By Dr Biwesh Neupane (University of Birmingham) and Hari Gopal Risal (Ph.D. Scholar, University of Strathclyde)

Green bonds (GBs) are a powerful green financing tool that supports progress towards accomplishing the United Nations’ Sustainable Development Goals (SDGs). GBs are a recent innovation to finance climate and environmental projects, aiming to hoist capital for environmental projects and initiatives promoting sustainable development.

GBs are essentially a type of conventional bond. Conventional bonds are an agreement whereby an issuer agrees to borrow capital from investors to be repaid at the end of maturity and repay an agreed interest rate at certain intervals until maturity. While the issuers may issue conventional bonds to invest in many projects (often unspecified), the proceeds received from the issuance of GBs must be invested in environment-friendly projects. GBs are considered as a bridge to SDGs as at least six SDGs (SDG 6, 7, 9,11, 13, and 15) receive a powerful boost through its issuance. For instance, the issuance of GBs supports green projects, such as financing renewable energy projects, that generate positive environmental externality and help institutions implement renewable energy solutions pushing nations towards accomplishing the climatic action (SDG 13) and facilitating affordable and clean energy (SDG 7).

The first climate-linked bond, ‘Climate Awareness Bond’, was issued by the European Investment Bank in 2007, whose proceeds were used to finance renewable energy and energy efficiency projects. The World Bank issued the first labelled GB, which turned out to be a history-making event that fundamentally changed how investors can invest in projects that directly benefit the environment. Since its first issuance, the size of GBs totalled $1 trillion by 2020 and $2 trillion by the end of September 2022, and such is the sheer size of the growth that it expects to achieve a single-year target of $5 trillion in 2025 alone.

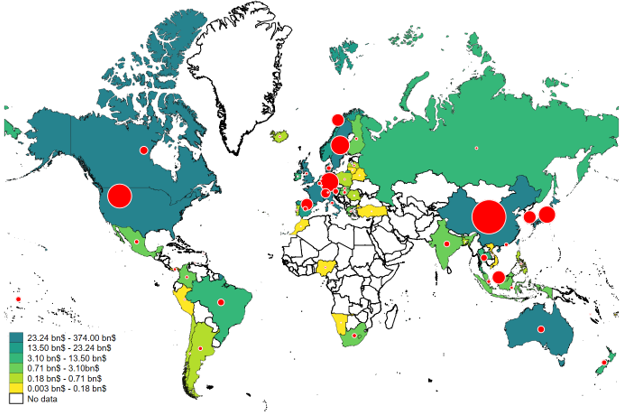

The geographical distribution of the GB issuance is highlighted in the map below. The GB market has witnessed a variety of issuers, such as governments, corporations, supranational; banks, and other entities; however, financial firms are the most active issuers. The financial and non-financial corporations are leading the GB issuance, weighing around two-thirds of the total issued amount. A recent study highlights the investor’s preference for GB issued by corporate and sovereigns. The report shows a substantial unfulfilled demand for GB issued by non-financial corporates in utilities, automotive, and industrials. Our (unpublished) study of demand for the greenness of GB shows that the demand for GBs in the primary market is consistently very large compared to similar conventional non-GBs. This effect is stronger for GBs issued by environment-friendly companies.

This growth and demand of GB can be attributed to several factors, including increased awareness of environmental issues, development of clear guidelines and standards, such as Green Bond Principles, and growing demand for environmentally friendly investment options. The Green Bond Principles, developed by International Capital Market Association (ICMA), are a collection of voluntary frameworks that help finance environmental and socially sustainable debt instruments. It has four components for alignment with the principles:

- the use of proceeds for environmentally sustainable activities

- the process for project evaluation and selection

- transparent management of proceeds that can be tracked and verified

- annual reporting of the use of proceeds.

Likewise, to increase credibility and transparency in the GB market, several organisations, such as Climate Bond Initiative and the World Bank, have developed guidelines and standards that provide a clear and consistent framework for issuers to follow while issuing GBs.

However, one of the challenges facing the GB market is the need for more transparency and consistency in how GBs are issued and the type of financed projects. An increasing number of GBs issued over time, and lack of harmony in standards and transparency surrounding the use of proceeds, has led to the risk of ‘self-labelling’ and ‘greenwashing’, a practice of making unsubstantiated or misleading claims about the company’s environmental commitment and the use of proceeds of GB in environment-friendly projects. Practitioners active in the GB market argue that around 15 percent of the GB issued by companies “involved in controversial practices that contravene environmental standards,” raising concerns about greenwashing.

One of the ways to mitigate the risk of greenwashing is by clarifying a clear purpose for using GB proceeds rather than aiming to use the proceeds for a range of projects or not specifying its use at all. Such greenwashing behaviour may also be curtailed by establishing a green taxonomy and improving the transparency through environmental disclosure requirements such as the one established by Green Bond Principles. Third-party verification and certification of the GB also mitigate greenwashing. For instance, Climate Bond Initiative’s Climate Bond Standard establishes sector-specific eligibility criteria to judge an asset’s low carbon value and suitability for issuance as GB – those that meet the criteria are then eligible for Climate Bond Certification after being verified by approved external verifiers. These certifications signal a company’s commitment to the environment in a more credible way reducing possible greenwashing.

The growth of the GBs is attainable through adopting SDG while designing green projects and effective communication about GB’s role in solving environmental issues. Further, clear guidelines for GBs issuances, such as Green Bond Principles and Climate Bond Standards, and impact reports post-issuance create a growing demand for environmentally friendly investment options. Overall, GBs offer clear environmental benefits and support the global net zero goal through the requirement that 100% of proceeds are applied in in green and sustainable projects, although better regulation of this is needed

The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of the University of Birmingham.