Dr Anandadeep Mandal, Scotcoin Distinguished Chair of Digital Finance and Programme Director MSc Financial Technology

Department of Finance, University of Birmingham

Cryptocurrencies have become increasingly popular in the recent years due to their decentralised nature and potential for excessive returns. However, the crypto market also has a dark side. Over the years we have witnessed hacking, theft, money laundering and fraud.

What are cryptocurrencies?

Cryptocurrencies are digital tokens using cryptography for security. Unlike fiat currencies (a type of currency that is not backed by a commodity, such as gold or silver), cryptos are decentralised and are independent of a central bank. The decentralisation means that the transactions are verified and recorded on a public digital ledger, implemented by blockchain. Over the years there have been several cryptocurrencies introduced and traded in the market. These digital tokens can be traded over online exchanges and can be used to purchase goods and services. Bitcoin, introduced in 2009, was the first and is the most popular crypto currency.

However, due to lack of regulations and accountability associated with cryptocurrency trading, there have been several incidents of hacking and fraudulent events. For instance, according to the Federal Trade Commission (FTC), during January 2021 and June 2022, more than 46,000 individuals reported losses exceeding $1 billion in cryptocurrency due to various fraudulent activities. Last year, the total value of crypto-related crimes reached a record-breaking $12 billion. To put this into perspective, the loss equates to $1.4 million per hour over the previous year due to crypto-related crimes.

Crypto as an investment

Low transaction costs and decentralisation characteristics attract investors towards crypto trading. However, lack of monitoring mechanisms increases the risk of crypto theft. One of the most notable examples of this is the Mt. Gox exchange hack in 2014, where over 850,000 Bitcoins worth over $450m were stolen arising from security vulnerabilities in the exchange.

Further, cryptocurrencies are extremely volatile. The volatility arises from several factors including, market sentiments, transparency of information, lack of market knowledge and understanding, speculation, economic factors, and herd behaviour. Several of these factors are difficult to estimate and forecast, making investing in cryptocurrencies risky.

