By Dr Ufuk Gunes Bebek, Lecturer in Economics

Department of Economics, University of Birmingham

Long before the most recent slump in the lira, the Turkish economy had already begun to deteriorate

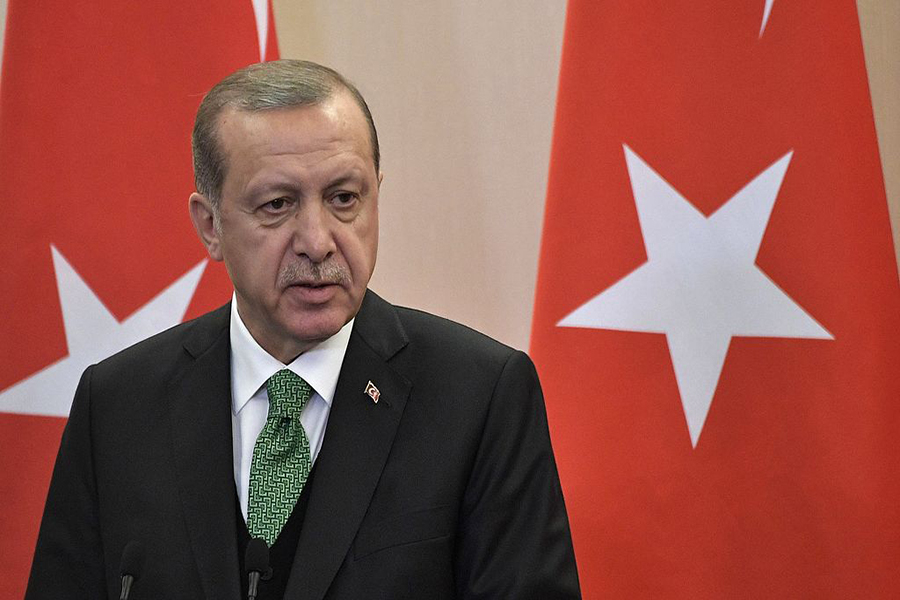

President Erdogan’s senior advisor Yigit Bulut’s opening line in a recent column was “August 10th has gone down as Turkey’s financial 15th of July in history”, as he compared Turkey’s current financial crisis to the 2016 coup d’état attempt. In reality, this political discourse fails to consider the plunge in the value of the Turkish lira, the country’s declining economy, or the slumping financial indicators as tangible issues, but rather defends Turkey’s resistance to kneel down before external powers.

This is not an entirely unreasonable description of the current state of affairs to the current government’s voter base, yet it raises concerns around whether such delusions will bury the underlying issues behind the current crisis, until it becomes too late to recover.

So, what were the reasons behind Bulut’s comments; what have the economic markets observed during the last few months, which have seen the most severe economic turbulence in the currency?

Deterioration of the Turkish economy

Long before the most recent slump in the lira, the Turkish economy had already begun to deteriorate as a result of trends in the country (i.e. excessive dependence on short-term external funding and a decline in foreign direct investment) and recent global developments (i.e. Federal Reserve tightening monetary policy). These factors warranted a reassessment of Turkey’s economic outlook, resulting in a sharp decline in the country’s growth forecasts. This preceded the downgrading in ratings of Turkish banks, as well as Turkey’s debt credit rating by major agencies.

President Erdogan’s reaction to these developments was rather relentless; he openly declared that his government would conduct an operation against these credit rating agencies following the general elections. This led to a decline in the lira relative to the dollar, resulting in its lowest point since 2008. Following the elections, Erdogan appointed his son-in-law as the minister of treasury and finance and seized the right to appoint a monetary authority within his presidential decree. These somewhat autocratic decisions, along with the inability of the monetary authority to meet its inflation target, has led to further backfire from an international outlook, weakened the credibility of economic policy, and increased uncertainty. On top of these issues, the central bank announced that it will fail to meet its inflation target for three more years, further damaging monetary credibility.

Relationship with the US

Unfortunately, these were not the only events feeding the financial catastrophe that the country was suffering. President Erdogan’s continuing tension with his counterpart in the US over Syrian policy, the aftermath of the 2016 coup d’état attempt (which also involved the imprisonment of an American pastor over terrorism-related activities) and the trade war have all further disintegrated the markets. The political discourse towards all of these events focused on an economic coup d’état. President Erdogan declared his stronghold as Turkey’s people with a true God, against American’s with their dollars. This was highly appreciated by Erdogan’s supporters, resulting in a boycott of American products, destruction of iPhones, and promotion of free kebabs to those exchanging their dollars for lira.

Where did this lead the country?

The lira plunged by more than 71% in 2018 compared to the previous year, annual inflation increased to historical levels since the global financial crisis, and further downgrading of its debt rating. Further to this, there has been an inversion of the credit-default swap, indicating an immense pressure on the markets and a potential default (being unable to make the required payments on their debt obligations).

Thanks to the somewhat orthodox measures taken by the central bank, the banking regulation and supervision agency, along with Qatar’s $15 billion investment pledge, the turbulence has cooled. Yet, the underlying issues are much more prominent to be resolved by such save-the-day type of policies.

1 thought on “It’s not a baptism of fire”