Dr Kostas Kollydas and Dr Abigail Taylor discuss current labour market challenges faced in the UK. You can find more analyis on the UK Labour Market in our blog - Why are the Over-50s Leaving the Workforce? Labour Market Flows and Future Participation Flows. - How do Fertility Rates and Childcare Costs Play out in the UK Labour Market? - International Migration and the UK Labour Market: Changes and Challenges - Changing Labour Market Participation of People Aged 50 Years and Over

Labour market challenges in the UK have been front-page news over recent months. Headlines include ‘What’s behind Britain’s recruitment crisis?’, ‘UK lags behind developed nations on post-Covid employment recovery’, ‘How can Britain solve its post-Brexit labour shortage?’ and ‘Brexit-backing Next boss says UK needs more overseas workers’.

Various reports provide insights into challenges faced by employers, people in work and people looking for work in the context of economic and political challenges (COVID-19; the Russian invasion of Ukraine), technological change (e.g. gig economy working; the rise in online recruitment) and impacts from changes in policy (e.g. Brexit):

- The Open University’s 2022 Business Barometer reveals 68% of SMEs and 86% of large organisations are currently facing skills shortages. 78% of organisations reported that such shortages have led to reductions in output, productivity or growth, whilst 72% said it leads to increased workload on other staff.

- The Federation of Small Businesses has warned that “the widespread labour shortage is limiting small firms’ ability to grow, as they also wrestle with a worsening energy crisis in the winter, rising interest rates and rampant inflation.”

- Nearly three-quarters of UK companies responding to the annual CBI/Pertemps Employment Trends Survey thought that the UK has become a less attractive place to invest/do business in over the past five years.

- The 2022 Youth Voice Census of 11–30-year-olds points to a mental health emergency. 51% of young people aged 19+ suggested mental health challenges were their biggest barrier to accessing work now or in the future. 52% of respondents in work cited anxiety as their biggest barrier. It also indicates young people feel unprepared for future employment. Only 35% of those in education thought they understood the skills employers were looking for. Only 45% of respondents thought they could write a CV.

In light of these labour market challenges, this blog provides data-driven insights into the evolution of labour demand in the UK over the last year, with a focus on the West Midlands. It also discusses possible ways to address skills and labour shortages.

Falling numbers of job vacancies

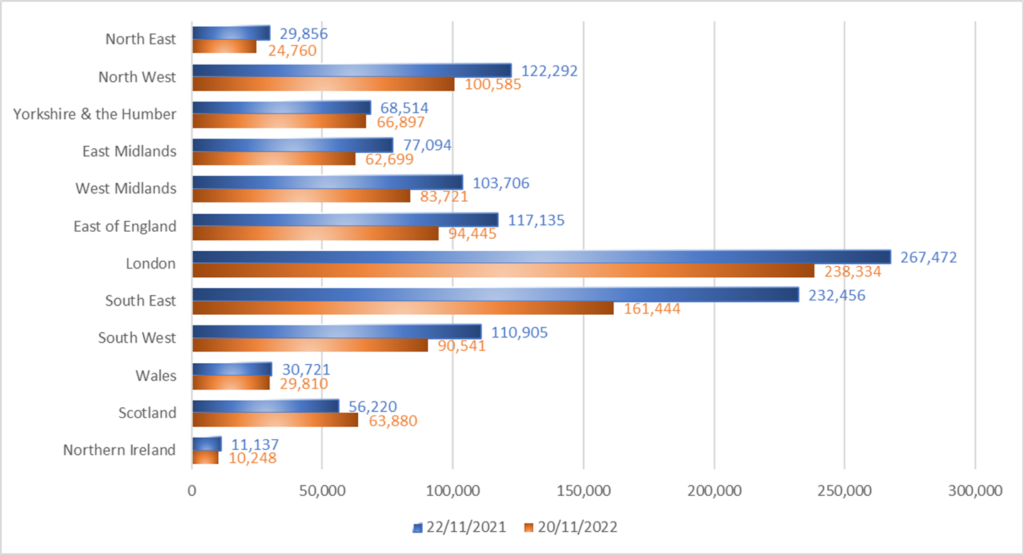

The total number of unique online job postings in the UK from August to November 2022 was 5.38 million, a drop of nearly one million (-15.3%) compared to the same time period in the previous year (6.35 million job postings). This decline in job openings is a result of the looming economic recession, accompanied by high inflation, rising interest rates and energy prices, all of which are likely causing employers across industries to think twice about hiring.