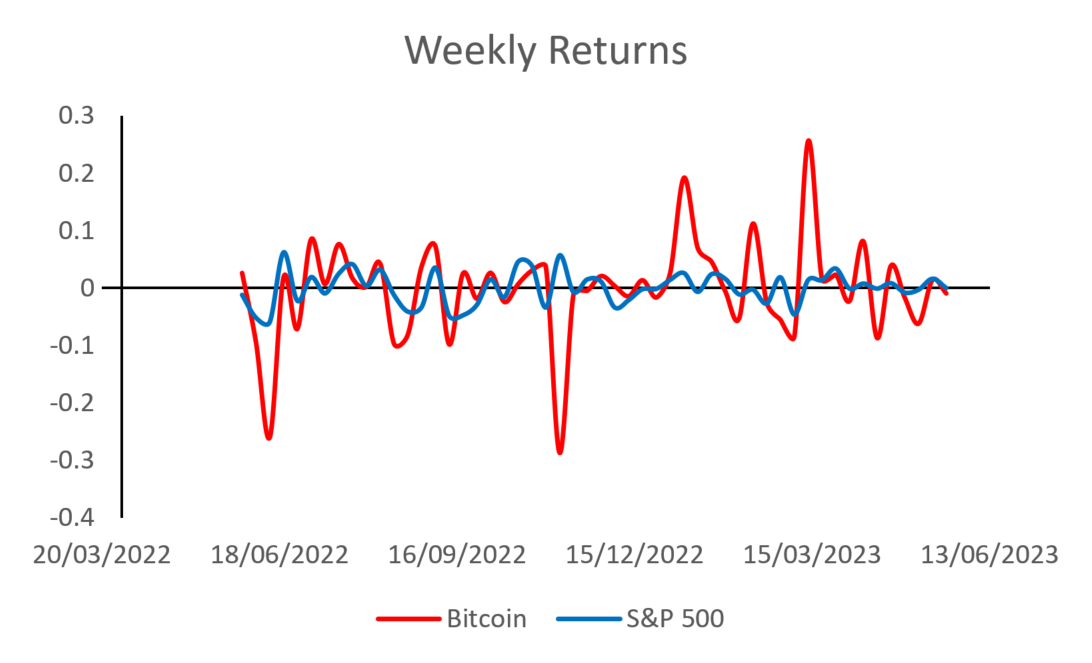

When comparing the returns of stock market (S&P) and cryptocurrency (Bitcoin) over the last year, it is evident that crypto volatility is significantly higher, and the losses are enormous. To illustrate from a trading standpoint, Cathie Wood, the CEO of ARK Invest, outlined her prediction that the price of BTC would range between $1 to $1.5 million USD per coin by the year 2030. This volatility in pricing is driven by several factors: i) cyberattacks, ii) lack of regulations and adaptation; iii) fierce competition among various blockchain projects, iv) vulnerabilities in cutting-edge technologies and v) scepticism around cryptocurrencies.

When comparing the returns of stock market (S&P) and cryptocurrency (Bitcoin) over the last year, it is evident that crypto volatility is significantly higher, and the losses are enormous. To illustrate from a trading standpoint, Cathie Wood, the CEO of ARK Invest, outlined her prediction that the price of BTC would range between $1 to $1.5 million USD per coin by the year 2030. This volatility in pricing is driven by several factors: i) cyberattacks, ii) lack of regulations and adaptation; iii) fierce competition among various blockchain projects, iv) vulnerabilities in cutting-edge technologies and v) scepticism around cryptocurrencies.

Crypto regulations in the UK

Scepticism around cryptocurrency has led to placing regulations and restrictions in the crypto trading market. Although cryptocurrency transactions are not banned in the UK, it is still not considered a legal tender. The Cryptoassets Taskforce was established in 2018 to harmonise the views and concerns of the Financial Conduct Authority (FCA), UK Treasury, and the Bank of England regarding regulating cryptocurrencies. Since then, the FCA has implemented multiple safeguards to protect consumers, such as cautioning about the risks associated with cryptocurrency transactions. Additionally, businesses participating in crypto asset activity within the UK must register and follow protocols to prevent money laundering and terrorist financing (HM Treasury, 2023). Recently, the government announced its intention to introduce comprehensive measures to effectively regulate crypto asset activities, aimed at providing assurance and transparency to both consumers and businesses.

The outlook of crypto-trading safety

There are three key aspects that will drive the future of crypto trading:

- Emergence of decentralised exchanges: Centralised exchanges are frequent targets of hackers and are at risk of theft of users’ digital assets. For security reasons, more and more cryptocurrency investors will choose decentralised exchanges in the future. With the development of the industry and private key management technology, the transaction efficiency of decentralised exchanges will improve. To overcome the problem of low trading efficiency, coupled with high trading security, decentralised exchange trading will likely become mainstream in the future.

- Advancement in encryption technology: Advanced encryption technologies are used to improve the security of cryptocurrencies. Adaptation of multi-signature technology can not only be used to protect the private key but also can be used in the process of cryptocurrency transactions. It needs multiple authorisation keys for Bitcoin transactions, which can share the responsibility of owning Bitcoin among multiple people and avoid hackers and single points of failure.

- Proof of Activity system (POA) will be combined with decentralised technology: Compared to Proof of Work (POW) and Proof of Stake (POS), POA has a more secure consensus mechanism, higher transaction speed, and lower energy consumption. However, the POA model is centralised and makes the system more efficient. Because of the centralised features of the POA system, the security of the entire system can be compromised. In future, the POA model is expected to combine with decentralised inter-chain interoperability protocols to improve transparency while ensuring security.

Even though cryptocurrencies may have their own set of advantages, investors need to be aware of the risks involved. Investing in cryptocurrency can be a risky decision because of various factors, including lack of regulation, susceptibility to hacking, lack of widespread adoption and the volatility of the market.

The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of the University of Birmingham.