First things first, stay in as much as possible. Never before such a simple action could have such a big impact. From protecting your loved ones to helping the economy, staying in is currently one of our best weapons. The more we stay in, the quicker we will be out of this challenge.

First things first, stay in as much as possible. Never before such a simple action could have such a big impact. From protecting your loved ones to helping the economy, staying in is currently one of our best weapons. The more we stay in, the quicker we will be out of this challenge.

Beyond the current health crisis, the economy is bracing for a significant downturn as well. This may be secondary at the moment but it is worth remembering that economic crises, and their management, cost lives as well. Undoubtedly, there is an economic challenge in front of us. At the very basic level, production is the outcome of the combination of capital and labour, and whatever you multiply by zero labour is zero product.

Estimating the crisis impact is difficult and risky. We have a systemic downturn on one of the most complex systems, our interconnected global society. What we can do about this is:

1) Test alternative scenarios such what André Carrascal-Incera has done here, here and here.

2) Consider the particularities of places and the extent of interconnectedness as Simon Collinson is doing in his blog.

What I am focusing on is a reflection on the magnitude of the 2008 crisis and a consideration of the factors at play for the current one for the West Midlands. From past experience, we know that the economic crisis will not be the same across places (Kitsos and Bishop, 2018). Different characteristics will exacerbate or mitigate the crash making local resilience a key determinant of the degree of the impact across different localities.

Tables 1 & 2 show the 2008 crisis impact on the UK, West Midlands Combined Authority (WMCA), constituent Local Authorities and Local Enterprise Partnerships. These geographies enable us to both see how the combined authority has performed differently compared to the country and how the different areas within the combined authority experienced the 2008 crisis.

The employment rate drops show the difference between the highest pre-recession and the lowest post-recession employment rate. WMCA has lost twice the percentage points (5.4) of the UK drop (2.4). Employment numbers were down by 50,000 jobs or 4.48% of the pre-recession peak. Similar variations are found for unemployment rates and numbers of those unemployed as well as those claiming for Job Seekers Allowance (JSA) and the GVA.

The differences within WMCA are even greater with Solihull losing 13% of its peak employment figure, Dudley seeing an increase of 260% in the number of those unemployed and Wolverhampton losing approximately 17% of its peak real GVA.

Table 1: The 2008 crisis impact

| Geography | Peak to trough impact 2004-2017 | |||||

| Employment rate drop | Employment decrease (000s) | Employment number % drop | Unemployment rate increase | Unemployment increase (000s) | Unemployment number % increase | |

| United Kingdom | -2.7 | 489.7 | -1.70 | 3.4 | 1,108.5 | 78.8 |

| West Midlands Combined Authority | -5.4 | 49.9 | -4.48 | 5.6 | 72.4 | 88.9 |

| Birmingham local authority | -8.1 | 17.7 | -4.32 | 7 | 36.6 | 95.1 |

| Coventry local authority | -8.5 | 10.6 | -7.54 | 4.5 | 6.6 | 91.7 |

| Dudley local authority | -6.9 | 15.9 | -10.74 | 7.7 | 11.4 | 259.1 |

| Sandwell local authority | -5.6 | 5.9 | -4.93 | 8.8 | 12.4 | 130.5 |

| Solihull local authority | -10.7 | 12.5 | -12.90 | 5.3 | 4.5 | 107.1 |

| Walsall local authority | -7.8 | 8.9 | -7.97 | 6.2 | 7.7 | 108.5 |

| Wolverhampton local authority | -8.2 | 10.5 | -10.05 | 8.8 | 9.9 | 167.8 |

| Black Country LEP | -5.9 | 29.7 | -6.22 | 7.6 | 39.7 | 139.3 |

| Coventry and Warwickshire LEP | -6 | 26 | -6.41 | 4.9 | 21 | 142.9 |

| Greater Birmingham and Solihull LEP | -5.8 | 32 | -3.90 | 4.3 | 40 | 70.5 |

Source: Author’s elaboration of ONS data.

