners, consultants etc.) who experience a growth in demand. A wider set of multipliers occurs when these employees spend locally, supporting additional jobs in local service providers, like restaurants, retailers, hairdressers and so on (which in turn have suppliers). The more of this economic activity that occurs locally, the more the region benefits from the capital investment at the start of the multiplier sequence. When we account for displacement effects (new jobs at the expense of jobs lost in nearby areas) and other complexities, for some types of investments, firms or sectors the local effects are significant, for others they are negligible. You can also see fairly easily that small firms will have a smaller volume of impact, but more of it will be local.

Automotive vs. Gaming?

As an example, if we compare the local impact of a large automotive cluster in the West Midlands with the creative gaming industry in Leamington Spa, the differences become clearer. The flagship firm JLR employs around 36,000 people in the UK and most of them are based in the West Midlands. But it supports an estimated 216,000 indirect jobs, largely locally via tiered supply chains. The extent of the loss, if JLR and other automotive manufacturers relocated elsewhere or collapsed the impact would be significant, and it would be largely focused on the region (Qamar, Collinson and Green, 2023).

The scale of employment in the computer gaming cluster in Leamington Spa (‘Silicon Spa’), which is comprised of almost 50 game development studios, is obviously far smaller. With an estimated 2,500 employees (but this accounts for 12% of the UK gaming industry) it is one of only two locations outside of London where this industry sector contributes over £100 million GVA (Davies and Collinson, 2023).

If we account for the difference in the scale of the local economic impacts, there are still important differences in the type of economic benefits flowing to the respective local areas. Growth in gaming-related jobs will increase the average GVA, compared to automotive manufacturing. One estimate suggests that the average GVA per head is £83,800 as against the UK average of £62,100 which is higher than the average in automotive manufacturing. The spending multiplier per job is also likely to be higher, but little of the gaming ‘supply chain’ is local and much of the ancillary economic activity is online. The wider economic dependence on this type of cluster is far smaller than for JLR, not just because of the volume and type of jobs, but because of the very different nature of the value created and its connection with the location. Policy interventions need to be developed, customised and delivered with these considerations in mind.

Where and How Universities Can Help

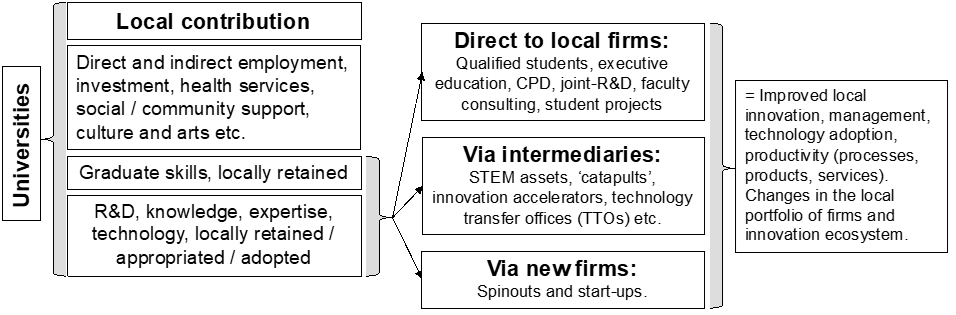

So, universities, in combination with other stakeholders, could more precisely target areas of growth, helping to attract specific kinds of inward investment, promoting starts ups and spinouts in selected industries, or helping existing firms to transition into new growth areas. A simple logic chain appears below, in Figure 1.

Figure 1: Local Pathways for Universities’ Contribution to Regional Innovation Ecosystems

But alongside doing more, the evidence suggests that focusing on particular firms, industries and economic activities, would yield greater long-term benefits for regions.

As a starting point, the above examples demonstrate that one of the contributions universities can provide, following the City-REDI example, is evidence and insight into the unique challenges and opportunities each region faces. This kind of objective, robust and data-driven policy support fills a current (capacity and capability) gap for local authorities in the UK, undermining their ability to be precise in investment asks of central government.

But the bigger gain would come from better aligning university assets, science, technology and R&D capabilities to the demand-side of innovation needs in local firms. As the UK government, via the Department for Science, Innovation and Technology (DSIT), UK Research and Innovation (UKRI) and other bodies, develops a stronger place-based approach to innovation and growth, support structures and incentive mechanisms should incorporate the above insights to target their efforts. This includes university-industry partnerships, technology transfer offices (TTOs), STEM assets, such as the MTC and WMG in the West Midlands region, and Small and Medium-sized Enterprises (SME)-support and scale-up programmes. The incentives that might be required to focus universities on these outcomes are also an important consideration. Most of the above have an element of public funding, and this enables some degree of locally customised targeting to be introduced. Recently announced government initiatives in England, such as the pilot £60 million ‘Regional Innovation Fund’ (discussed in the next blog in the series), provide the opportunity to do just this.

This blog was written by Professor Simon Collinson, Professor Fumi Kitagawa, Chair of Regional Economic Development at City-REDI / WMREDI, University of Birmingham and Tomas Ulrichsen, Director of the University Commercialisation and Innovation (UCI) Policy Evidence Unit at the University of Cambridge.

Disclaimer:

The views expressed in this analysis post are those of the authors and not necessarily those of City-REDI, WMREDI or the University of Birmingham.