By Dr Sarah Forbes and Dr Holly Birkett

Co-directors of the Equal Parenting Project

In 2011, the HMRC introduced a scheme which allowed employers to pay homeworking employees up to £4 per week to cover the cost of overheads and claim this back from HMRC. At the start of lockdown in April 2020, the scheme was increased to £6 in recognition of the face that homeworking costs incurred during lockdown could be considerable. While £6 a week could be considered to be quite a modest sum, it could make a significant difference to household expenditure, particularly when more than one person may be working from home.

Recent research undertaken by Equal Parenting Project at the University of Birmingham and the WAF Project at the University of Kent has shown that a very small number of organisations made use of the HMRC scheme since the COVID-19 lockdown began.

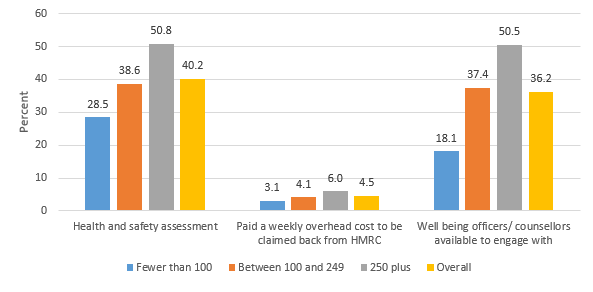

Only 4.5% of managers surveyed across the United Kingdom reported that they paid their employees the £6 per week that can be claimed back from HMRC (without receipts), which is intended to cover the overhead costs incurred as a result of working from home, such as increased electricity costs or costs for work-related phone calls. Meanwhile, 80.9% of managers surveyed agreed or strongly agreed that working from home allows for cost savings for the organisation.

There could be a number of reasons for this low uptake. For example, many organisations, and particularly line managers in organisations, are unaware of the HMRC scheme and very few employees have heard of it or realise that they can claim some of the costs directly if their employer will not. There is also a possibility that some organisations are not keen to open up a conversation about costs of working from home and overheads while they are struggling to deal with the economic consequences of the pandemic.

With many organisations encouraging large numbers of employees to continue to work from home into 2021, now is the time for organisations to recognise that overhead costs have been transferred to their employees during lockdown and to take advantage of the HMRC scheme to cover these costs. By using this scheme, employers can offer a great deal of support for their employees, helping them financially by being proactive in offering employees working from home £6 a week to cover these extra costs, all of which they can claim back from HMRC.

HRMC and the government also have a role to play here in raising awareness of the scheme that could help so many workers who are struggling financially through the COVID-19 pandemic. Employees required to work from home during lockdown are able to claim some of the overhead costs back directly if they do not receive a payment from their employer and information about how to do this is available at the HMRC webpage.

Further analysis and information will be released covering the experiences of managers during the COVID-19 lockdown and the implications for the future of work in an upcoming report from the University of Birmingham and the University of Kent. The manager survey aimed to understand how this pandemic, the lockdown, and working from home has influenced attitudes towards remote working more generally and potential future support by organisations for flexible working policies. The survey also explored norms around working from home, trust toward employees/team members as well as tools and support provided to employees while working from home.

- More about Dr Sarah Forbes at the University of Birmingham

- More about Dr Holly Birkett at the University of Birmingham

- More about the Equal Parenting Project

The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of the University of Birmingham.