Table 2: The 2008 crisis impact

| Geography | Peak to trough impact 2004-2017 | ||||

| JSA rate increase | JSA increase (000s) | JSA number % increase | real GVA loss in 2016 £ million | % drop in real GVA | |

| United Kingdom | 2.1 | 900.2 | 114.6 | 69,051 | -4.28 |

| West Midlands Combined Authority | 3.2 | 59 | 101.2 | 4,405 | -7.66 |

| Birmingham local authority | 3 | 22.8 | 76.9 | 1,628 | -6.66 |

| Coventry local authority | 3 | 6.5 | 124.5 | 566 | -7.40 |

| Dudley local authority | 3.3 | 6.3 | 128.6 | 495 | -9.83 |

| Sandwell local authority | 3.6 | 7.7 | 118.5 | 650 | -12.12 |

| Solihull local authority | 2.8 | 3.6 | 188.2 | 963 | -14.33 |

| Walsall local authority | 3.9 | 6.7 | 146.0 | 353 | -8.77 |

| Wolverhampton local authority | 4.3 | 7.1 | 127.1 | 855 | -16.87 |

| Black Country LEP | 3.7 | 27 | 125.0 | 1,750 | -9.03 |

| Coventry and Warwickshire LEP | 2.5 | 14.3 | 153.1 | 2,171 | -9.81 |

| Greater Birmingham and Solihull LEP | 2.9 | 37 | 99.4 | 3,231 | -7.20 |

Source: Author’s elaboration of ONS data.

Current scenario estimates, under what may shortly seem as optimistic assumptions, suggest a loss of 65,000 jobs and 4.75% of GVA for the WMCA. So the region is looking at least at a similar impact to the 2008 crisis albeit within a much shorter timeframe.

There are not many reasons to support that the impact of this crisis will be geographically homogenous. Indeed the shock is different and social distancing and closures are universally applied across the country, but resilience determinants such as local industrial structure characteristics, human capital (Kitsos, 2020) and household incomes remain unevenly distributed across space.

Below we take a look at some of the variables that are likely to influence the economic hit for the region and constituent geographies.

Previously identified resilience factors

WMCA has lower than average share of self-employed than the country (Table 3). The self-employed have been identified as a particularly vulnerable group during the current crisis due to the lockdown. Simultaneously, the region suffers from lower than average level of qualifications and higher than average share of population without any qualifications. These factors have been previously identified as significant determinants of how the 2008 crisis impacted on local authorities (Kitsos and Bishop, 2018, Lee, 2014). Given the over-representation of low qualifications in transport and distribution that continues at the time of writing, it is likely that most of the COVID-19 economic crisis will hit those in the middle of the qualification distribution (NVQ1, NVQ2, NVQ3). It is important to note the significant variations within the WMCA in terms of qualifications.

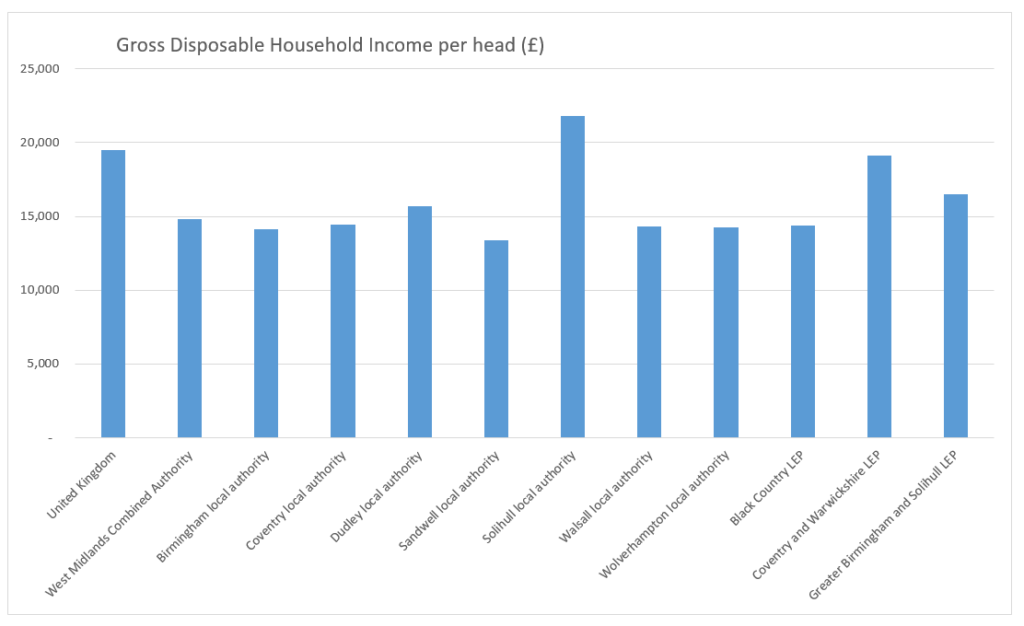

In terms of Gross Disposable Household Income (GDHI, table 3 and figure 1), the WMCA is only at 75% of the UK average. If this is linked to reduced levels of savings, households in the West Midlands are expected to be more dependent on regular employment income and hence, at a precarious position during and after the lockdown. It also can have significant knock-on effects on local authority budgets in the case that reducing disposable incomes leads to deferring the payment of council taxes and an increase in requests for support.