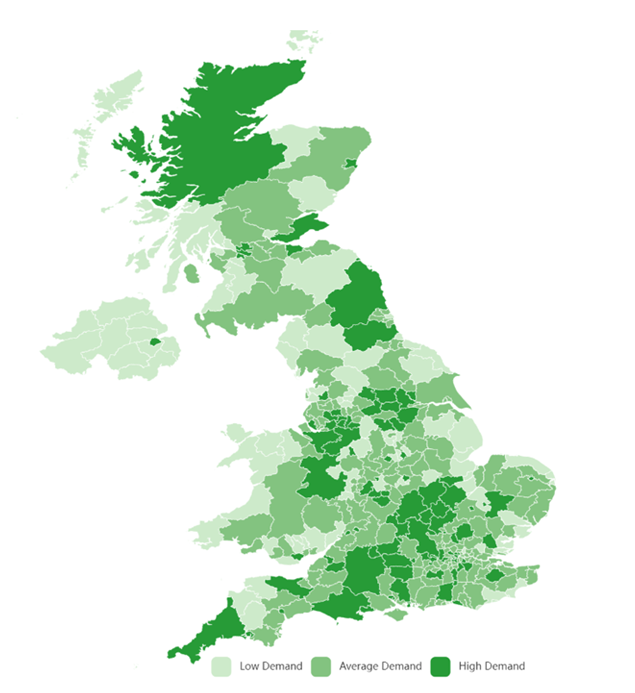

Comparison of labour demand levels by Local Authority District (LAD) based on the number of online job postings (21.08.2022 – 20.11.2022)

Regional variations in the fall in job vacancies

However, the fall in labour demand across UK regions and nations is not uniform. The point-in-time estimates shown below reveal that the decline in the number of job postings was more pronounced in the South East (a decrease of 30.5% on 20th November 2022 relative to the previous year), followed by the East of England (-19.4%) and the West Midlands (-19.3%). The sole exception is Scotland, where the number of job adverts increased by 13.6% over the same period.

Total number of unique online job postings across UK regions (November 2022 versus November 2021)

Undoubtedly, the demand for labour and skills varies by industry and is influenced by each region’s economic structure and conditions. The table below illustrates the occupation categories that are currently in the highest demand in the West Midlands, accounting for over 70% of the total number of job adverts from August to November 2022. Although logistics and warehouse-related jobs continue to be the most in-demand by employers in the region, they also experienced the highest percentage decrease relative to 2021 (-42.7%), followed by jobs in trade and construction (-33.5%), social work (-29.9%) and sales (-29.4%). Demand for Engineering, Information Technology and Hospitality & Catering occupations remains high, and relative decreases in the number of online job postings are smaller.

Occupation categories with the highest number of unique online job postings in the West Midlands (WM)

| Job category | Number of job postings | YoY change | |

| 21 Aug – 20 Nov 2022 | 22 Aug – 21 Nov 2021 | ||

| Logistics & Warehouse | 41,585 | 72,610 | -42.7% |

| Engineering | 36,779 | 42,317 | -13.1% |

| Information Technology | 36,420 | 48,041 | -24.2% |

| Hospitality & Catering | 30,265 | 31,651 | -4.4% |

| Teaching | 25,911 | 28,238 | -8.2% |

| Trade & Construction | 24,232 | 36,413 | -33.5% |

| Healthcare & Nursing | 23,951 | 29,593 | -19.1% |

| Accounting & Finance | 23,857 | 27,482 | -13.2% |

| Sales | 21,696 | 30,712 | -29.4% |

| Social work | 19,866 | 28,334 | -29.9% |

| Total (10 job categories) | 284,562 | 375,391 | -24.2% |

| Overall demand in the WM | 400,994 | 523,234 | -23.4% |

Source: Adzuna Intelligence

What types of skills are employers looking for?

