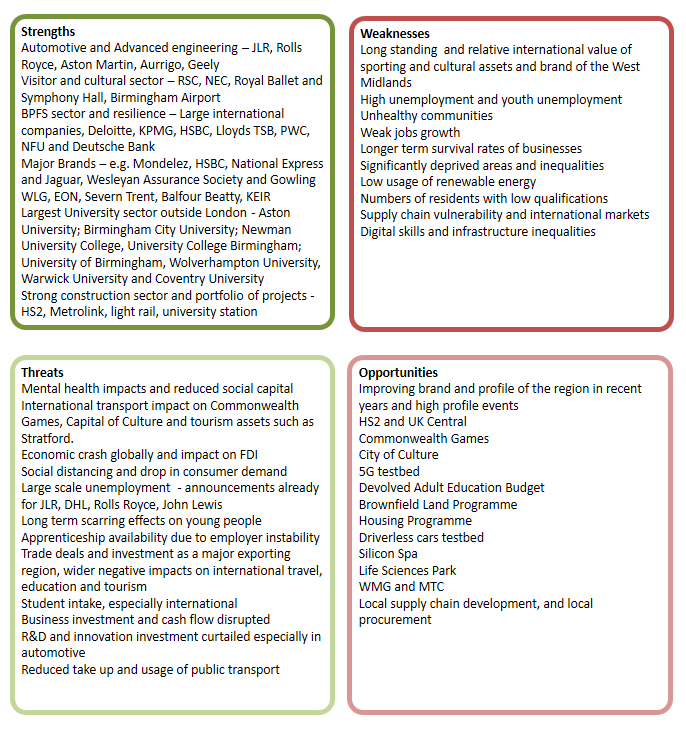

This blog is based on a review of assets carried out as part of the Midlands Engine Independent Economic Review and the development of LEP profiles. We have also looked at what the major risks are to those assets going forward. You can find full details in the State of the Region 2020.

This blog is based on a review of assets carried out as part of the Midlands Engine Independent Economic Review and the development of LEP profiles. We have also looked at what the major risks are to those assets going forward. You can find full details in the State of the Region 2020.

Tourism Assets

The OECD has stressed how the pandemic and measures to contain its spread are having a heavy impact on the tourism economy. Its analysis shows that depending on how long the crisis lasts, the potential shock could cause a 60-80% decline in the international tourism economy worldwide in 2020. Whilst Coventry and Warwickshire is less reliant on tourism than other parts of the national economy overall, certain areas are likely to be heavily hit in the short-term. This includes Stratford-upon-Avon which, according to estimates by Centre for Cities, is likely to suffer one of the largest declines in GVA in the West Midlands. If the crisis continues, the projected benefit from Coventry being UK City of Culture could also be threatened, although the start date has been pushed back to May 2021. The rise of virtual meetings during the pandemic raises questions over whether Birmingham will continue to see growth in its business tourism sector.

International Travel

If Coronavirus has a medium to long-term impact on air travel, being close to Birmingham International Airport would be less beneficial for the region than previously (i.e. the benefits of productivity would be less). Forecast growth in passenger numbers over the next decade may be impacted. Whilst the extent of the medium-long-term impact is as yet unclear, we know that traffic at the airport has fallen considerably since March, declining by 90% in April. The Chief Executive of the airport stated at the end of June that they expect a passenger scenario for this financial year of 90 per cent less than in 2019/20. We have already seen this start to negatively impact on jobs in the region, with the airport announcing plans to cut up to 250 jobs representing 27% of its workforce due to unsustainable income losses.

Young People

Young People

A concern across the West Midlands, but especially in Greater Birmingham and Solihull and the Black Country, where skills levels are lower and unemployment rates higher, is that recent progress in increasing skills and employment levels will be slowed or reversed as a result of the pandemic. Unless effective countervailing measures are introduced at a national level, it is likely that lockdown is reducing opportunities for young people to gain work experience and participate in work-based learning. Although the number of apprenticeship starts across the West Midlands is increasing, numbers remain low, and the Covid-19 crisis is creating worries that there will be less appetite for recruiting apprentices in firms going forward. A survey by the Association of Employment and Learning Providers found 60% of employers nationally have stopped recruiting apprentices. It is encouraging that the government has announced an “opportunity guarantee” to ensure every young person had the chance of an apprenticeship or placement. However, it as yet unclear if the placements will be paid and if a guaranteed interview will be available at the end of the placement. Evidence emphasises the importance of supporting out-of-work people, particularly young people and those over 50 to rapidly find work if they are to avoid long-term unemployment.

Life Sciences

Assets in the West Midlands likely to be strengthened rather than weakened by the COVID crisis include those linked to life sciences. Birmingham with its Life Sciences Park due to open in 2022 and associated well developed medical technology complex (including various hospitals, University of Birmingham Medical School, Birmingham Health Partners and the Institute of Translational Medicine) appears particularly well placed to be at forefront of developing this sector.

Universities

The Coronavirus crisis is also having an impact on universities in the region. City-REDI research into the impact of student spending, paints a worrying picture for the West Midlands. It finds important variations across the UK by region in the benefits generated by student spending with the West Midlands hardest hit. The West Midlands (NUTS2) is the region that generates the largest multiplier for the UK economy with student spending generating over 4 billion pounds of output, 2 to 3 billion GVA and supporting between 44 and 55 thousand jobs. These figures suggest that student spending generates up to 4.2% of GVA in the West Midlands. Student expenditure directly supports 4.2% of employment in the West Midlands compared to up to 2% nationally. This means that for each 3 to 5 students not starting in September 2020, a job is at risk. Universities also underpin the innovation assets across the three LEP areas, and the West Midlands is a leader in the business R&D which with reduced investment capacity in the private sector may be hit hard. Especially in the automotive, aerospace and manufacturing sectors

Transport

The drop in patronage of transport assets could reduce the available income for further investment, and the costs of running a much-reduced infrastructure under social distancing and lockdown measures could make private and public sector delivery unsustainable. A drop in passenger numbers in the regional airport as highlighted earlier also threatens the integrated infrastructure which has made the West Midlands the heart of the transport network. Future-proofing already in place in the region such as autonomous vehicles and electric vehicles could see demand accelerated because of the need for personal and safe transport options.

Digital and Technology

Coventry and Warwickshire is home to one of the country’s largest digital gaming sectors and this sector has seen significant growth and demand under lockdown. Accelerated digitisation and application of technology has accelerated with increased homeworking and adoption by businesses of online sales. This presents an opportunity for the region to build and expand the skills and expertise.

Key companies

Many of the regions key companies are under significant pressures, with redundancies being announced and more expected. The companies most at risk are those that rely on face to face business, non-food consumer demand and international supply chains. This puts many of our region’s assets at severe risk, such as automotive, tourism and hospitality, retail, passenger transport, manufacturing and culture. Loss of major companies also reduces the investment they make in their supply chain, R&D, skills and supply chains.

This blog was written by Dr Abigail Taylor and Rebecca Riley, City-REDI / WM REDI, University of Birmingham.

Disclaimer:

The views expressed in this analysis post are those of the authors and not necessarily those of City-REDI or the University of Birmingham.

To sign up to our blog mailing list, please click here.