Table 3: Performance in resilience critical factors

| Geography | Self-Employed % | NVQ4+ % | No NVQ % | GDHI/head £ |

| United Kingdom | 10.6 | 39.2 | 8 | 19,514 |

| West Midlands Combined Authority | 7.8 | 30.5 | 12.9 | 14,846 |

| Birmingham local authority | 7.9 | 33.2 | 12 | 14,128 |

| Coventry local authority | 6.5 | 35.3 | 10.3 | 14,455 |

| Dudley local authority | 9.2 | 24.4 | 14.1 | 15,698 |

| Sandwell local authority | 6.8 | 21.1 | 20.3 | 13,359 |

| Solihull local authority | 9 | 40.2 | 6.9 | 21,782 |

| Walsall local authority | 7.7 | 30.2 | 11.4 | 14,300 |

| Wolverhampton local authority | 7.7 | 22.8 | 16.3 | 14,231 |

| Black Country LEP | 7.8 | 24.5 | 15.7 | 14,403 |

| Coventry and Warwickshire LEP | 9.2 | 38.2 | 9 | 19,146 |

| Greater Birmingham and Solihull LEP | 9.1 | 33.8 | 9.3 | 16,476 |

Source: Author’s elaboration of ONS data

Figure 1: GDHI per head (£)

Together with the self-employed, newly born firms are also expected to be increasingly impacted. The lack of credit history, and possibly experience, may make it harder for entrepreneurs to access financing either through traditional channels or via the government support schemes. The WMCA shows similar entrepreneurship rates to the rest of the country (Table 4), although the lower survival rates and the proportion of high growth firms point to increase vulnerability.

Research suggests that places with higher entrepreneurial activity have been hit harder during the recession period but recovered faster during the upturn of the 2008 crisis (Kacher et al., 2018). This makes the case for business support even stronger during downturns.

Table 4: Entrepreneurship statistics

| Geography | Business Births per 1000 population | 5-year survival rate | high-growth firms per 1000 population |

| United Kingdom | 5.7 | 42.4 | 0.21 |

| West Midlands Combined Authority | 5.8 | 40.5 | 0.16 |

| Birmingham local authority | 8.2 | 39.4 | 0.15 |

| Coventry local authority | 4.4 | 40.6 | 0.15 |

| Dudley local authority | 3.8 | 42.7 | 0.17 |

| Sandwell local authority | 4.2 | 38.9 | 0.11 |

| Solihull local authority | 5.0 | 45.9 | 0.26 |

| Walsall local authority | 3.9 | 40.5 | 0.14 |

| Wolverhampton local authority | 4.3 | 39.4 | 0.15 |

Source: Author’s elaboration of ONS data. Birth rates for Birmingham and WMCA may be overestimating births due to multiple enterprises registering in the same postcode. For more information see here.

