By Professor Rob J R Elliott, University of Birmingham, Ben Jones, University College London, and Viet Nguyen-Tien, London School of Economics

Governments around the world are actively promoting EVs and global sales have now exceeded two million vehicles. Automakers and their suppliers have made plans for large scale investment in EV related production capacity.

When looking at the widespread use of electric vehicles (EVs), it is important to consider the availability and affordability of the raw materials that are required to facilitate the energy needed for mass adoption of EVs. Currently, the impacts on mineral demand are not well understood.

To analyse the demand for raw materials caused by mass EV adoption, we have developed a Cost, Macro, Infrastructure, Technology (CoMIT) model. The framework of the model simulates the demand for eight different raw materials that are essential for EVs in a way that is consistent and inclusive of numerous driving factors.

Within the model, we consider the following variable factors:

-

- Increases in EV adoption across regions

- ‘Green’ policies

- Changes in the price and associated operating costs

- Metal needed for charging and hydrogen stations

- The anticipated progress in lithium-ion battery production, meaning a better range, reduced cost, and less dependence on cobalt

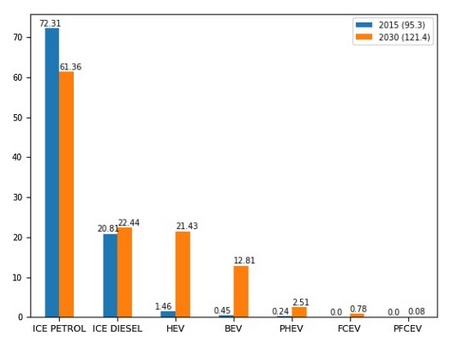

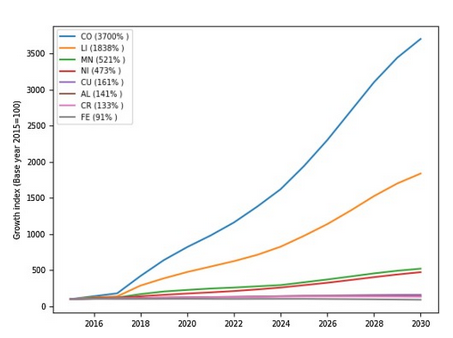

By 2030, we anticipate that the demand for vehicles general will increase by 27.4%, of which 13.3% will be EVs. Our model also predicts a large increase in the demand for certain base metals, including a 37 and 18-fold increase in demand for cobalt and lithium (relative to 2015 levels), respectively. Without major changes in certain technologies, the cobalt and lithium supply chains could seriously constrain the widespread deployment of EVs. Significant demand increases are also predicted for copper, chrome, and aluminium. We also highlight the importance of China in driving demand for EVs and the critical materials needed to produce them.

By evaluating the role of key economic, technological, policy and societal drivers underpinning the EV revolution, we can examine key market dynamics. Incremental demand due to mass EV penetration could critically shape the size and spatial distribution of raw materials demand. For example, China’s share of global lithium and cobalt demand for transport (the dominant end use) is likely to rise to about 68% by 2030. China’s leading role is likely to have a major bearing on raw material trade flows and associated supply chain risks.

These trends could exacerbate an emerging, and challenging to address, deficit across a range of critical metal markets. To fully assess these risks, it is important to consider these impacts within the wider context of the market, technical, financial and policy conditions facing the resource industries.

Policy makers will need to be mindful of these issues, raising a clear need to design energy policy in parallel with wider resource and materials sector policies. Rapid growth in mineral demand reinforces the need for effective policies to ensure adequate recycling as well as land and waste-water management; and will further sharpen the importance of effectively managing environmental and social risks associated with mining and metal processing.

You can read the full paper on ScienceDirect.

The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of the University of Birmingham.