Co-authored by Huanjia Ma and Simon Collinson, they have been discussing new firm creation in regions outside London and the South-East in the context of the government’s levelling up policy plans.

The UK government’s recent levelling up plans promise large investments in infrastructure, R&D, skills and education, and the relocation of public sector employment, to stimulate economic growth in regions outside London and the South-East. One of the major objectives is to improve the innovation ecosystems of these regions and drive-up firm-level productivity.

One of the challenges facing this agenda is the persistently lower levels of new firm creation in places that have experienced slower economic growth. This is one key indicator of the entrepreneurial vitality of regional systems of innovation and should be a focus for policymakers.

Spatial Patterns of New Firm Formation

Recent data shows that the number of new firms created across the UK has grown relative to the pre-covid period, indicating a strong recovery and future employment opportunities. However, London still accounts for a disproportionately high percentage of the total number of new firms and is the main driver of this UK-wide growth trend.

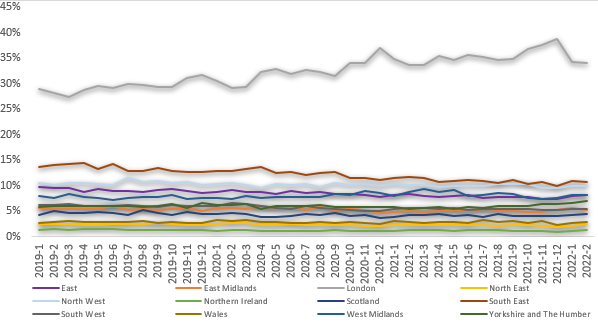

Figure 1 plots the percentage of new firms created in UK regions by NUTS1 since January 2019 using registry data which includes information on all 5 million UK companies from Companies House (published in March 2022; the data can be found here). The percentage of firms created in London increased from 29.6% in January 2019 to 35% in January 2022. On the other hand, the percentage of firms created in South-East declined to 10.7% in January 2022 from 13.6% in 2019. The total percentage of firms created in regions outside London and South-East has decreased from 57% in January 2019 to just over 54% in January 2022.

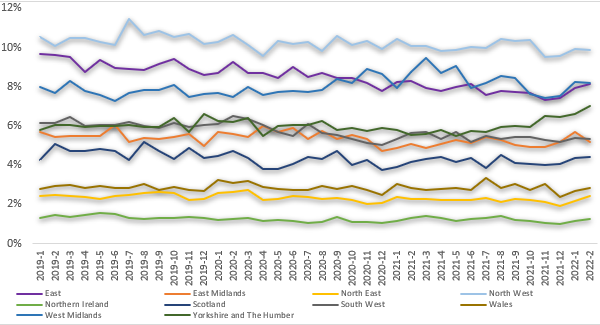

There is also a large disparity between regions outside London and the South-East (Figure 2). In January 2022, North-West leads other regions with 10% of new firms created. East and West Midlands follow with 8.2% of firms created. The North-East sits at the bottom of the ranking of English regions with just 2% of firms created over the last three years, surpassing only Northern Ireland in the UK. There were no significant changes in trends in most regions. The share of firms in the East declined to 8% in January 2022 from 9.6% in January 2019. While the share of firms created in the West Midlands briefly increased to 9.4 in March 2021, it fell to 8.2% again in January 2022. On the other hand, Yorkshire and Humberside is the only region growing their share of overall firms created since the start of the Covid Pandemic in March 2021.

Note that the data is a snapshot of firms that are still alive as of March 2022. A region with a high firm birth rate and a high death rate will look very similar to a region with moderate birth and death rates. So, the data reflects how long new firms survive in different regions, and points very clearly to the breadth and depth of policies needed to incentivise firm creation outside of London and the South-East.

Too Few High-Tech and Knowledge-Intensive Services Firms in Target Regions

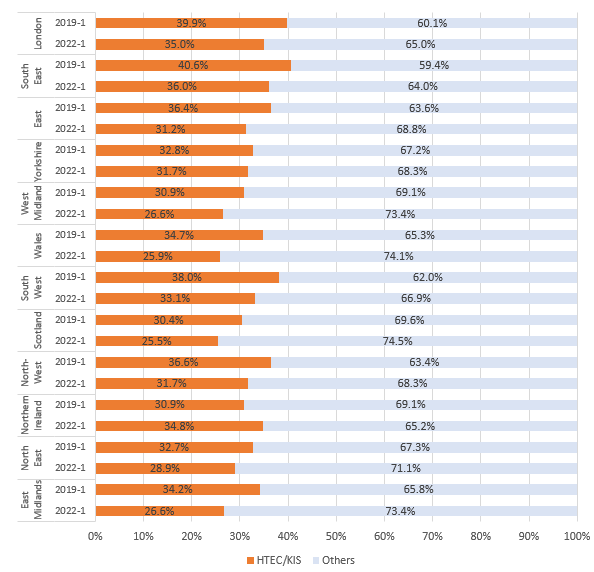

For the UK overall, and particularly for regions outside London, more High technology (HTEC)/ knowledge-intensive services (KIS) firms need to be created as part of the wider drive to stimulate innovation. However, the opposite is happening. Combining firm registry data with Eurostat data on HTEC/KIS firms, we can trace the total volume and geographic distribution of these over time. Nationally, HTEC firms in the economy remain consistently low at around 0.2%, with no significant increase between 2019 and 2022, and the share of new HTEC/KIS firms declined from 36.8% in 2019 to 31.8% in 2022.