Industrial structure

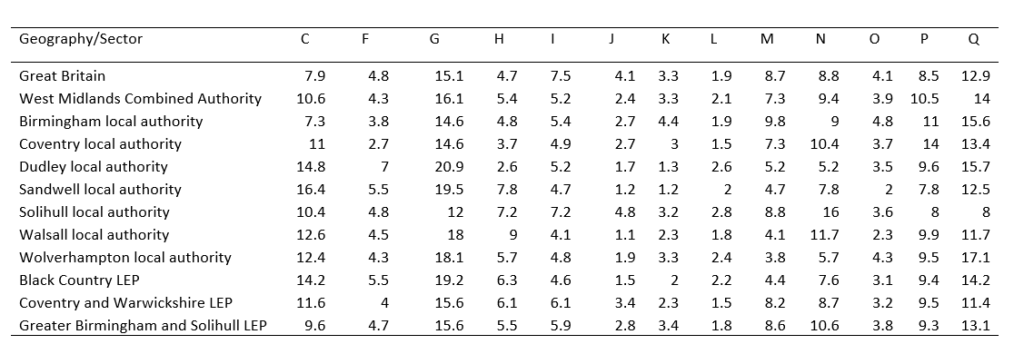

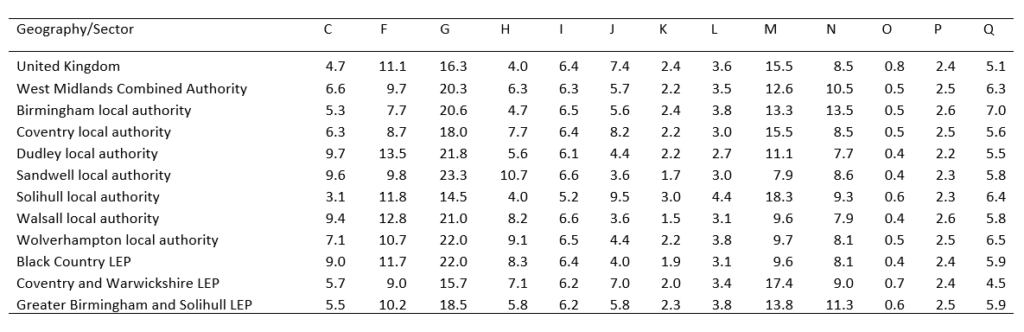

Another important factor is likely to be the relative share of industries in terms of employment and businesses (Tables 5 & 6). As André discussed in his blogs, some sectors will be severely negatively affected (see hospitality-related activities) whilst some will see an increase in demand (health services). Equally important are the links of these industries with the rest of the economy both in terms of resilience (Kitsos et al., 2019) and in terms of contagion. The high concentrations of manufacturing and wholesale and retail need particular attention in the WMCA. Especially for manufacturing, the presence of dense value and supply chains make contagion a critical matter.

Table 5: Share of sector by employment

Table 6: Share of sector by number of businesses

Key for Sector letters – Table 5 and 6

- C: Manufacturing;

- F: Construction;

- G: Wholesale and retail trade; repair of motor vehicles and motorcycles;

- H: Transportation and storage;

- I: Accommodation and food service activities;

- J: Information and communication;

- K: Financial and insurance activities;

- L: Real estate activities;

- M: Professional, scientific and technical activities;

- N: Administrative and support service activities;

- O: Public administration and defence; compulsory social security;

- P: Education;

- Q: Human health and social work activities

Homeworking

Finally, the ability of homeworking emerges as a significant factor that can shape how places are impacted by the current lockdown. Tables 7-9 show the variation of homeworking across several variables. Table 7 shows that more people work from home in Information and communication (J), Real estate activities (L) and Professional, scientific and technical activities (M). If these shares are an indication of how possible it is to perform tasks from home and hence firms to continue operating, places where these sectors are prevalent are expected to mitigate some of the crisis impact.

Table 7: Homeworking by sector

| Sector/Homeworking status | Own Home | Same grounds or buildings, or home as base | Separate from home |

| C Manufacturing | 3.9 | 6.0 | 90.0 |

| F Construction | 3.8 | 24.3 | 71.5 |

| G Wholesale, retail, repair of vehicles | 3.2 | 4.0 | 92.5 |

| H Transport and storage | 1.8 | 9.5 | 88.6 |

| I Accommodation and food services | 2.1 | 3.5 | 94.1 |

| J Information and communication | 14.8 | 12.5 | 72.5 |

| K Financial and insurance activities | 5.2 | 5.4 | 89.1 |

| L Real estate activities | 12.3 | 12.4 | 75.1 |

| M Prof, scientific, technical activity. | 12.8 | 13.5 | 73.6 |

| N Admin and support services | 5.6 | 16.7 | 77.6 |

| O Public admin and defence | 2.6 | 3.6 | 93.5 |

| P Education | 2.7 | 5.9 | 91.2 |

| Q Health and social work | 3.9 | 4.2 | 91.7 |

Source: ONS

Table 8 shows that the propensity to work from home also differs by occupation with managerial jobs being more likely to work from home. The last column also shows the share of each occupational class in the WMCA. Lower than average shares in occupations with a high probability of homeworking mean that WMCA could experience worse impact than other places.

