By Dr Chloe Billing, Research Fellow

City Region Economic and Development Institute (City REDI), University of Birmingham

With the historic defeat of the Government’s Brexit deal on Tuesday 15th January, what are the economic implications for UK regions in the event of a no-deal Brexit?

The work of our international research team, led by Professor Raquel Ortega-Argilés, focuses on assessing the size of the Brexit-related risk exposure for the UK, every other EU country, and all of the individual UK and EU regions. Our analysis draws upon the most detailed regional-national-international trade and competition datasets currently available anywhere in the world, allowing us to examine the impacts of different post-Brexit trade scenarios on European regions.

What would a ‘No Deal’ mean for trade flows?

Currently our UK economy has open borders, with trade criss-crossing European borders multiple times. For example, a small engineering company based in the West Midlands will get a contract from Jaguar Land Rover or Toyota. After they have consulted with their financial advisers, experts, lawyers, intellectual property specialists and IT advisers – which is all often done locally – they will develop their product through a series of global value chain steps. They produce a component that is sent to Italy as part of a joint venture, the Italian firm will add research and development inputs which are then sent to a consortium in France. The French consortium adds value to the joint venture product which is then sent back to a company in Germany. In Germany, the component is embodied and sub-assembled and sent back to the UK.

The result of advanced sub-assembly in the UK, which is classically what happens in Birmingham, is then sent back to the Netherlands, which is sent to Germany and then back to the UK. It is embodied in the automobile which then goes back to Denmark and Sweden.

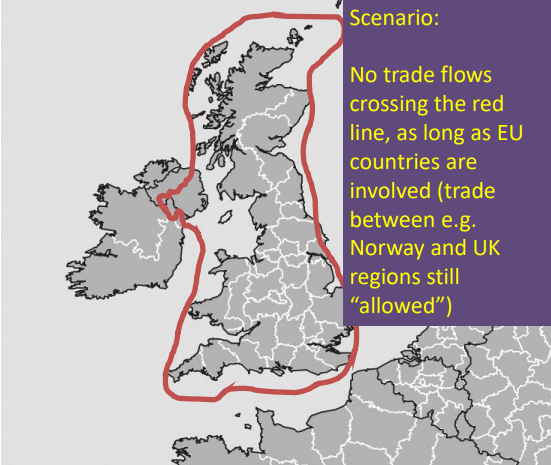

That is how trade works. Our research asks what would happen to this ‘value added in exports’ in the worst case Brexit scenario or a ‘chaotic Brexit’, as Professor Anon Menon would refer to it as. Where there is a collapse in negotiation for a minute, or a day, or a month, or a year, trade stops – as if a big red line is drawn around the UK. Our data compares that scenario with the current scenario and is used to measure the exposure level of every industry and region i.e. how much would they have to change what they do and how they do to overcome and adapt to the shocks of Brexit.

What share of regional labor income and regional GDP would be at risk in this scenario?

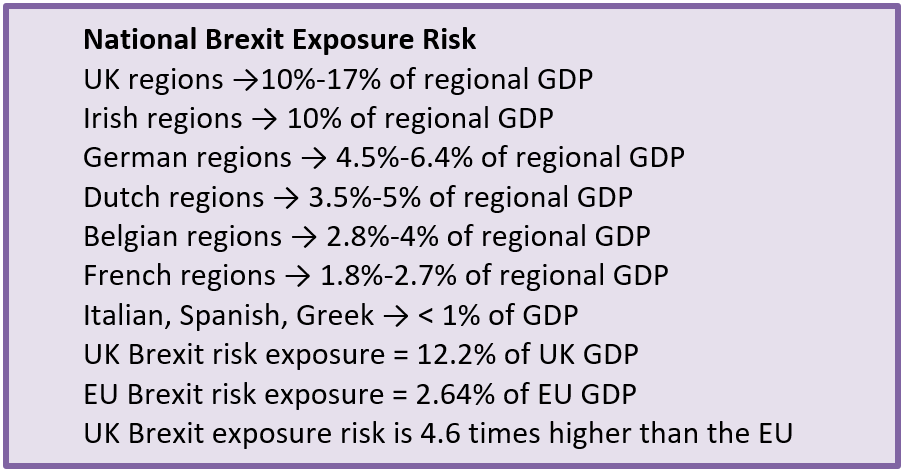

Three major findings emerge from our analysis. First, most of the UK regions outside of London and the South East of England are far more exposed to Brexit risks than London and its hinterland areas. London’s exposure is 12% of GDP, whereas many UK regions face Brexit risk levels that are 25%-50% higher than London. In addition, our results show that many of the regions with the higher risks voted in favour of Brexit, even though they tended to be more dependent on EU markets.

Second, regions in countries close to the UK, such as Ireland, Germany, The Netherlands and Belgium, are much more exposed than regions in southern or central Europe. Irish regions face similar levels of exposure to the least exposed UK regions, namely London and parts of northern Scotland. In contrast, the risk exposure of German, Dutch or Belgian regions are between one quarter and one half of those faced by UK regions. The rest of the EU is largely unaffected, with Brexit-related risks of just 2% of GDP, or less for more than two thirds of the EU member states.

Third, the Brexit-related risk exposure levels of the UK as a whole are 4.6 times higher than for the EU as a whole.