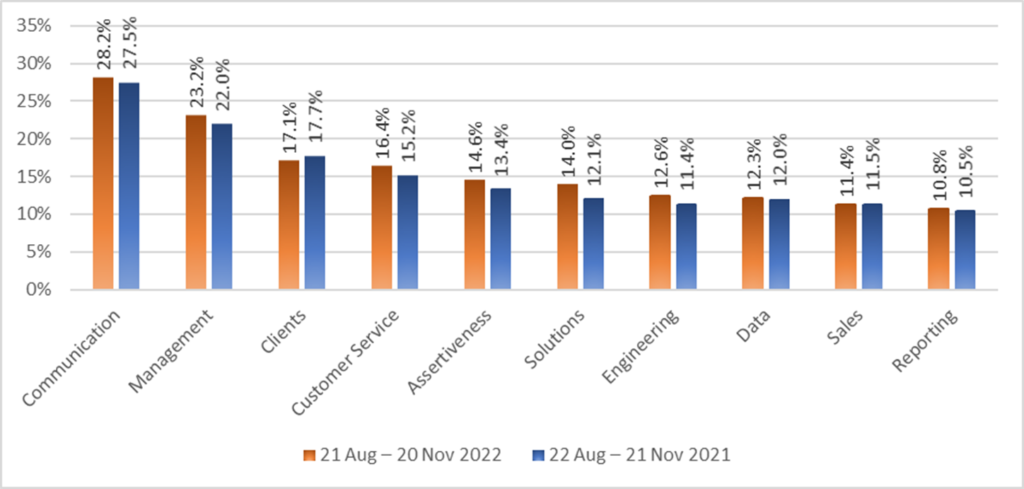

Employers are currently generally seeking a blend of technical skills applicable to specific occupations and sectors and transversal skills (such as communication, team-working, management, and leadership skills). Interestingly, as shown in the graph below, communication and management skills are the skills in greatest demand in the West Midlands, appearing in 28.2% and 23.2% of all job postings, respectively, from August to November 2022. The frequency of these skills has increased by approximately one percentage point since 2021. Customer service, assertiveness, problem-solving, engineering, and data-related skills are also in high demand.

Skills with the highest number of job postings in the West Midlands

What is the economic impact of labour and skills shortages?

There has been a vigorous debate about how labour and skills shortages (including but not limited to digital skills) may threaten the UK’s long-term economic sustainability. Estimates vary, but a recent report by the Recruitment and Employment Federation suggests that such shortages could cost £30-39 billion annually in real GDP from 2024 to 2027.

When the supply of skills does not meet the skills that employers seek in the labour market (skills mismatches), there are negative effects on productivity, innovative performance, and the overall competitiveness of firms and countries. Consequently, the demand issues discussed earlier represent only one aspect of skills mismatches.

The availability of people with the appropriate skills is important and has become more challenging as a result of Brexit, as well as the consequences of the COVID-19 pandemic, partially reflected in early retirements and the increasing number of people reporting chronic health problems. Specific sectors (“wholesale and retail trade”, “public administration, education and health”, and “financial and business services”) may be disproportionately impacted by the point-based immigration system, partly because of the greater reliance on EU nationals employed in these industries.

How can these challenges be addressed?

In this context, the visa regime could be restructured to facilitate the attraction of international talent. There have been calls for the Government to reduce the financial and administrative requirements to hire overseas talent. For example, the CBI has called for more fixed-term visas for overseas workers in shortage occupations and the Federation of Small Businesses wants visa fees to be limited to £1,000 for small employers. Improving information/guidance to businesses concerning the available visa programmes could also be key to helping firms to navigate current systems.

In addition, it is important that businesses focus on retaining their current staff by, for instance, providing more flexible roles and working conditions, as well as developing upskilling and training opportunities. The latter point emphasises the importance of establishing and sustaining strong connections between higher and further education institutions and industry.

In terms of supporting employees and self-employed and unemployed adults to learn new skills, the Government could expand Skills Bootcamps – free, flexible courses of up to 16 weeks designed to develop up sector-specific skills and fast-track participants to a job interview. A recently published survey of wave 2 Skills Bootcamps suggests that “most providers make good use of regional partnerships and labour market intelligence to develop and provide courses that meet identified skills needs”. However, it identified a series of challenges with the current provision. These include inconsistency in the quality of teaching and that “staff do not have sufficiently frequent or detailed discussions with learners about the next steps that learners might take”. Key recommendations include ensuring that all trainers regularly refresh their pedagogical skills and ensuring the staff at Skills Bootcamp providers hold in-depth discussions with learners regarding their future career plans during and post-course completion.

This blog was written by Dr Kostas Kollydas and Dr Abigail Taylor, Research Fellows at City-REDI / WMREDI, University of Birmingham.

Disclaimer:

The views expressed in this analysis post are those of the authors and not necessarily those of City-REDI / WMREDI or the University of Birmingham.