Alice Pugh looks at the impact of lockdown on Small and Medium Enterprises (SMEs), what support they’ve received and how they have fared compared to their larger counterparts.

Covid-19 has created significant shocks throughout the business base. In the first wave, 47% of all UK industries reported that their turnover had been lower than normal within the last two weeks. As a result of this decrease in trade across all industries on average 29% of firms were having to lay off staff in the short run and 16% of firms across all industries stated that they were confident they would survive Covid-19, with 44% unsure (ONS Covid-19 waves statistical bulletins). In order to mitigate the impact of Covid-19 on businesses within the UK, both national and regional governments introduced schemes to help businesses (For more information on the impact of Covid-19 on the West Midlands visit City-REDI Blog Weekly Economic Impact Monitor).

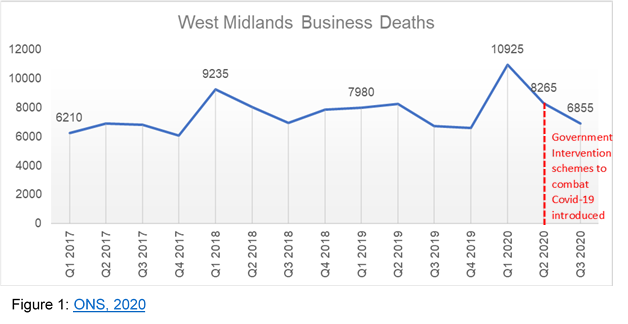

In the first quarter of 2020, not only did Covid-19 hit the UK economy but, the UK also left the EU on the 31st January 2020, having failed to meet the deadlines for a trade deal agreements (City-REDI Blog on UK-EU trade). This led to the highest number of business deaths in one quarter since Q1 2017; the number of deaths for this quarter was 35% higher than the average number of deaths in the same quarter of the previous 3 years. The West Midlands also saw its highest number of business deaths since 2017, at 10,925 business deaths. Figure 1, shows business deaths from Q1 2017 to Q3 2020, in Q1 2020 the number of business deaths was 76% higher than it had been in Q1 2017 and 18% higher than it had been in the previous highest quarter in 2018 (Q1). Covid-19 led to an increase in the number of  business deaths and the Government had to provide interventions in order to mitigate any further impact of Covid-19 on businesses, especially when the UK is in the processes of exiting the EU. Several intervention schemes were introduced including the furlough scheme, grants specified for businesses that would face greater restrictions on their businesses (e.g. nightclubs, restaurants etc) and other grants and loans were made available depending on the size of the firm.

business deaths and the Government had to provide interventions in order to mitigate any further impact of Covid-19 on businesses, especially when the UK is in the processes of exiting the EU. Several intervention schemes were introduced including the furlough scheme, grants specified for businesses that would face greater restrictions on their businesses (e.g. nightclubs, restaurants etc) and other grants and loans were made available depending on the size of the firm.

Of UK businesses surveyed, 30% stated that they had 0 to 3 months reserves of cash; in the West Midlands, this was 26%. This is worrying as 99% of UK and 99.9% of West Midlands private sector businesses are SMEs, who are unlikely to have great access to credit when compared to their larger counterparts. In order to aid firms in England, SMEs could apply for a one-off cash grant of £10,000 from their local council. SMEs could then choose how to utilise this grant; some firms invested in PPE which would enable them to open their store, some used the cash injection to invest in new machinery that would help them meet new demands under Covid-19 or to help with cash reserves as demand falls. Whilst applications for this may have closed in October, firms who had not applied for the full amount may now apply for the rest of the grant, up to £10,000, by the end of January.

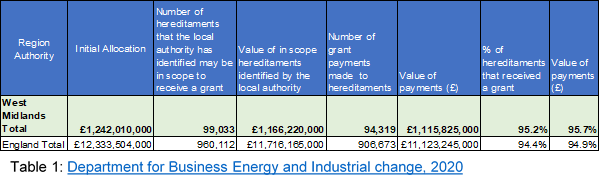

As shown in Table 1 below, 99,033 SME firms within the West Midlands were identified as potentially being within the scope to receive the grant from the Small Business Grants Fund (SBGF) and Retail Hospitality and Leisure Grants Fund (RHLGF). Of these, 95.2% of businesses had received  their grant by the 30th of September, with 95.7% of the grant value of in-scope business units (hereditaments) identified by local authorities being claimed. This provided up to a £10,000 cash grant to 94,319 businesses within the West Midlands region, supplying businesses with a cash reserve boost, which will have been utilised by firms within the region to help them through the pandemic.

their grant by the 30th of September, with 95.7% of the grant value of in-scope business units (hereditaments) identified by local authorities being claimed. This provided up to a £10,000 cash grant to 94,319 businesses within the West Midlands region, supplying businesses with a cash reserve boost, which will have been utilised by firms within the region to help them through the pandemic.

Government support mainly began at the end of Quarter 1 in April. Subsequently, there was a 37% decrease in business deaths as can be seen in figure 1; the largest fall in two quarters between Q1 2017 and Q3 2020. This suggests some of the government support provided to help businesses cope with the pandemic has been successful, as the number of business deaths has significantly decreased by 37% between the start of the pandemic and Q3 of this year. This is in a time when business deaths should have been increasing due to falls in demand and issues with supply both as a result of Covid-19 and Brexit.

The challenge of evaluating the success of interventions during multiple shocks

Whilst, the government has analysed the impact of the Covid-19 waves (found here), there have been inconsistencies in the data sets, as earlier on surveys were smaller when compared to their successors, and questions have changed, creating disparities in data sets. To fully evaluate the success of grant schemes offered, there would need to be an in-depth evaluation conducted, which includes interviews with SMEs, to find out whether they received a grant, how it was utilised, was furlough used, the number of people furloughed; part-time/ full-time and the length of time furlough lasted. But these same questions would also have to be given to firms that permanently stopped trading due to Covid-19, to understand why the intervention schemes worked for some and not others. However, how will these be identified and approached if they no longer exist? Also, due to firms facing the duel impacts of both Covid-19 and Brexit, it may be difficult to distinguish between which firms ceased trading due to Covid-19 alone. It is important that this evaluation be conducted in the West Midlands, as SMEs not only make up 99.9% of the private sector they also employ 58% of the private sector workforce. Fully understanding how SMEs cope with this shock will be important for future policy. Especially as the World Health Organisation, has predicted increases in the frequency with which we suffer pandemics, as climate change worsens.

This blog was written by Alice Pugh, Policy and Data Analyst for City REDI and WM REDI.

Disclaimer:

The views expressed in this analysis post are those of the authors and not necessarily those of City-REDI or the University of Birmingham.