Table 8: Homeworking by occupational class

| Occupational class/Homeworking status | Own Home | Same grounds or buildings, or home as a base | Separate from home | Share of occupational class in the UK | Share of occupational class in the WMCA |

| SOC 1 | 10.0 | 12.7 | 77.3 | 10.8 | 8.6 |

| SOC 2 | 5.8 | 7.6 | 86.5 | 20.7 | 19.1 |

| SOC 3 | 8.1 | 11.3 | 80.4 | 14.6 | 13 |

| SOC 4 | 6.9 | 2.1 | 90.8 | 10.1 | 10.2 |

| SOC 5 | 2.4 | 22.1 | 75.2 | 10.1 | 9.9 |

| SOC 6 | 4.5 | 6.0 | 89.2 | 9 | 9.3 |

| SOC 7 | 1.6 | 2.1 | 96.1 | 7.5 | 7.6 |

| SOC 8 | 1.2 | 10.1 | 88.5 | 6.4 | 9.4 |

| SOC 9 | 0.5 | 5.6 | 93.6 | 10.4 | 12.3 |

| Source: Author’s elaboration from ONS data. SOC 2010 – 1: managers, directors and senior officials; 2: professional occupations; 3: associate prof & tech occupations; 4: administrative and secretarial occupations; 5: skilled trades occupations; 6: caring, leisure and other service occupations; 7: sales and customer service occupations; 8: process, plant and machine operatives; 9: elementary occupations | |||||

Finally, homeworking also differs in space with some regions more probable to have employees working from home (Table 9). The West Midlands is lower than average and this echoes the expected impact of homeworking seen so far. At the moment of writing, data by the local authority is unavailable without access to microdata but evidence suggests that Sandwell is one of the areas with the smallest shares of homeworkers in the country.

Table 9: Homeworking by region

| Government Office Region/Homeworking status | Own Home | Same grounds or buildings, or home as a base | Separate from home |

| North East | 3.5 | 7.0 | 89.3 |

| North West | 4.2 | 8.1 | 87.4 |

| Yorkshire and The Humber | 4.6 | 8.9 | 86.1 |

| East Midlands | 4.4 | 9.6 | 85.7 |

| West Midlands | 4.3 | 8.6 | 86.8 |

| East of England | 5.5 | 8.5 | 85.7 |

| London | 5.5 | 9.4 | 84.6 |

| South East | 6.8 | 10.8 | 82.1 |

| South West | 6.4 | 11.9 | 81.4 |

| Wales | 4.4 | 9.6 | 85.6 |

| Scotland | 4.0 | 6.2 | 89.6 |

| Northern Ireland | 3.8 | 5.6 | 90.0 |

| UK | 5.1 | 9.1 | 85.5 |

Source: ONS

Overall, it is too early to estimate the effects of the COVID-19 disruption to the economy with any degree of certainty. What is widely expected, is that despite the global nature of the shock, local responses will likely differ. This will be due to local differences in the presence of previously identified resilience determinants such as stocks of human capital, as well as to differences in factors that are particular to this crisis such as the ability of homeworking, the characterisation of businesses as essential and non-essential and the length of the lockdown. The realisation that this crisis will be mitigated by brave and unprecedented fiscal measures rather than austerity, is a reason for cautious optimism. However, it is important for these measures to come strong and come soon and also recognise the spatial variation of the crisis.

Stay safe, stay in.

References

KACHER, N., KITSOS, A., PETACH, L., ORTEGA-ARGILÉS, R. & WEILER, S. 2018. Entrepreneurship and Resilience: Implications for Regional Development in the US and UK. North American Regional Science Association, 65th Annual Meeting. San Antonio, USA.

KITSOS, A. 2020. Economic resilience in Great Britain: an empirical analysis at the local authority district level. In: BRISTOW, G. & HEALY, A. (eds.) Handbook on Regional Economic Resilience. Cheltenham: Edward Elgar.

KITSOS, A. & BISHOP, P. 2018. Economic resilience in Great Britain: the crisis impact and its determining factors for local authority districts. The Annals of Regional Science, 60, 329-347.

KITSOS, A., CARRASCAL-INCERA, A. & ORTEGA-ARGILÉS, R. 2019. The Role of Embeddedness on Regional Economic Resilience: Evidence from the UK. Sustainability, 11.

LEE, N. 2014. Grim down South? The Determinants of Unemployment Increases in British Cities in the 2008–2009 Recession. Regional Studies, 48, 1761-1778.

This blog was written by Dr Tasos Kitsos, Research Fellow, City-REDI / WM REDI, University of Birmingham.

To sign up for our blog mailing list, please click here.

Disclaimer:

The views expressed in this analysis post are those of the authors and not necessarily those of City-REDI or the University of Birmingham

2 thoughts on “Local Resilience and the Coronavirus (COVID-19) Economic Crisis”