Figure 3 shows the share of new firms in HTEC/KIS industries except for London and the South-East in January 2019 and January 2022. The share of HTEC/KIS firms decreased from 2019 to 2022 in almost all regions except Northern Ireland. The shares of HTEC/KIS firms in London and South-East are highest in the UK (35% and 36% respectively). There is also a wide discrepancy in the shares of HTEC/KIS firms among other regions. Take the West Midland as an example, the share of HTEC/KIS firms is 26.6% in January 2022, this is notably lower compared with 31.7% in the North-West and 31.2% in the East where there are a similar number of new firms created.

It is important to recognise that this only reflects the number of firms and not the level of added value created by firms. The West Midlands may produce as much as value added in HTEC/KIS industries compared to the other regions with a higher percentage of new firms in HTEC/KIS industries.

What Kinds of Policy Interventions are Needed?

If the government follows up on its pledge to increase public R&D spending outside London by 40% by 2030, there are significant opportunities to attract matched private sector investment in R&D and help regions grow. But this should be done on the basis of a robust understanding of (1) local regions and their very different growth constraints and opportunities, and (2) past evaluations and experience of R&D investment as a stimulus for local growth.

In particular we know that:

- Some policies can crowd out existing local industries. There is evidence showing that the relocation of public workers, for example, can have the effect of crowding out tradeable sectors (such as manufacturing) while only increasing employment in non-tradable sectors (such as construction).

- Inward investment by R&D-intensive firms which employ higher-skilled, higher-income earners usually has a positive effect on regional productivity (GVA per head) and consumption-driven multipliers through increased demand for local services. But this can also drive-up house prices and displace lower-skilled workers, often to areas where they have less access to employment.

- New entrants into a region may also have fewer local linkages, and for example, create less demand for local SME suppliers. This results in lower spill-over or multiplier effects for other firms in the region.

All of these examples illustrate the importance of understanding regional economies as complex, interactive systems. This also points to the need for coordination across a range of complementary policies, addressing skills, housing, transport infrastructure, business support programs and entrepreneurship support.

Firms, Jobs and Households

One of the most important relationships in regional socio-economic systems is the link between firms and households, largely mediated via employment. Firms create employment that underpins household incomes. More high-income jobs (a product of firm demand and skills availability) mean higher average household incomes and less vulnerability and deprivation, but only if these jobs are spread across socio-economic groups.

A high level of new business formation in a region indicates a vibrant entrepreneurial culture, but if the mortality rate is also high, this is unlikely to help create long-term employment. Out of just over 3 million firms in the UK in 2020, there were 358 thousand new firms born (11.9%) and 316 thousand ‘deaths’ (10.5%). London had the highest rate of turnover, with both the highest business birth rate at 14.0% and death rate at 12.1% but resulting in a strong net growth rate. The West Midlands had one of the highest birth rates at 12.2% and the second-highest death rate of 11.9%. Its net rate of firm formation for that year was 0.3%, the lowest of the English regions and this has been a consistent challenge for the region.

Depending on the local dynamics of firm creation, individuals and households with different backgrounds will be affected differently. New firms will increase competition levels and can push incumbent firms in the same industry to innovate. This can drive increased investment in R&D and labour skills, which grows the pool of skilled workers. But less innovative, agile firms can be driven out of the market, and this will normally impact lower-skilled workers and increase unemployment in lower socio-economic communities.

Labour markets are also dynamic. If new firms are in high-skilled, knowledge-intensive sectors this can attract national and international migrant workers. High-skilled migration has a complex impact on the local economy. On the one hand, it benefits both native skilled and unskilled individuals by promoting long-run economic growth by creating innovation, increasing productivity, and expanding the consumer base. But it can also have negative effects, leading to reduced wage and employment opportunities for low-skilled workers, pushing up the cost of living (particularly housing) and creating welfare loss through a squeeze on relative incomes. If most new firms are less skill intensive, this is positive in terms of reducing unemployment (but also lowers productivity). But it can trigger the in-migration of low skill workers and depress wages, with a longer-term impact on more deprived communities.

Conclusions

The Government’s plans to improve innovation ecosystems and entrepreneurial vitality through a basket of policies face an uphill struggle. Both the spatial data and the trend data on new firm formation work against this objective and point to the need for stronger policies and higher levels of investment. The share of new firms in regions outside London and the South-East has decreased despite the fact that more new firms have been created across the UK, relative to the pre-covid period. In addition to this, the presence of HTEC/KIS firms in low-growth regions is small and declining. These are critical to regional innovation and competitiveness, and to high-skilled and high-income employment.

This blog was written by Huanjia Ma, Research Fellow, and Professor Simon Collinson, City-REDI / WMREDI, University of Birmingham.

Disclaimer:

The views expressed in this analysis post are those of the authors and not necessarily those of City-REDI or the University of Birmingham.