By Dr Jing Du, Lecturer in Finance

Birmingham Business School, University of Birmingham.

The latest UK Household Finance Index (IHS Markit) shows that households in the UK hold renewed pessimism about their financial outlook over the next 12 months.

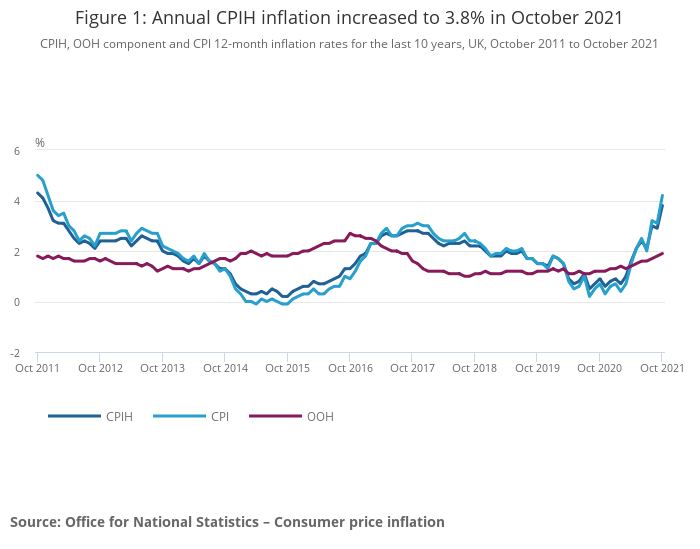

Due to sharply increased inflation, British residents are experiencing higher prices on their everyday goods and services, causing them to spend hundreds of pounds more on their daily bills. The Bank of England (BoE) predicts that UK inflation will continue to rise, increasing from 4.2% to approximately 5% by April 2022. On top of inflation predictions, interest rate is at an historic low, indicating people are losing their purchasing power with every passing month.

Inflation can be caused by a number of factors. The largest contributor being fuel and energy costs for the most recent surge. The average price for petrol currently stands at 147p/litre in the UK, and many businesses will be passing the extra cost onto their customers. A second issue is that shortages of many commodities and materials lead to imbalances in supply and demand, and therefore higher prices. Moreover, it is difficult for businesses to recruit lorry drivers and hospitality staff, leading to further supply chain disruptions. Finally, it comes to the end of government support to businesses, such as reduced VAT for hospitality, during the pandemic.

The latest UK Household Finance Index (IHS Markit) shows that households in the UK hold renewed pessimism about their financial outlook over the next 12 months. The Index shows that both the overall financial wellbeing and the cash available to spend of UK households experienced a decline. People’s time preferences for their money changes with the inflation. If inflation is expected to increase, you are more likely to make purchases today as your money will buy less in the future. Therefore, it is worthwhile to think about something that you can do to manage your personal finance and combat inflation.

Outside of funds for emergencies, you may want to invest some of your savings into the stock market. By doing so, it could generate higher expected returns, beating inflation. However, it also comes with a higher risk of losing your money. Therefore, it is crucial to keep a diversified portfolio (e.g. with growth stocks and dividend-paying equities) and always keep your risk tolerance in mind. Besides, investors may want to have long-term investments, as it is demonstrated that a diversified basket of stocks can beat the inflation rate over time. On the other hand, inflation affects long-term bonds more significantly, as the longer the term of a bond, the more its price will drop when interest rates increase. It means that in order to offset the damage, you may want to incorporate some bonds with a shorter maturity into your portfolio. Including inflation – linked bonds could be another good strategy.

Apart from financial assets, some physical assets, such as property and precious metals, could be considered to combat inflation. Being a homeowner rather than renting could protect you from inflation by avoiding increased rent, and gold is always considered as a safe haven from inflation.

From a consumer’s perspective, it is important to know your priorities and put together a budget. Your budget will help you to determine your expenditure priorities and ensure that you are watching what you spend. It is useful to think about ways to stretch your budget further without affecting your quality of life. You can go through bank statements and trim any unnecessary expenses, such as reducing eating out and making your own coffee at home.

Consumers can also shop smarter, making use of coupons, shopping at bulk stores, and stocking up on some non-perishable food and other essentials when they are on sale. Checking your phone contracts, home broadband, insurances, and energy bills is also important. You may want to consider undertaking energy efficiency projects at home, such as sealing your windows and doors or installing solar panels. When you buy a durable good, make sure you buy a quality one as the performance-price ratio is higher over time.

Finally, yet importantly, you can still have fun by exploring free and cheap things. For example, you can do container gardening to save money and also feel the joy of growing your own goods and take advantage of museums with free admission. Besides, households can exchange or sell items they no longer need (i.e. Freecycle), which both saves money and is sustainable.

Overall, although we are negatively affected by surging inflation, we should not overreact. We can prepare for it and mitigate its effect by controlling and managing our financial decisions.

- Find out more about Dr Jing Du at the University of Birmingham

- Back to Social Sciences Birmingham

The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of the University of Birmingham.